Present Value Excel Template

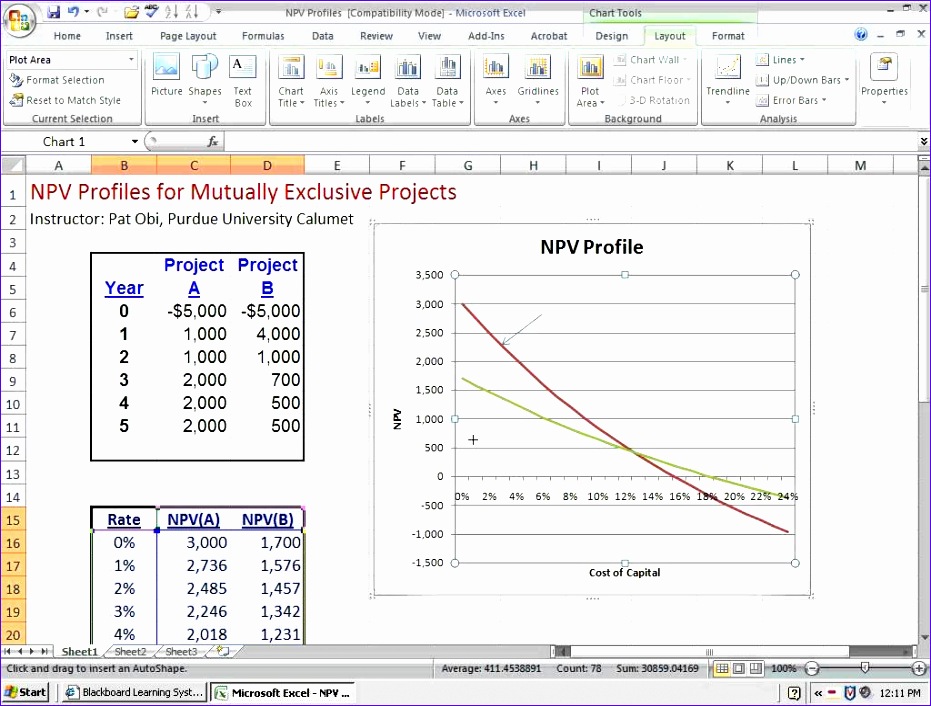

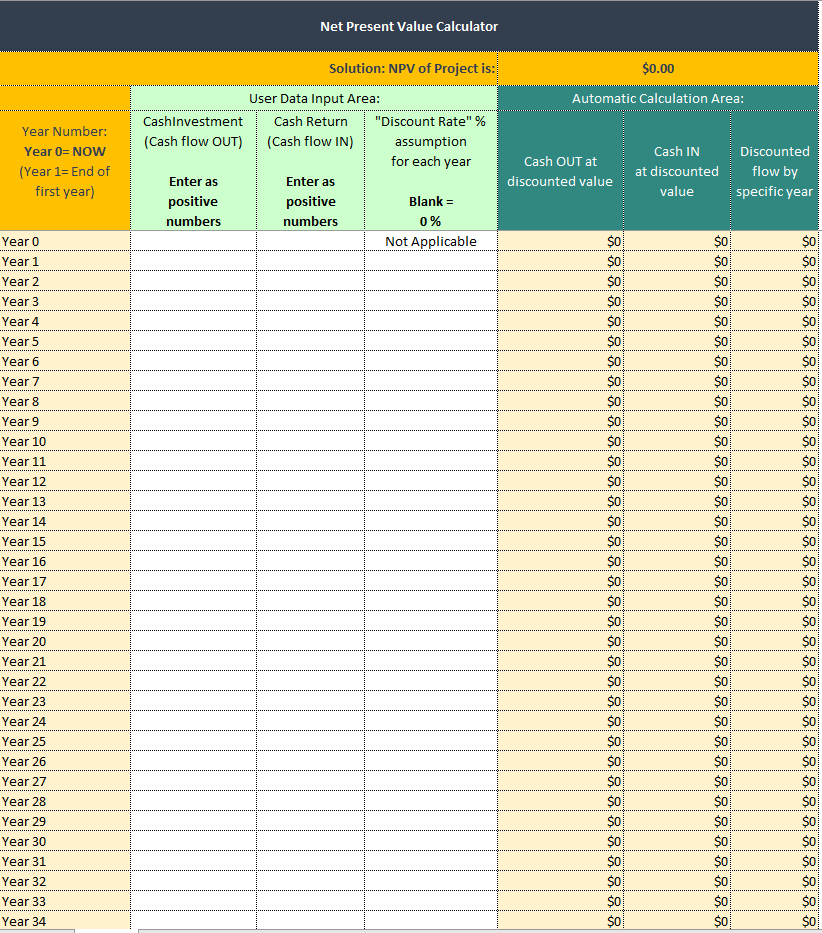

Present Value Excel Template - Below this column header you’ll be calculating the net present value. Present value = $2,000 / (1 + 4%) 3. Now, in the destination cell, which is e2 in the current. Similarly, we have to calculate it for other values. It is a financial measure to tell if an investment is going to be profitable or if it is. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. The big difference between pv and npv is that npv takes into account the initial. Let’s first understand what net present value means. Web net present value template. Syntax of the pv function. In this example, we will calculate present value in excel for single payment. Web what is npv? First, we have to calculate the present value. Calculate present value for single payment. Syntax of the pv function. Net present value (npv) excel template helps you calculate the present value of a series of cash flows. Similarly, we have to calculate it for other values. The pv in excel calculates the present value of the investments made by the investor in the form of shares, bonds,. Web net present value template. The net present value (npv) of an. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Web net present value template. Web updated december 20, 2023. Net present value is the difference between the pv of cash flows and the pv of cash outflows. The adjusted present value is a modified version. How to calculate present value (pv) present value formula (pv) how does the discount rate affect present value? =pv ( 4%, 5, 0, 15000 ) for example, the spreadsheet on the right shows the excel pv function used to calculate the present value of an investment that earns an. We calculate the present value using the following formula: Web what. Net present value is the difference between the pv of cash flows and the pv of cash outflows. Use this free excel template to easily. Net present value (npv) is a core component of corporate budgeting. Web use this template to calculate the present value of a series of expected annuity payments, paid at the beginning of the period. Single. Web updated december 20, 2023. Net present value (npv) is a core component of corporate budgeting. Web what is npv? The big difference between pv and npv is that npv takes into account the initial. In this example, we will calculate present value in excel for single payment. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web what is npv? Web table of contents. Similarly, we have to calculate it for other values. Net present value is calculated using. The adjusted present value is a modified version of the net present value (npv) that incorporates the benefits and. Now, in the destination cell, which is e2 in the current. Present value = $2,000 / (1 + 4%) 3. Single cash flow with compound interest. Net present value means the net value of an investment today. How to calculate present value (pv) present value formula (pv) how does the discount rate affect present value? Similarly, we have to calculate it for other values. The pv in excel calculates the present value of the investments made by the investor in the form of shares, bonds,. Net present value (npv) excel template helps you calculate the present value. We calculate the present value using the following formula: Let’s first understand what net present value means. Below this column header you’ll be calculating the net present value. It is a financial measure to tell if an investment is going to be profitable or if it is. Net present value is calculated using. =pv ( 4%, 5, 0, 15000 ) for example, the spreadsheet on the right shows the excel pv function used to calculate the present value of an investment that earns an. Present value is discounted future cash flows. How to calculate present value in excel. Web net present value template. Net present value is calculated using. Net present value (npv) is a core component of corporate budgeting. Syntax of the pv function. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. It is a financial measure to tell if an investment is going to be profitable or if it is. Now, in the destination cell, which is e2 in the current. Net present value means the net value of an investment today. Web what is npv? Use this free excel template to easily. Let’s first understand what net present value means. While you can calculate pv in excel, you can also calculate net present value(npv). Npv is the value that represents the current value of all the future cash flows without the.

Professional Net Present Value Calculator Excel Template Excel TMP

Net Present Value Calculator Excel Templates

6 Net Present Value Excel Template Excel Templates Excel Templates

10 Excel Net Present Value Template Excel Templates Excel Templates

6 Net Present Value Excel Template Excel Templates

Net Present Value Calculator Excel Template Eloquens

Net Present Value Calculator Excel Template SampleTemplatess

Net Present Value Formula Examples With Excel Template

Present Value Excel Template

Present Value Calculator »

The Big Difference Between Pv And Npv Is That Npv Takes Into Account The Initial.

Web Table Of Contents.

The Pv In Excel Calculates The Present Value Of The Investments Made By The Investor In The Form Of Shares, Bonds,.

Similarly, We Have To Calculate It For Other Values.

Related Post: