Pre Money Safe Template

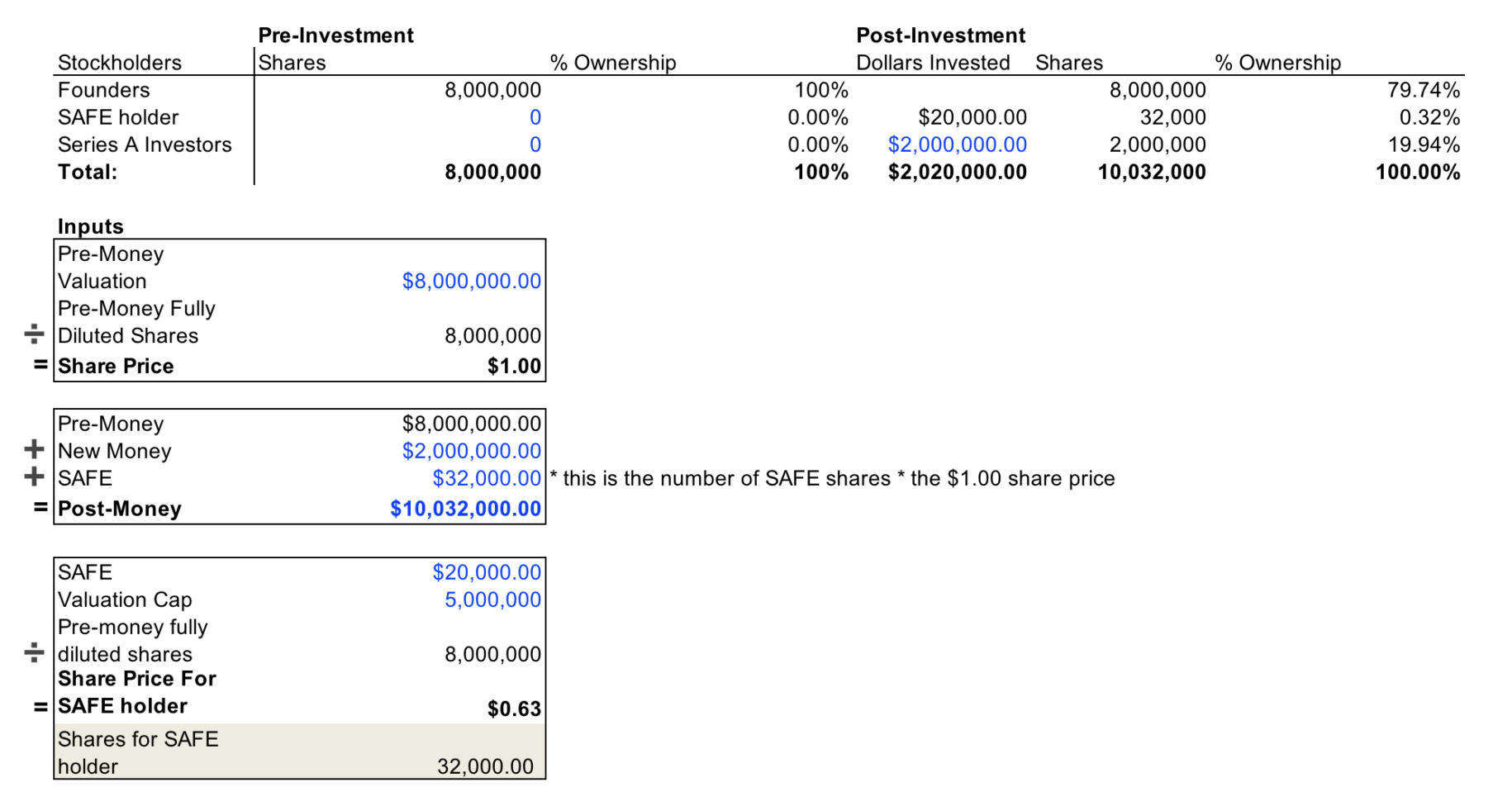

Pre Money Safe Template - How founders should paper their own investments in their startups. It's just a different way to express it, to explain it. Learn the key differences between the original safe and newer safe versions, when to use each version, and general issues with safes. Safes allow startups to structure their seed investments without interest rates or maturity dates. And so in both a. Web click here to use the cooley go docs y combinator safe financing documents generator. Safe #1 and safe #2. When the safe converts into shares, the number of shares to be issued is determined based on the conversion price, which in turn is. And similarly with the 2018 yc safe. Calculate ownership percentages based on the company's value before new. This document is intended only for us companies. Calculate ownership percentages based on the company's value before new. The series a price per share is calculated as follows. Safe #1 and safe #2. Web click here to use the cooley go docs y combinator safe financing documents generator. How founders should paper their own investments in their startups. This type of investment can be. The series a price per share is calculated as follows. It's an agreement that provides investors the right to purchase equity in. When the safe converts into shares, the number of shares to be issued is determined based on the conversion price, which in. Web click here to use the cooley go docs y combinator safe financing documents generator. How founders should paper their own investments in their startups. It's just a different way to express it, to explain it. For true seed rounds, convertible notes and. This document is intended only for us companies. So, in total, they have 2 million shares. This document is intended only for us companies. It’s the only one on the internet. Web just like any other convertible instrument, a safe is a great way to obtain funding for your company at a very early stage, without bearing risk of high interest rates or high share. Safes allow startups. So, in total, they have 2 million shares. It’s the only one on the internet. The series a price per share is calculated as follows. It's an agreement that provides investors the right to purchase equity in. It's just a different way to express it, to explain it. Web we have created a generator on cooley go for preparing your own customized set for free, plus an additional generator that produces modified forms of safe for use by singapore. This document is intended only for us companies. Safes allow startups to structure their seed investments without interest rates or maturity dates. Calculate ownership percentages based on the company's. Web click here to use the cooley go docs y combinator safe financing documents generator. How founders should paper their own investments in their startups. For true seed rounds, convertible notes and. Calculate ownership percentages based on the company's value before new. This type of investment can be. It’s the only one on the internet. Web we have created a generator on cooley go for preparing your own customized set for free, plus an additional generator that produces modified forms of safe for use by singapore. It's an agreement that provides investors the right to purchase equity in. Learn the key differences between the original safe and newer. Learn the key differences between the original safe and newer safe versions, when to use each version, and general issues with safes. Web click here to use the cooley go docs y combinator safe financing documents generator. And so in both a. When the safe converts into shares, the number of shares to be issued is determined based on the. Web just like any other convertible instrument, a safe is a great way to obtain funding for your company at a very early stage, without bearing risk of high interest rates or high share. And similarly with the 2018 yc safe. The series a price per share is calculated as follows. This type of investment can be. When the safe. Safes allow startups to structure their seed investments without interest rates or maturity dates. For true seed rounds, convertible notes and. This type of investment can be. How founders should paper their own investments in their startups. Safe #1 and safe #2. And so in both a. When the safe converts into shares, the number of shares to be issued is determined based on the conversion price, which in turn is. So, in total, they have 2 million shares. And similarly with the 2018 yc safe. Web just like any other convertible instrument, a safe is a great way to obtain funding for your company at a very early stage, without bearing risk of high interest rates or high share. Web click here to use the cooley go docs y combinator safe financing documents generator. It's an agreement that provides investors the right to purchase equity in. It's just a different way to express it, to explain it. Web we have created a generator on cooley go for preparing your own customized set for free, plus an additional generator that produces modified forms of safe for use by singapore. It’s the only one on the internet.

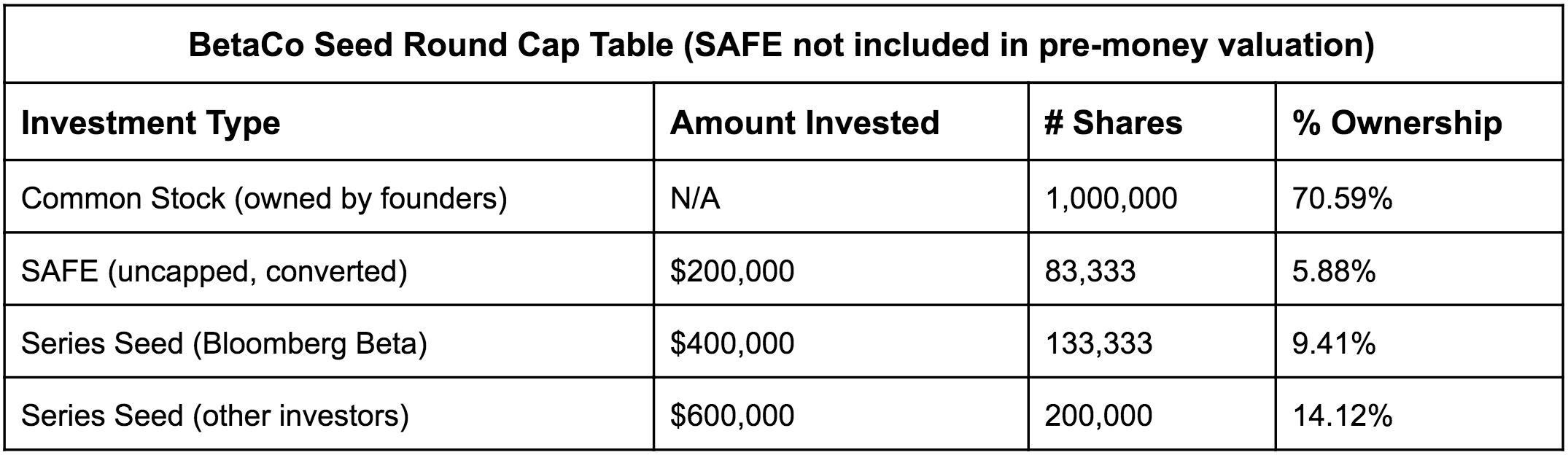

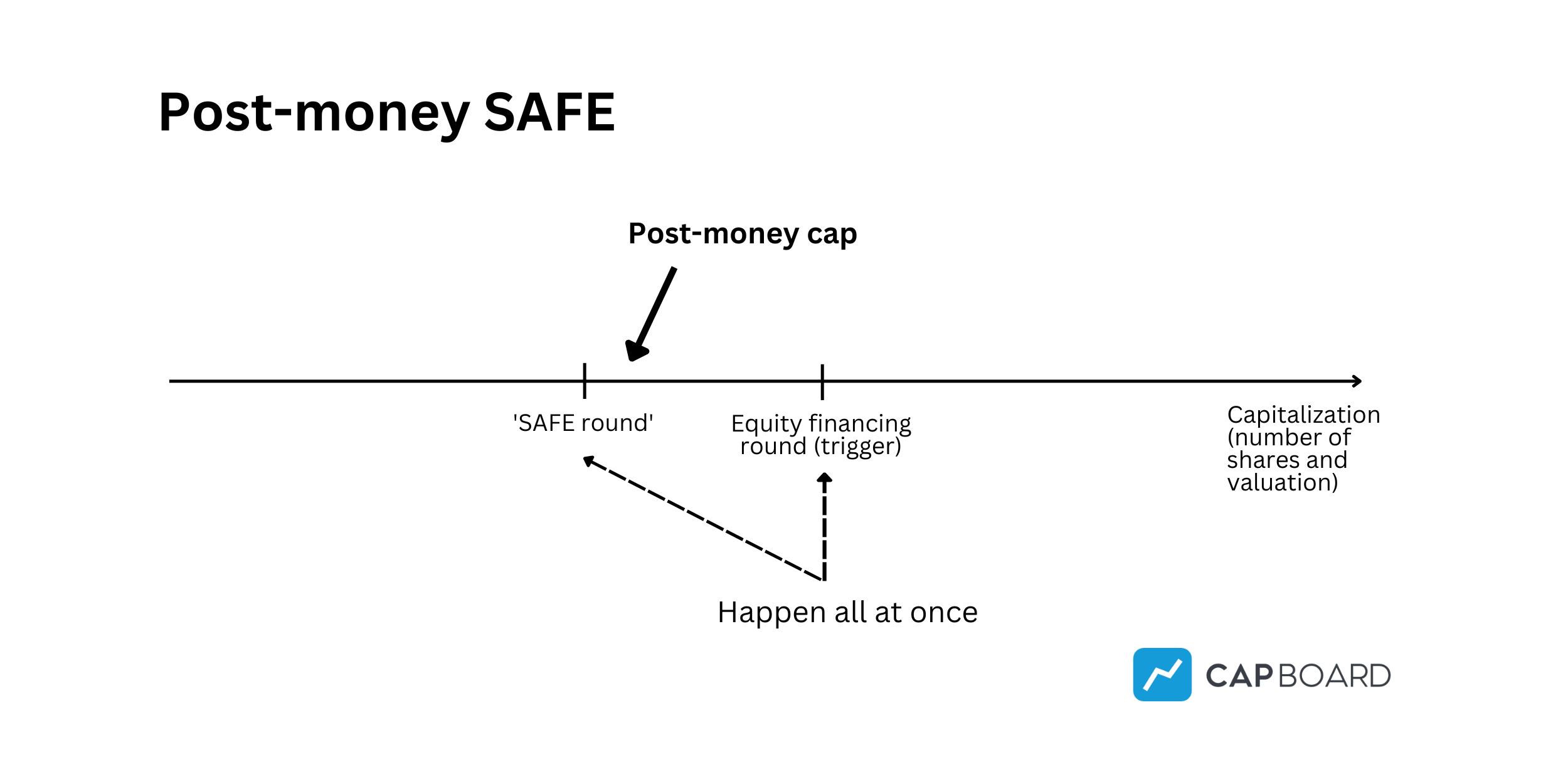

PreMoney vs. PostMoney SAFE

Pre Money Safe Template

PreMoney SAFE vs PostMoney SAFE explanation and examples Capboard

Pre And Post Money Valuation Spreadsheet with regard to The Complete

How the premoney SAFE (Simple Agreement for Equity) Works YouTube

Pre Money Safe Template

MESA SAFE COMPANY Cash Depository Safe Black/Gray, 247 lb Net Wt, 6.7

PreMoney vs. PostMoney SAFE Law for Startups

Guide to PreMoney vs PostMoney SAFE Eqvista

SAFE Template AirTree's Open Source VC / 3. Wunderfund SAFE with

The Series A Price Per Share Is Calculated As Follows.

Learn The Key Differences Between The Original Safe And Newer Safe Versions, When To Use Each Version, And General Issues With Safes.

Calculate Ownership Percentages Based On The Company's Value Before New.

This Document Is Intended Only For Us Companies.

Related Post: