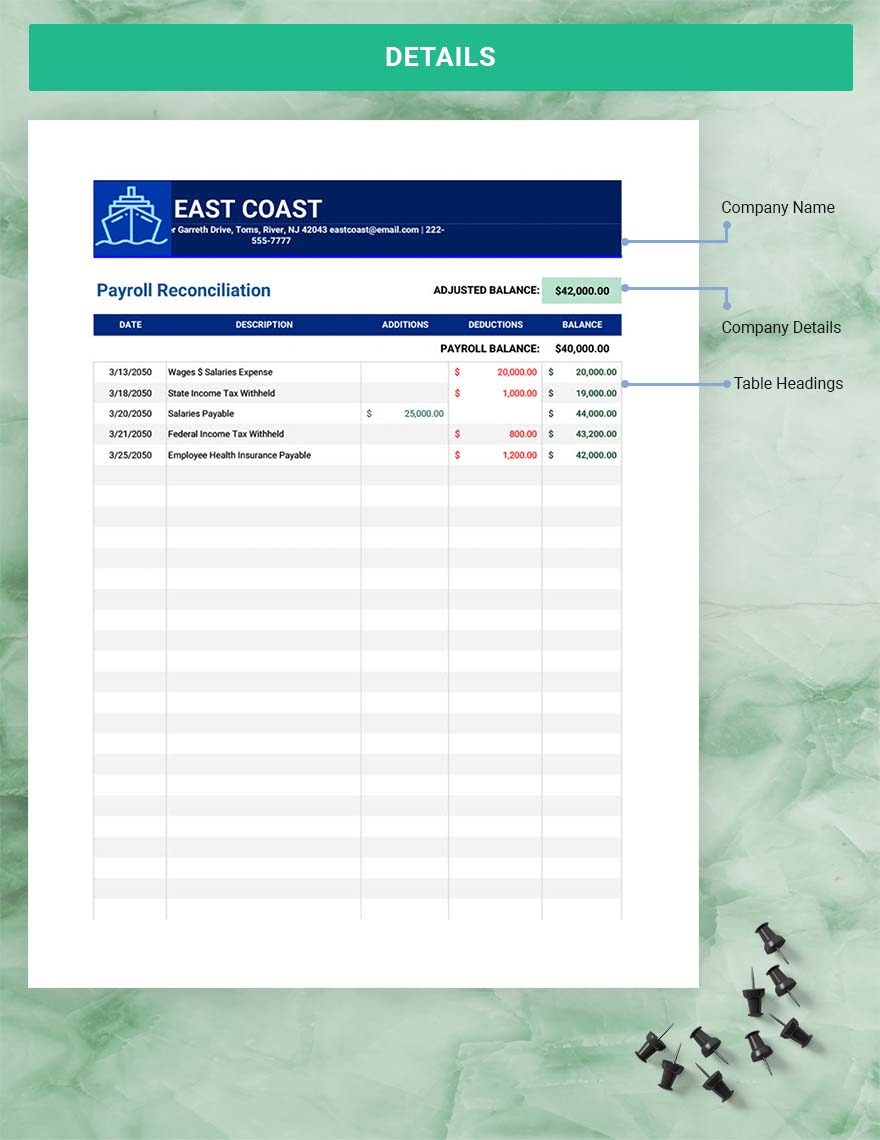

Payroll Reconciliation Template

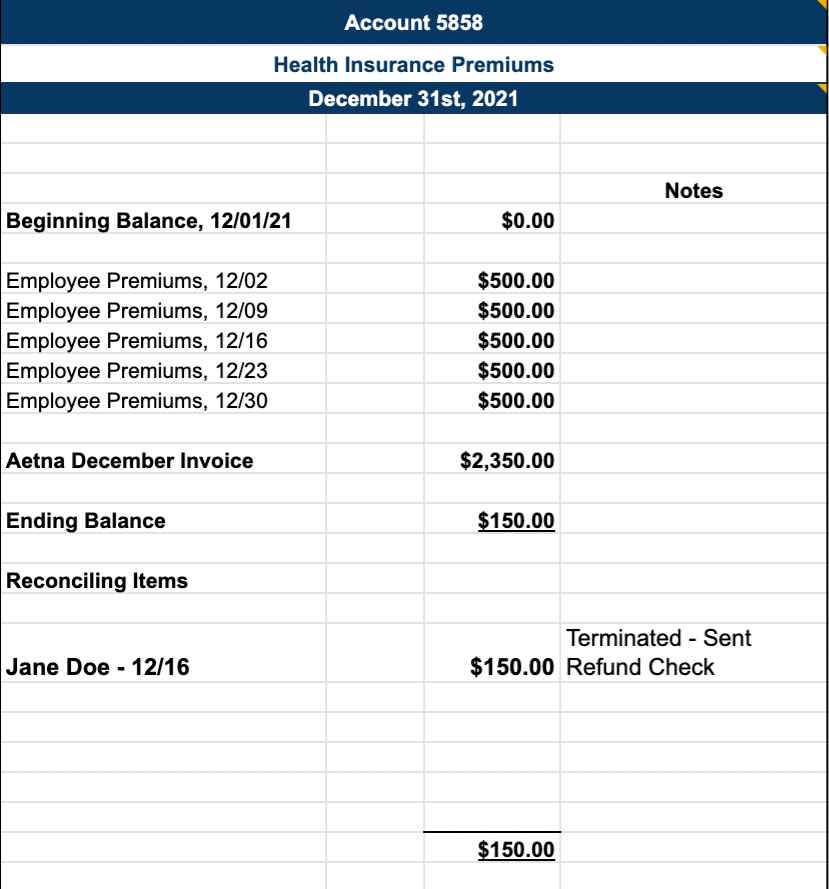

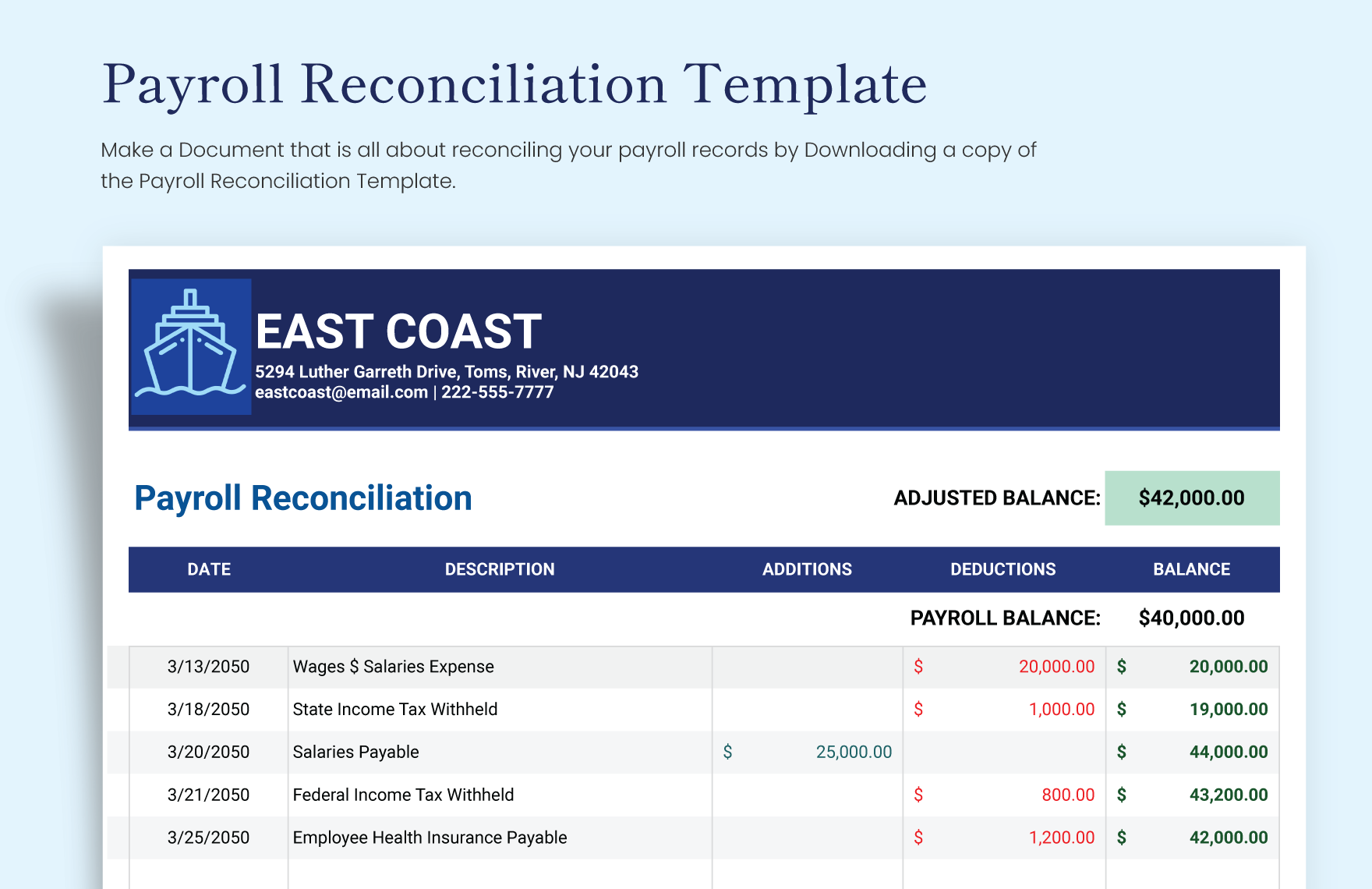

Payroll Reconciliation Template - It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Web steps to reconciling form 941. You know that you can’t just multiply the hours worked in that pay period by the employee’s pay rate and cut a check for that amount. It was premade by industry experts to contain. Web payroll reconciliation is the key to maintaining accurate records of employee wages, withholdings, and other key pieces of tax information. This template offers a useful summary for employees who. Web this editable template simplifies reconciliation processes, ensuring accuracy and efficiency. Review the “next action” column for additional. Web use the following steps to reconcile payroll. Follow these five simple steps to reconcile form 941. Web payroll reconciliation template. Web a payroll summary report template is a template that contains detailed information about employees’ payments and deductions. Review the “next action” column for additional. Here, we are assuming the present month is october. A payroll reconciliation template is a type of spreadsheet that is used to help businesses reconcile their payroll expenses. The payroll register is the central database where all the information about each. Make a document that is all about reconciling your payroll records by downloading a copy of the payroll reconciliation template. Web this step is crucial, as you’ll use these pay rates to determine your employee’s gross wages. The payroll register summarizes each employee’s wages and deductions for. At first, open the salary sheet for the month of september. Web before submitting a payroll, it’s important to perform a reconciliation to avoid having to correct any potential mistakes. The payroll register is the central database where all the information about each. You know that you can’t just multiply the hours worked in that pay period by the employee’s. Web in finance terms, “reconciliation” is the process of ensuring all records of the same event are matching and accurate. So, the previous month should be september. Web let's say you run a small organization and you're looking to establish a payroll process for the first time—or maybe you're a young business professional taking on a new payroll job. Print. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. With payroll templates, you can record your employees' salaries and calculate hourly rates. Match each hourly employee’s time card to the pay register. Web use the following steps to reconcile payroll. Make a document that is all about reconciling your payroll records by. Web below are the best free online top 10 payroll reconciliation template excel. Web for example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. So, the previous month should be september. It contains details such as overtime payments, withheld taxes, hourly rates,. Web below are the best free online top 10 payroll reconciliation template excel. Compare those figures with the totals reported on all four 941s for the year. Here are four simple steps you can follow: Here are a few excellent tips to incorporate into reconciliation to make it quick, efficient, and accurate. Here is an overview of the main steps. If this isn’t correct, your entire payroll will be off. Pick any template like pdf, psd, ms word, and more that are available. Web use the following steps to reconcile payroll. The payroll register is the central database where all the information about each. With this free downloadable payroll template, you can calculate wages based on regular hours and overtime. Web this editable template simplifies reconciliation processes, ensuring accuracy and efficiency. Pick any template like pdf, psd, ms word, and more that are available. Performing this crucial task every pay period ensures you won’t be overwhelmed during the quarterly and annual reconciliation. Review the “next action” column for additional. Web before submitting a payroll, it’s important to perform a reconciliation. Here are four simple steps you can follow: Web before submitting a payroll, it’s important to perform a reconciliation to avoid having to correct any potential mistakes. Web payroll reconciliation is the key to maintaining accurate records of employee wages, withholdings, and other key pieces of tax information. Payroll registers consist of reports or. Gather payroll registers from the current. Web payroll reconciliation is the key to maintaining accurate records of employee wages, withholdings, and other key pieces of tax information. Web use the following steps to reconcile payroll. Copy and paste data in predefined formats and spaces. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. It was premade by industry experts to contain. Embrace payroll reconciliation excellence with the use of this customizable template from template.net. Review the “next action” column for additional. Performing this crucial task every pay period ensures you won’t be overwhelmed during the quarterly and annual reconciliation. Whether you track payroll taxes and wages in a spreadsheet or software, the first step in reconciling form 941 is printing or reviewing your payroll registers. Here is an overview of the main steps of the payroll reconciliation process that should happen for each pay period:. With this free downloadable payroll template, you can calculate wages based on regular hours and overtime. At first, open the salary sheet for the month of september. Employees expect consistent, timely paychecks, but rushing the process. Web for example, you might need to correct the employee’s wages and taxes in your payroll system and file an amended form 941 for the quarter with the irs. Pick any template like pdf, psd, ms word, and more that are available. It’s a huge task to authenticate transactions in a company.

How to Do Payroll Reconciliation for Small Businesses [+ Free

How to Do Payroll Reconciliation for Small Businesses [+ Free

Payroll Reconciliation Template Download in Excel, Google Sheets

Payroll Reconciliation Template Google Sheets, Excel

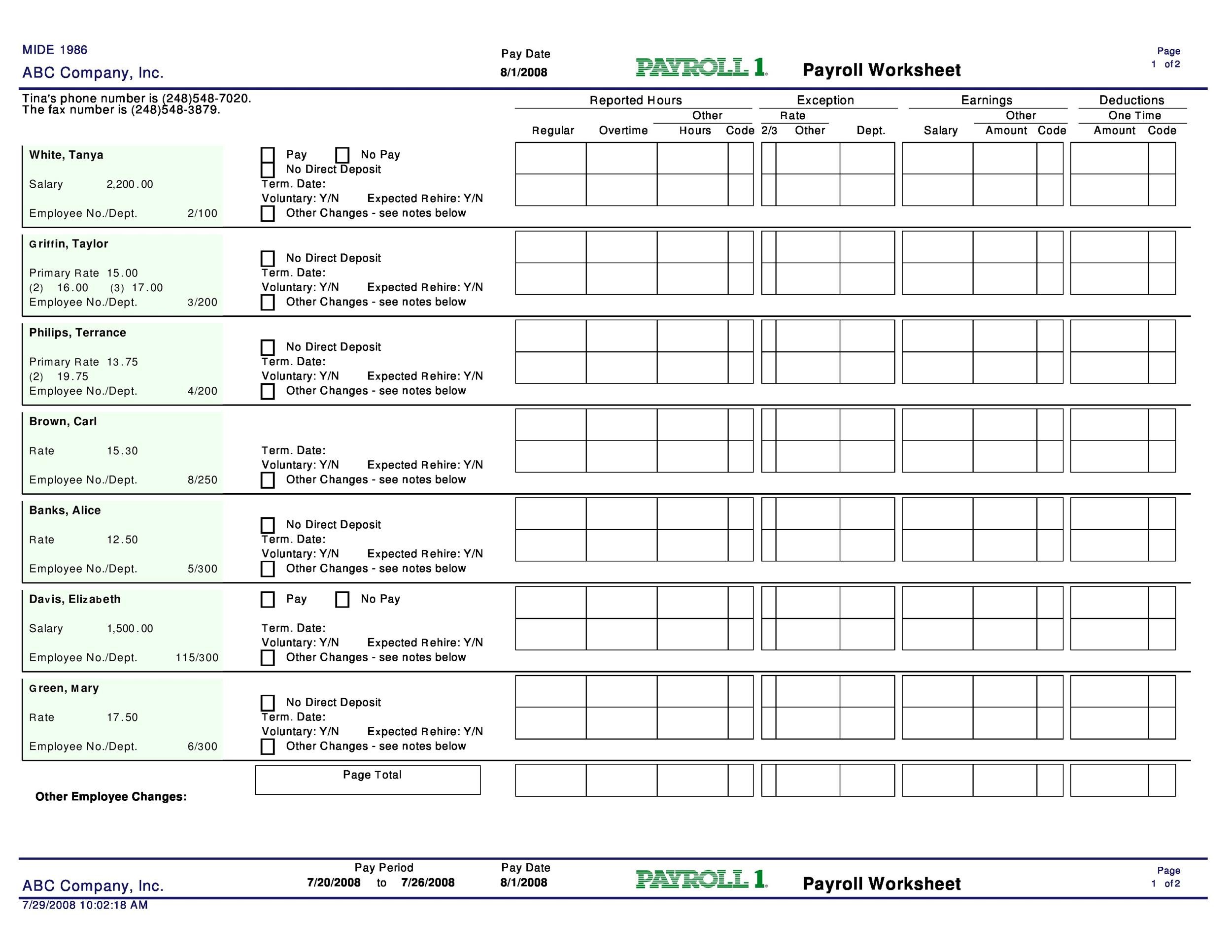

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Payroll Reconciliation Template Google Sheets, Excel

Payroll Reconciliation Excel Template

Payroll Reconciliation Excel Template

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Payroll Reconciliation Template Excel Template Business Format

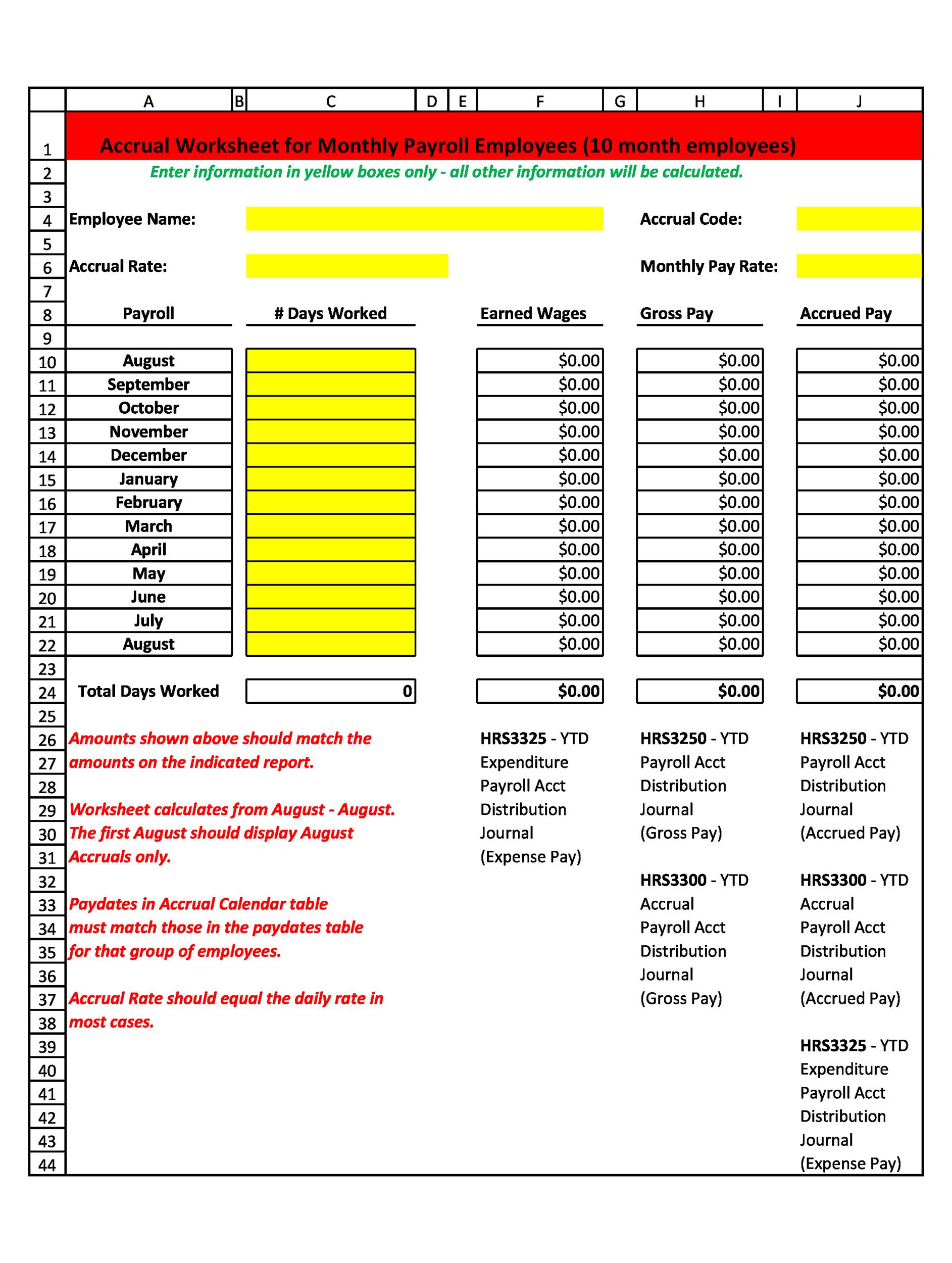

So, The Previous Month Should Be September.

With Payroll Templates, You Can Record Your Employees' Salaries And Calculate Hourly Rates.

Here, We Are Assuming The Present Month Is October.

So, Let’s See It In Action.

Related Post: