Probate Accounting Template

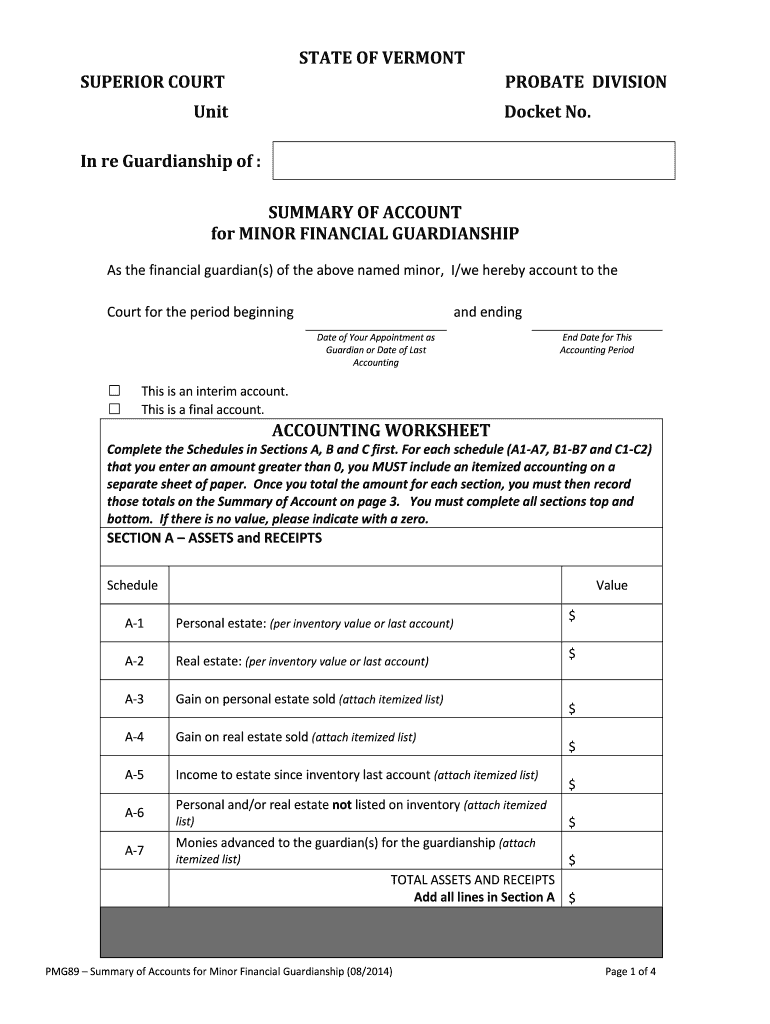

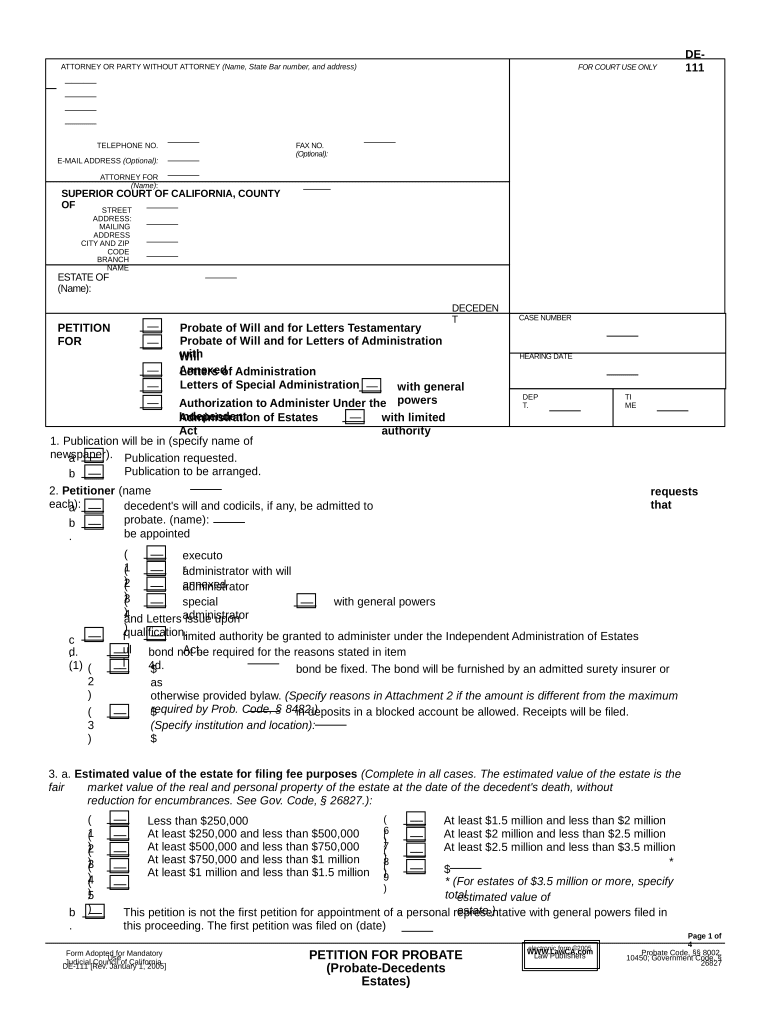

Probate Accounting Template - ** if a registered account, indicate beneficiary. Early in the probate process, an executor is required to provide the probate court with an inventory of the estate’s assets. The initial account is due nine months after the date of appointment of the personal representative. After updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Web we can also help you if you are thinking about compelling an accounting, examining the fiduciary, or objecting to an accounting. Web here are the steps for preparing an estate inventory for probate: That means it includes property (like houses, cars, and jewelry) as well as bank accounts. Relatively simple estate, no debts except possibly utilities etc., executor's expenses. Trust accounting is often required by law when a trustee is appointed, terminated, or changed. After finalizing the inventory of assets. This is done for two major reasons: Identify all assets owned in the estate. Web in simple terms, probate accounting is when you take account of all the assets in a deceased person’s estate for the purposes of distribution to their heirs. Web probate accounting in california. 27 april 2019 at 3:03pm. Web in simple terms, probate accounting is when you take account of all the assets in a deceased person’s estate for the purposes of distribution to their heirs. According to the article closing an estate in a formal probate process, finalizing the inventory of assets is a prerequisite to the final accounting. Web probate final accounting is a report prepared. Web probate accounting in california. Relatively simple estate, no debts except possibly utilities etc., executor's expenses. Accounts must be filed with the commissioner of accounts. Accounts must be signed by each of the executors, administrators or curators. Good record keeping is necessary for an accurate final accounting. Trust accounting is often required by law when a trustee is appointed, terminated, or changed. As mentioned in the article closing an estate in a formal probate process, the attorney sent me three schedules that made up the final account. It is also necessary when a current trustee brings a petition for the estate’s final distribution or closing. Gather details. Testatrix was sole surviving parent, only. 27 april 2019 at 3:03pm. Web estate accounts template. Web here are the steps for preparing an estate inventory for probate: After updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. Finding the accounting soft spot. There are two types of accounts, an interim account anda final account. Section 16062 of the california probate code requires trustees to provide an accounting at least once a year. ** if. There are two types of accounts, an interim account anda final account. Gather details of all assets. We will go over each of these steps in detail in the corresponding sections below. Early in the probate process, an executor is required to provide the probate court with an inventory of the estate’s assets. Web probate final accounting is a report. Finding the accounting soft spot. Our office routinely assists personal representatives in probate matters. Take extra steps to prepare a full inventory. We will go over each of these steps in detail in the corresponding sections below. After updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. An account must be filed within 16 months of qualification or the date of the last account period, covering a period not exceeding 12 months. Trust accounting is often required by law when a trustee is appointed, terminated, or changed. Web in such cases, the probate court must resolve any disputes after giving both sides an opportunity to be heard.. The inventory is an overview of the fair market value of all assets owned by. According to the article closing an estate in a formal probate process, finalizing the inventory of assets is a prerequisite to the final accounting. Let’s review the basic process of taking inventory, keeping financial records and the final accounting of an estate in wisconsin. Web. Early in the probate process, an executor is required to provide the probate court with an inventory of the estate’s assets. It is also necessary when a current trustee brings a petition for the estate’s final distribution or closing. Accounts must be filed with the commissioner of accounts. This post explains the financial reporting involved in those matters, and how we help our clients handle their responsibilities appropriately. Can anybody direct me to a suitable account template/guide etc.? First, it is a necessary part of probating the estate, and generally required by the probate court. After updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. ** if a registered account, indicate beneficiary. This lists all the property that is in the estate, and establishes the starting value of the estate. Gather details of all assets. Summary of account—standard and simplified accounts (name): We will go over each of these steps in detail in the corresponding sections below. Web the probate final accounting is the last step to close the estate and distribute assets to the estate heirs and pay the creditors who have filed legitimate claims. Finding the accounting soft spot. Web however, it is still helpful to have a basic understanding of the accounting aspect of the probate process. This is done for two major reasons:

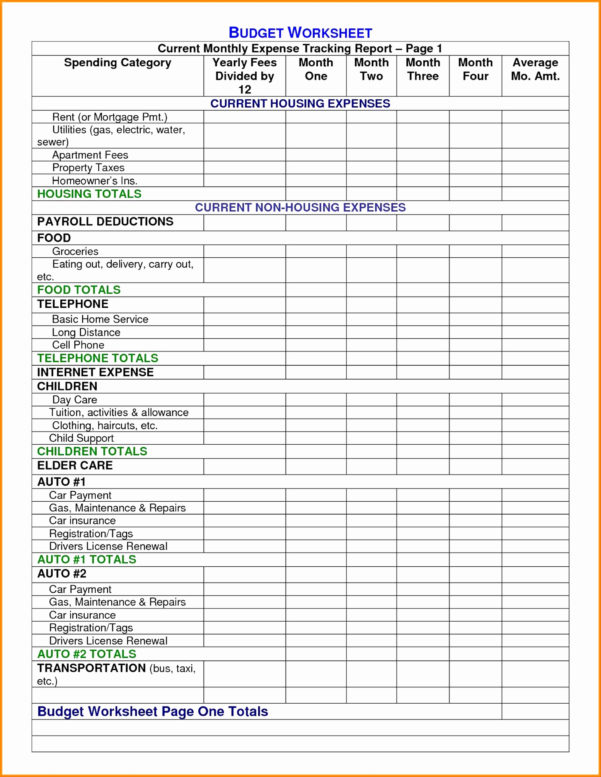

Probate Accounting Spreadsheet Inside 50 Beautiful Probate Accounting

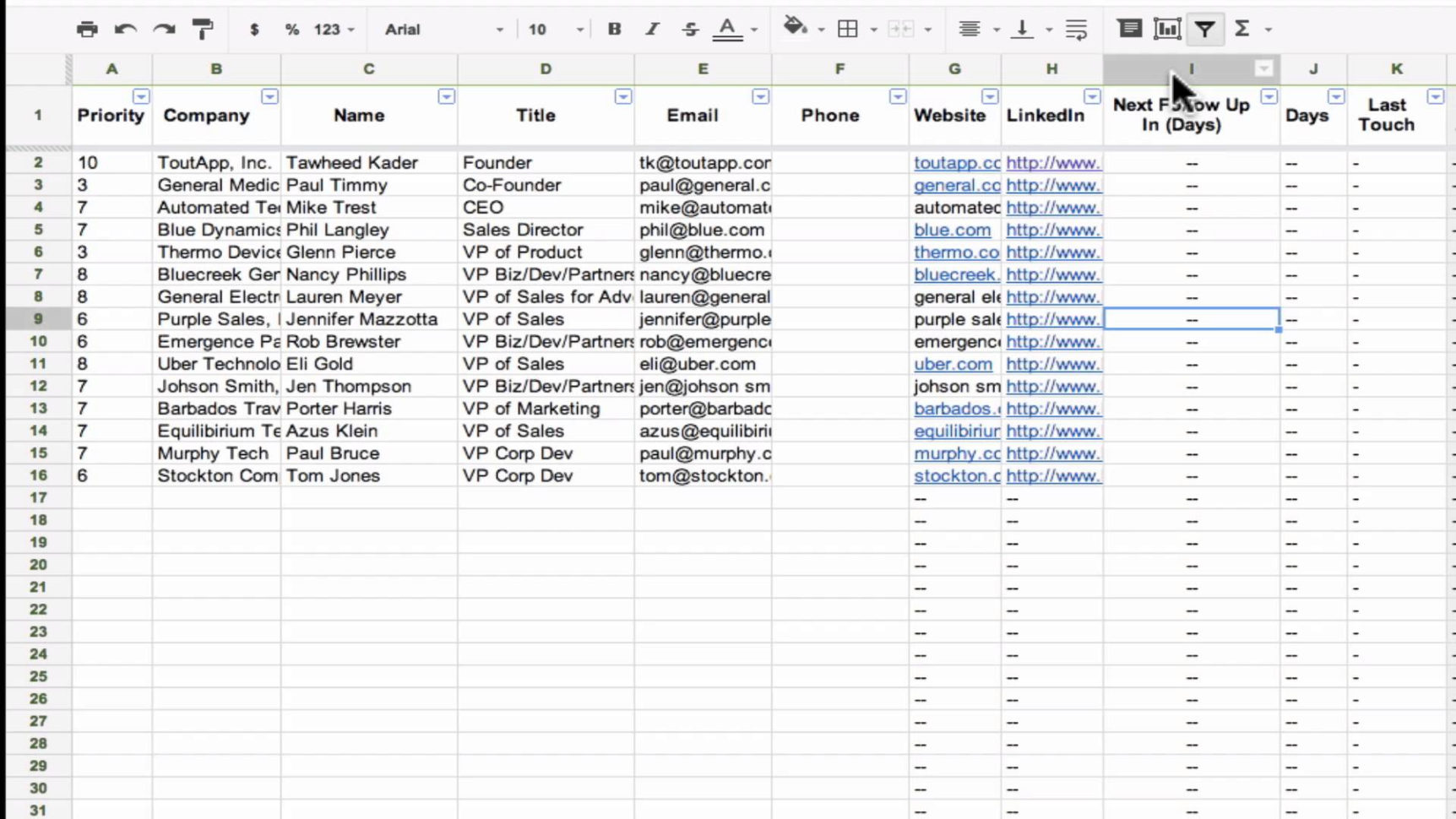

Probate and Estate Management Software • thewealthworks • Troika

Probate Spreadsheet Template —

Probate Accounting Template Excel

Final Account Probate Doc Template pdfFiller

Probate Accounting Template Excel

Probate Accounting Template Excel

Probate Accounting Form Fill Out and Sign Printable PDF Template

Probate Accounting Template Excel

Ca Probate Form Fill Out and Sign Printable PDF Template airSlate

It Is A Crucial Step In Settling An Estate.

Web Probate Final Accounting Is A Report Prepared By An Estate Executor Or Personal Representative To Document The Financial Transactions And Distribution Of Assets Throughout The Probate Process.

It Is Simply An Accounting Of The Transactions Undertaken By An Estate During A Specific Reporting Period.

Identify All Assets Owned In The Estate.

Related Post: