Pay Off Credit Card Excel Template

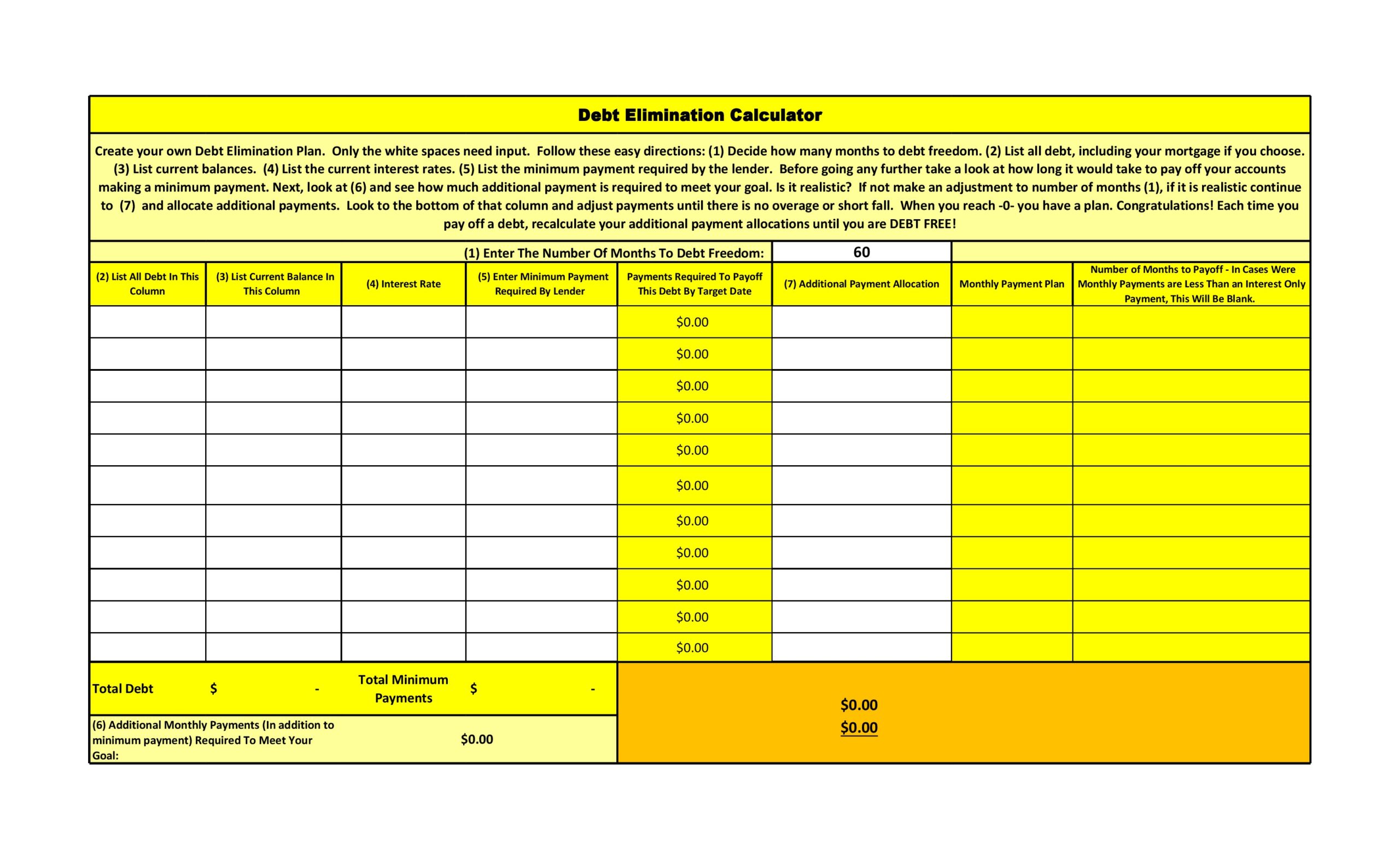

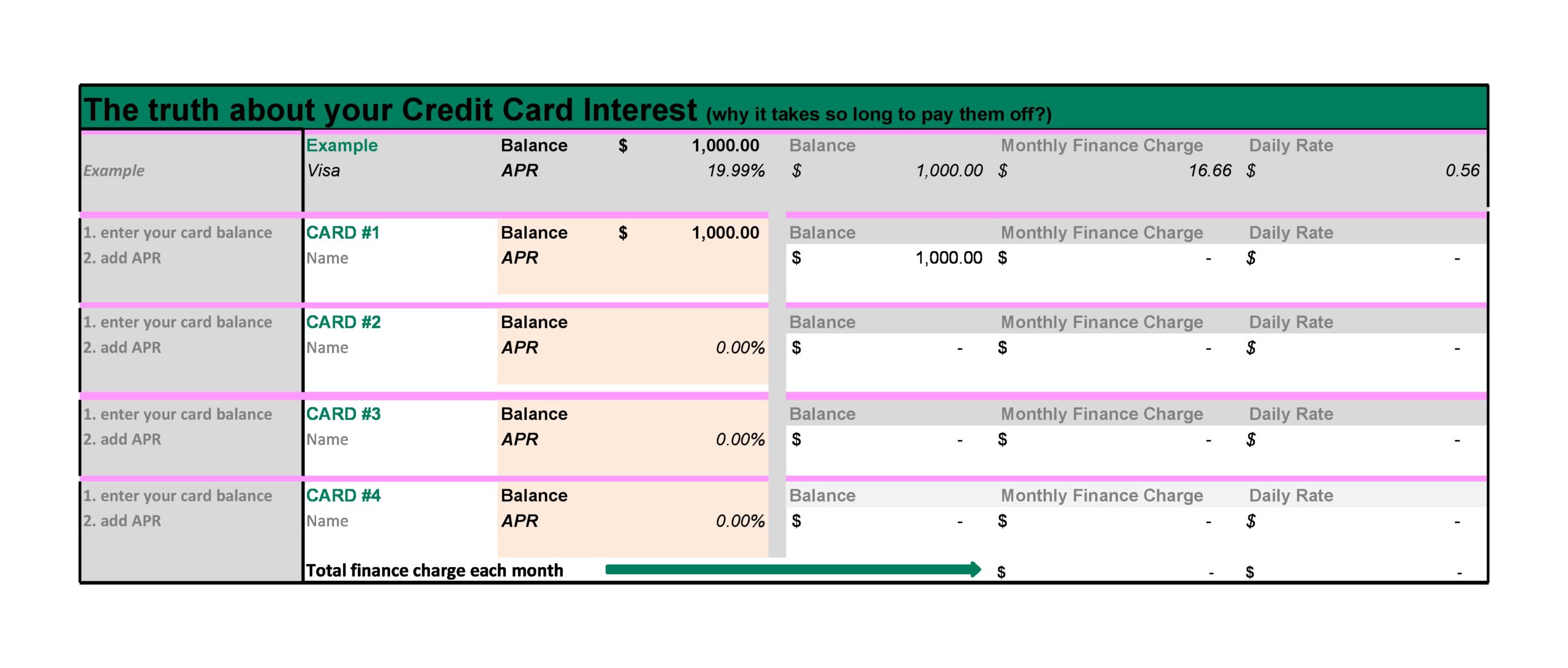

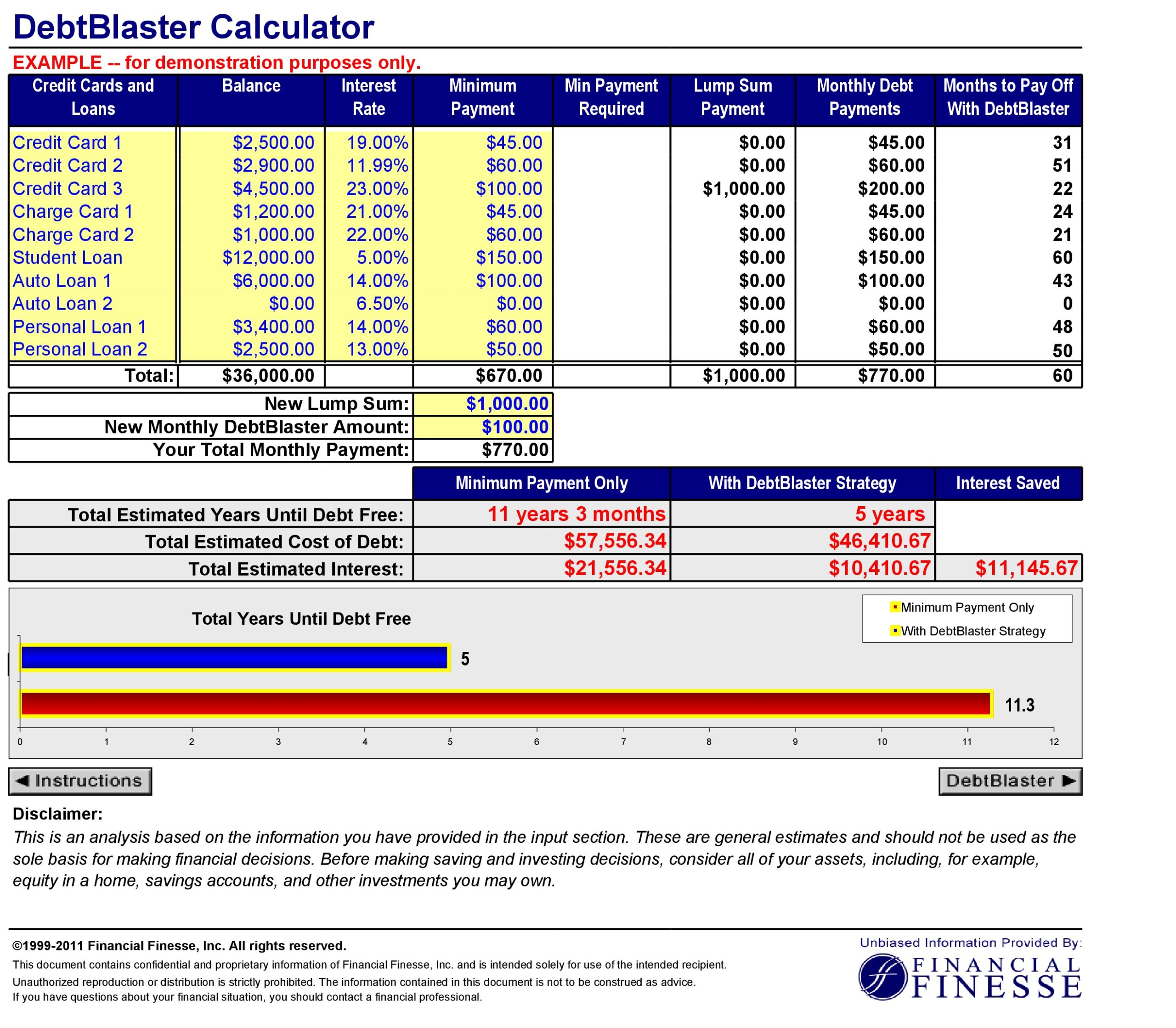

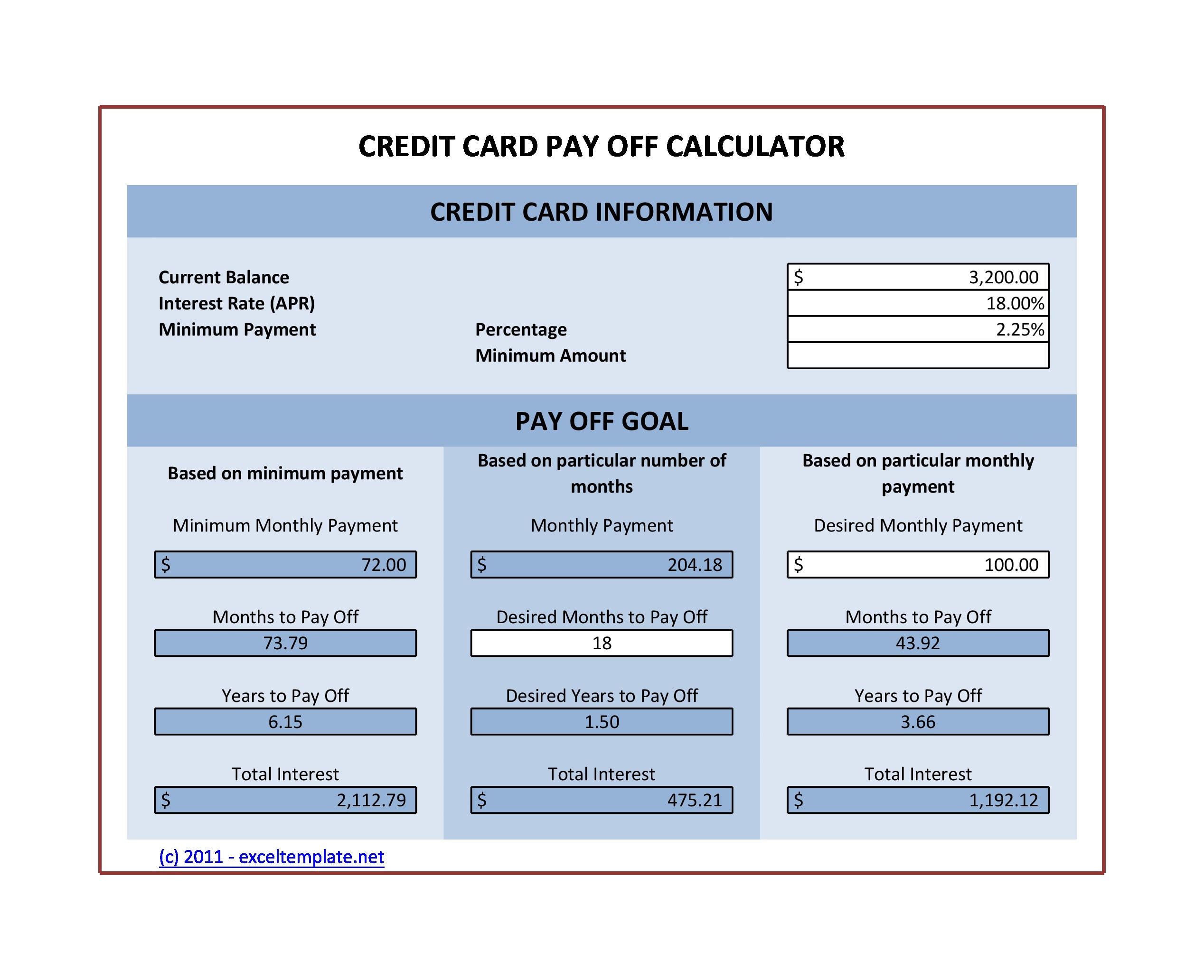

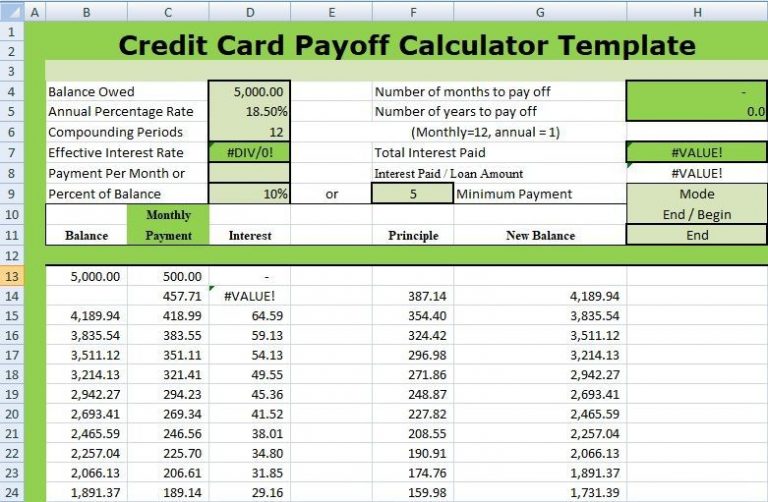

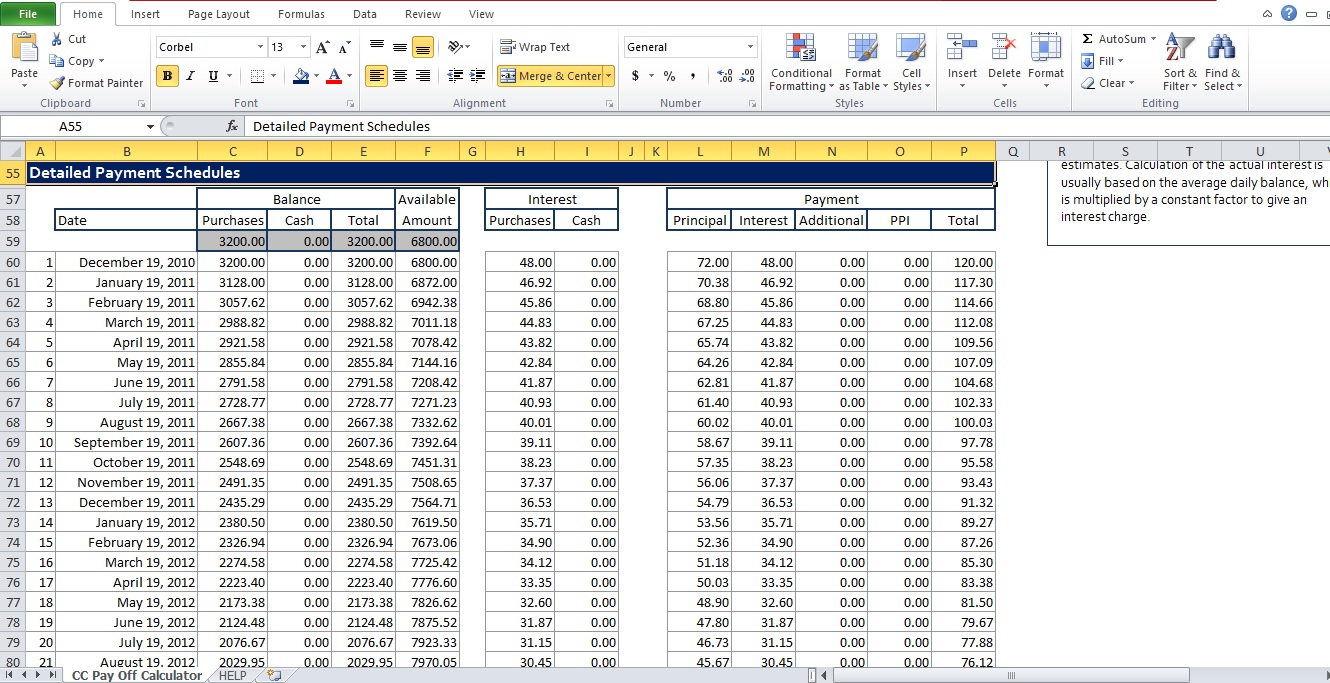

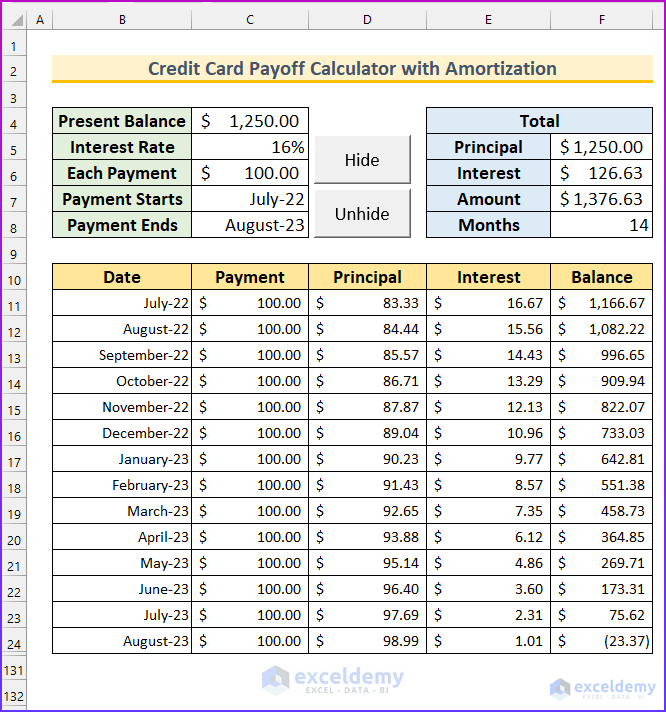

Pay Off Credit Card Excel Template - Personal use (not for distribution or resale) description. The debt payoff planner provides a focused. Pay off credit card debt easily: Web download free credit card payoff calculator for microsoft excel that will calculate the payment required to pay off your credit card in a specified number of years, or calculate. You can use a debt calculator excel to make. Excel and google sheets template. Maximize tax deductionstrack income & expensesget organizedsave time Web with this free credit card payment calculator template, you can plug in your balance, interest rate, and your expected monthly payment (either fixed or as a. See every debt in one view. Web oriana nesbit knows that feeling. You can use a debt calculator excel to make. Web 1) open a blank page in google sheets or excel. Web automatically track all your debt in a flexible template with a custom plan to pay it off. Web credit card payoff calculator is an excel template that helps you calculate the number of installments to pay off your credit. This excel template makes it easy to calculate how long it will take to pay off your credit. Pay off credit card debt easily: Web free credit card payoff calculator: Web this credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. Nobody wants to pay 25% interest. Web paying your credit card in full possibly saves you some money in interest and keeps your credit record healthy. Pay off credit card debt easily: No upfront fees.credit repairdebt counseling24/7 customer support In addition to the above, it. Free excel spreadsheet template | 60 chars. Web assume you will make no additional purchases. Web this credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. Web download free credit card payoff calculator for microsoft excel that will calculate the payment required to pay off your credit card in a specified number of years,. Web oriana nesbit knows that feeling. Personal use (not for distribution or resale) description. Web 1) open a blank page in google sheets or excel. Web download free credit card payoff calculator for microsoft excel that will calculate the payment required to pay off your credit card in a specified number of years, or calculate. No upfront fees.credit repairdebt counseling24/7. Web this credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. Web credit card payoff calculator is an excel template that helps you calculate the number of installments to pay off your credit card outstanding amount. Nobody wants to pay 25% interest. Pay off credit card debt. Web oriana nesbit knows that feeling. Pay off credit card debt easily: Create a table named credit card information. The debt payoff planner provides a focused. See every debt in one view. Built with smart formulas, formatting, and dynamic tables, you can view credit. See every debt in one view. Web free credit card payoff calculator: 2) list your debts across the top with your balance, minimum payment, and interest rates. In addition to the above, it. Pay off credit card debt easily: Personal use (not for distribution or resale) description. Web oriana nesbit knows that feeling. Web download free credit card payoff calculator for microsoft excel that will calculate the payment required to pay off your credit card in a specified number of years, or calculate. Excel and google sheets template. Maximize tax deductionstrack income & expensesget organizedsave time No upfront fees.credit repairdebt counseling24/7 customer support Web assume you will make no additional purchases. Get rid of your credit card debt asap with our excel tools. Create a table named credit card information. You can use a debt calculator excel to make. Excel and google sheets template. This excel template makes it easy to calculate how long it will take to pay off your credit. Get rid of your credit card debt asap with our excel tools. Track multiple debts with a. Nobody wants to pay 25% interest. Free excel spreadsheet template | 60 chars. Built with smart formulas, formatting, and dynamic tables, you can view credit. 3) add a column for months and extra. Personal use (not for distribution or resale) description. Create a table named credit card information. 2) list your debts across the top with your balance, minimum payment, and interest rates. Web assume you will make no additional purchases. No upfront fees.credit repairdebt counseling24/7 customer support Maximize tax deductionstrack income & expensesget organizedsave time In addition to the above, it.

Excel Credit Card Payoff Calculator and Timeline Easy Etsy

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Credit Card Payment Spreadsheet Template

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

credit card payoff ExcelTemplate

Credit Card Payoff Calculator Excel Template Excel TMP

Make Credit Card Payoff Calculator with Amortization in Excel

Web Paying Your Credit Card In Full Possibly Saves You Some Money In Interest And Keeps Your Credit Record Healthy.

This Credit Card Requires A Minimum Payment Of 9% Of The Balance Or $15 Each Month, Whichever Is Higher.

Web Automatically Track All Your Debt In A Flexible Template With A Custom Plan To Pay It Off.

The Debt Payoff Planner Provides A Focused.

Related Post: