Qualified Income Trust Template

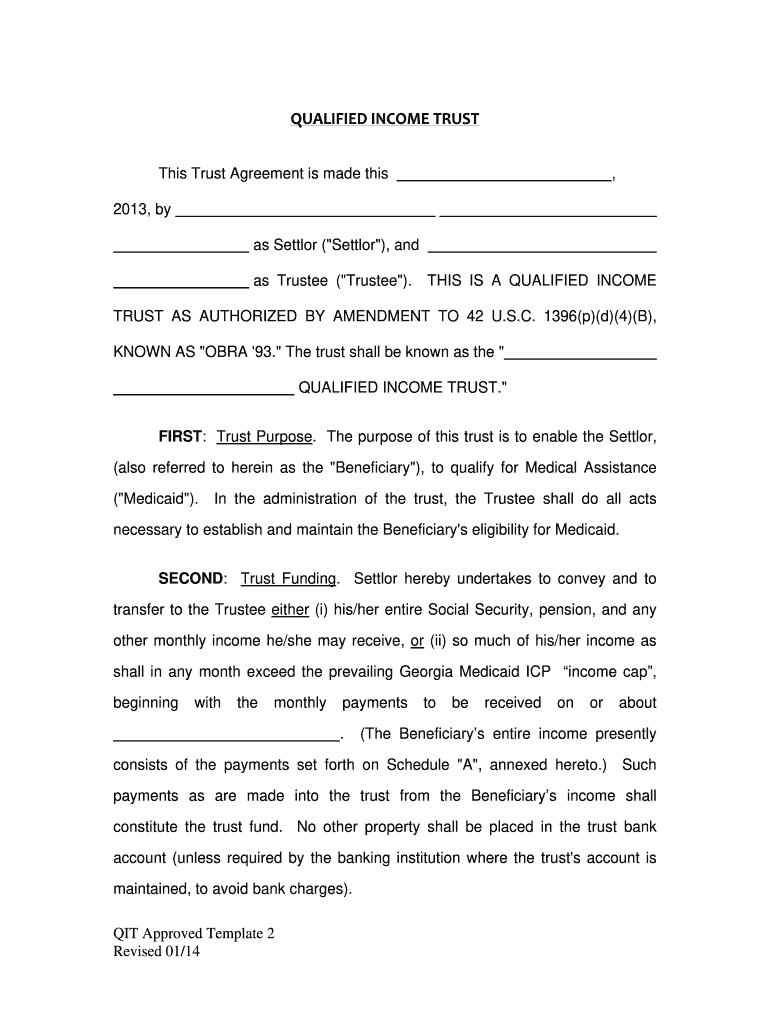

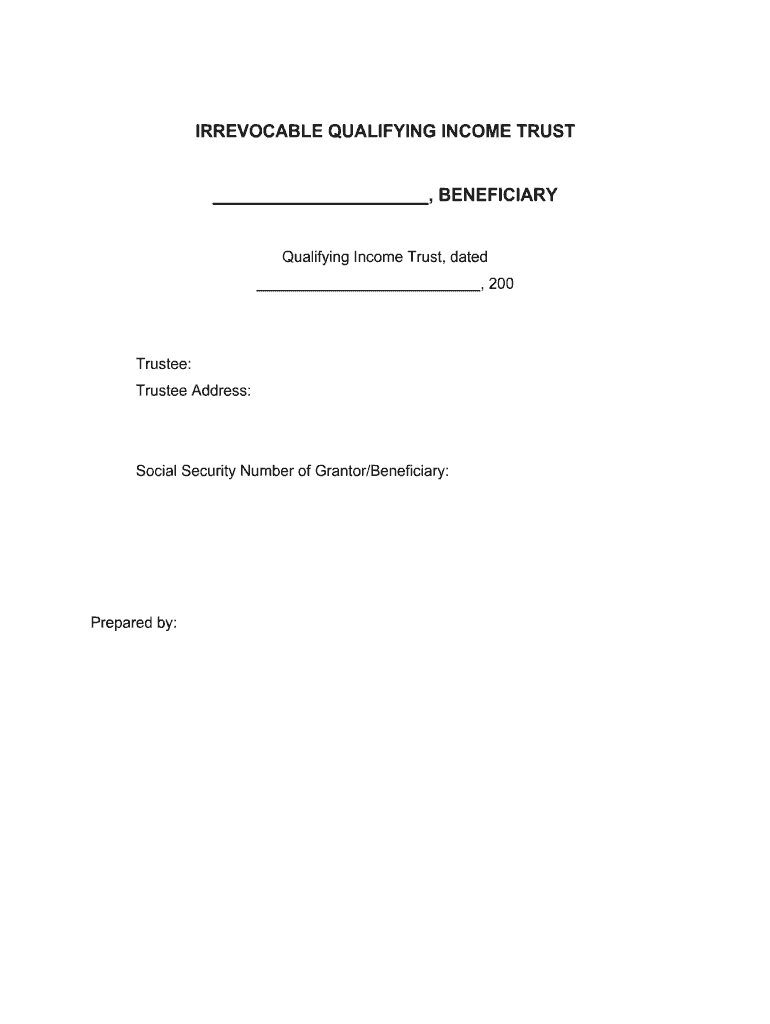

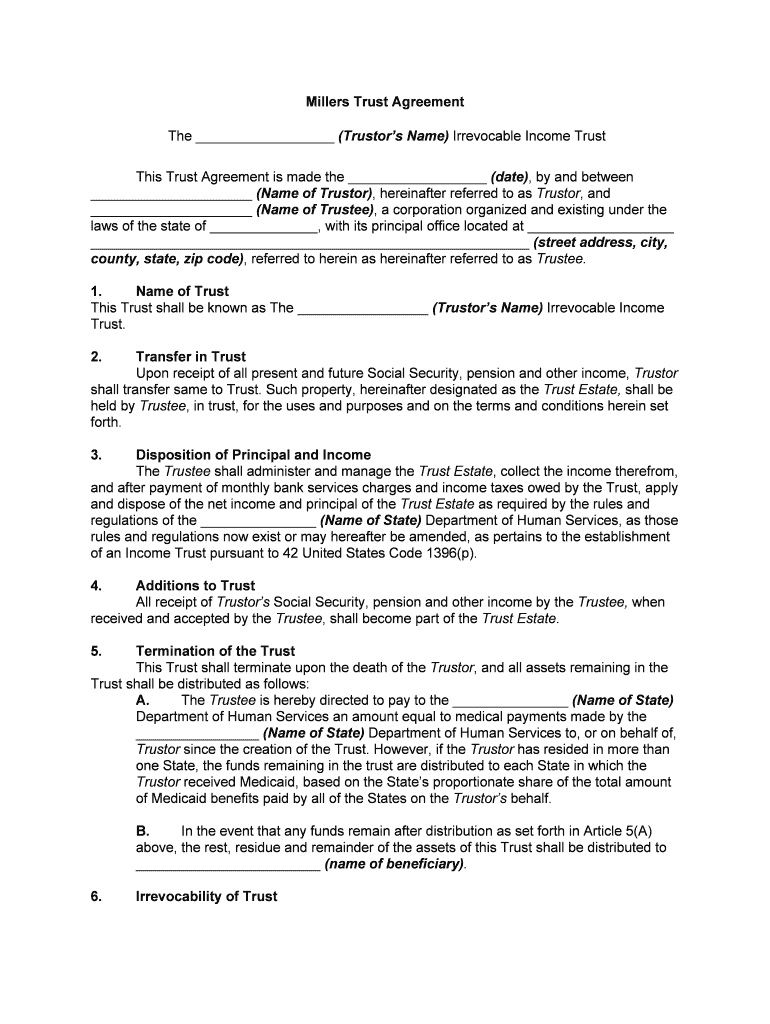

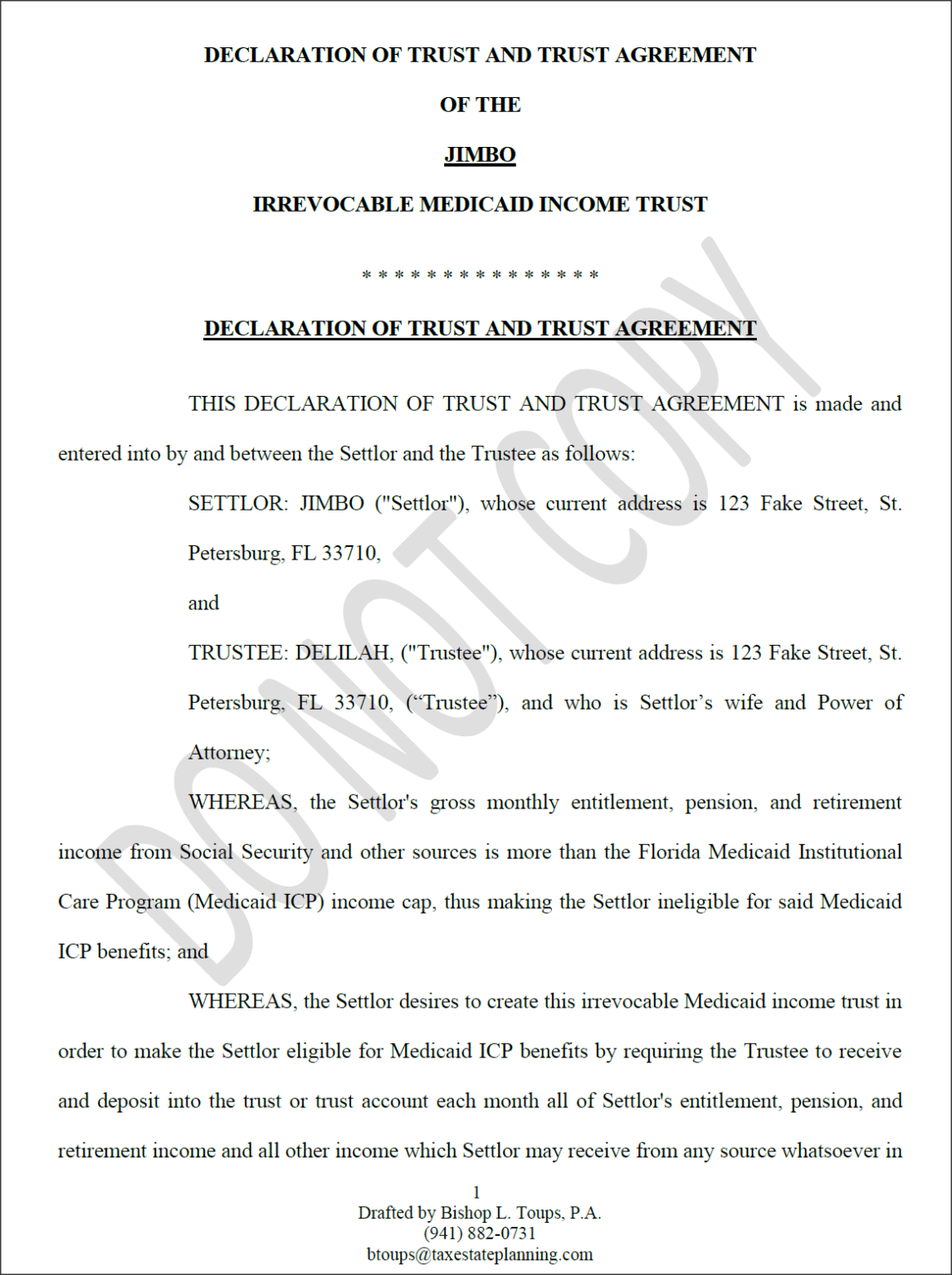

Qualified Income Trust Template - What is a qualified income trust (qit)? Web qualified income trust template | medicaid. Web a miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. This article explains qualified income trusts (qits) in texas. Qit frequently asked questions (faqs) qualified income trust template : What medicaid applicants need to tell a bank when. Web overview of qualified income trusts : Web not everyone will benefit from a qualified income trust (which is also commonly referred to as a “miller trust”). Estimated miller trusts needed per county. Web basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and. Qualified income trust, certification of. Search forms by statecustomizable formschat support availableview pricing details In order to receive medicaid long. What medicaid applicants need to tell a bank when. If you have gross income of more than $2,829 a month, and you want medicaid benefits to pay for long term care, you will need a qualified income. Web not everyone will benefit from a qualified income trust (which is also commonly referred to as a “miller trust”). Web you can find the qualified income trust template which includes the qit form and certification of trust document on the ohio department of medicaid’s website. Web overview of qualified income trusts : Composed by legal hotline for texans •. Information on establishing a miller trust for banks. Web qualified income trust miller trust template. This trust agreement is made this , 2013, by as settlor (settlor), and. This is a qualified income. Web a qualified income trust, or miller trust, is a trust (a special bank account) that allows individuals to qualify for tenncare choices benefits when their monthly. Web a qualified income trust, or miller trust, is a trust (a special bank account) that allows individuals to qualify for tenncare choices benefits when their monthly income is too. It is to help people applying for medicaid and their attorneys and provides. Web overview of qualified income trusts : What is a qualified income trust (qit)? Web qualified income. Web a miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. It is to help people applying for medicaid and their attorneys and. A qualified income trust (qit), also known as a miller trust, is a special legal arrangement for holding a. In order to receive medicaid long. If you have income that exceeds. Web prepare your qit now, online! Estimated miller trusts needed per county. Web basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and. It is to help people applying for medicaid and their attorneys and provides. Web a miller trust (also known as a qualified income trust) is designed to own income in order. If you have gross income of more than $2,829 a month, and you want medicaid benefits to pay for long term care, you will need a qualified income. You can find it on the ohio department of medicaid’s website at. Grantor is establishing this qualified income trust in order for grantor to qualify for medicaid assistance under florida’s institutional care. If you have gross income of more than $2,829 a month, and you want medicaid benefits to pay for long term care, you will need a qualified income. Web this irrevocable qualified income trust agreement is made this __ day of____, 20____ by _____, by _____, attorney in fact for _____, (hereinafter, the “grantor), whose. Grantor is establishing this qualified. Grantor is establishing this qualified income trust in order for grantor to qualify for medicaid assistance under florida’s institutional care program. This trust agreement is made this , 2013, by as settlor (settlor), and. Web qualified income trust template | medicaid. It is to help people applying for medicaid and their attorneys and provides. Web the state of ohio has. Information on establishing a miller trust for banks. Web not everyone will benefit from a qualified income trust (which is also commonly referred to as a “miller trust”). Web this irrevocable qualified income trust agreement is made this __ day of____, 20____ by _____, by _____, attorney in fact for _____, (hereinafter, the “grantor), whose. Web basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and. It is to help people applying for medicaid and their attorneys and provides. Web a qualified income trust (qit), also known as a “miller trust,” is a legal arrangement that can help you become or remain eligible for medicaid. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. Estimated miller trusts needed per county. Web qualified income trust template | medicaid. What is a qualified income trust? If you have gross income of more than $2,829 a month, and you want medicaid benefits to pay for long term care, you will need a qualified income. Web the texas health and human services commission (hhsc) offers this information. This is a qualified income. Web _______________________qualified income trust (miller trust) [name of beneficiary] _________________________ [name of settlor] hereby creates a trust, to. This trust agreement is made this , 2013, by as settlor (settlor), and. Web a miller trust (also known as a qualified income trust) is designed to own income in order for an individual to get around medicaid’s income caps.

Qualified Trust Form Fill Online, Printable, Fillable

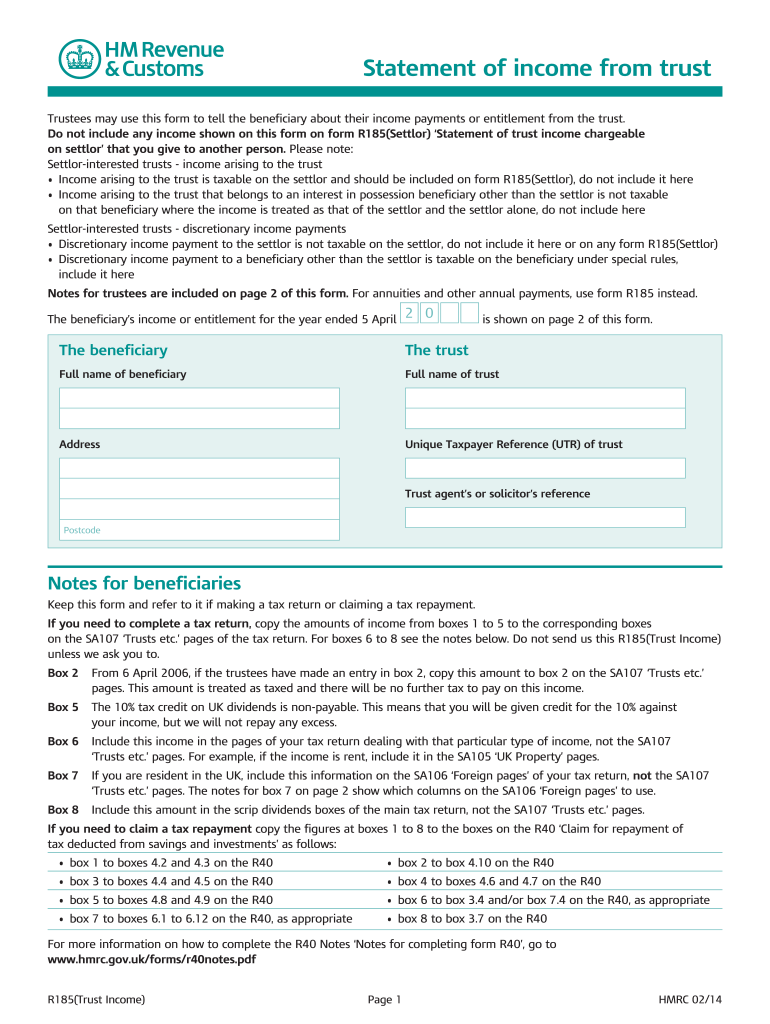

Does a Qualified Trust File a Tax Return airSlate SignNow

Florida Qualified Trust Template Fill Online, Printable

Fillable Online icew Qualified Trust Form. qualified

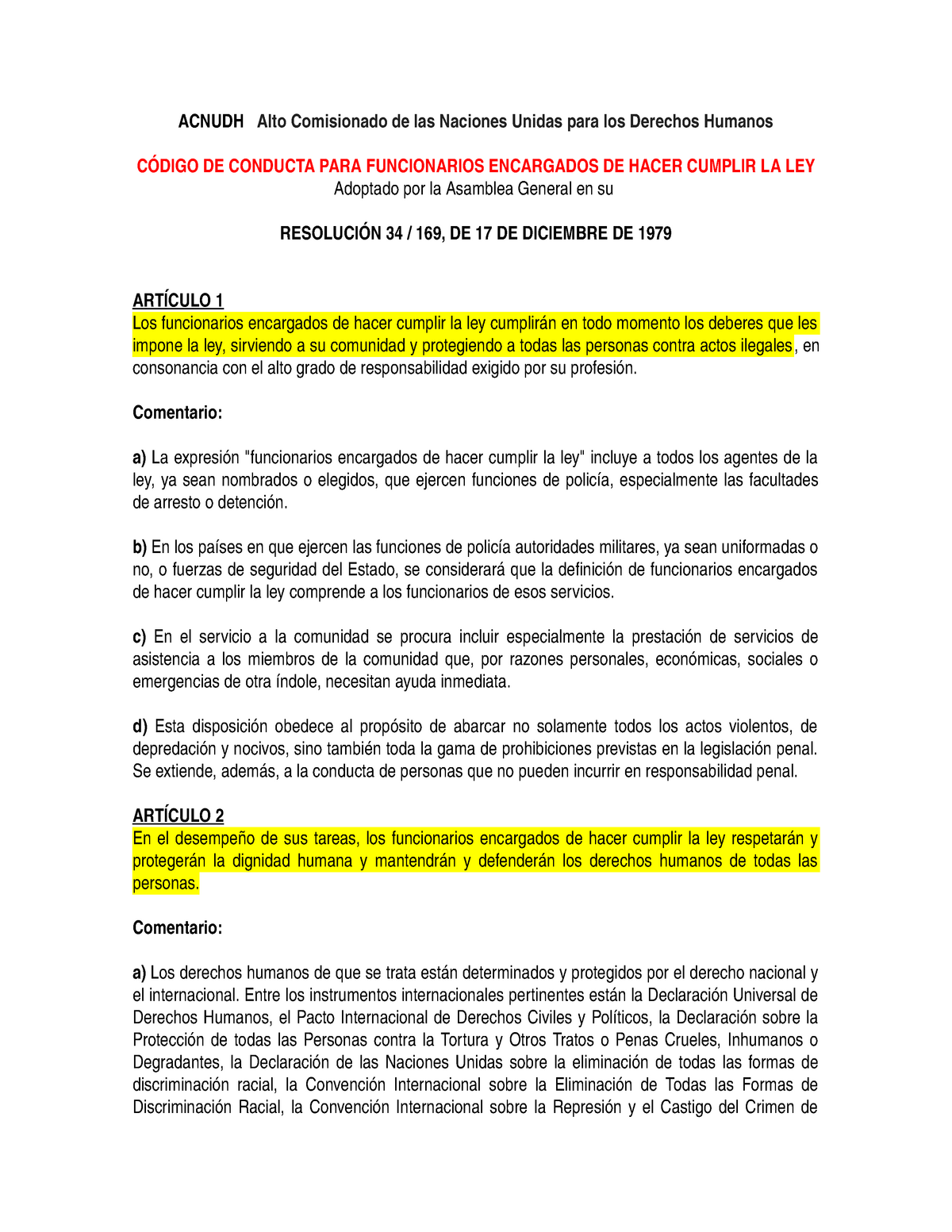

Resolución 34 169 DE 17 DE Diciembre DE 1979 Acnudh Alto Comisionado de

Tennessee Qualified Trust Form Fill Online, Printable

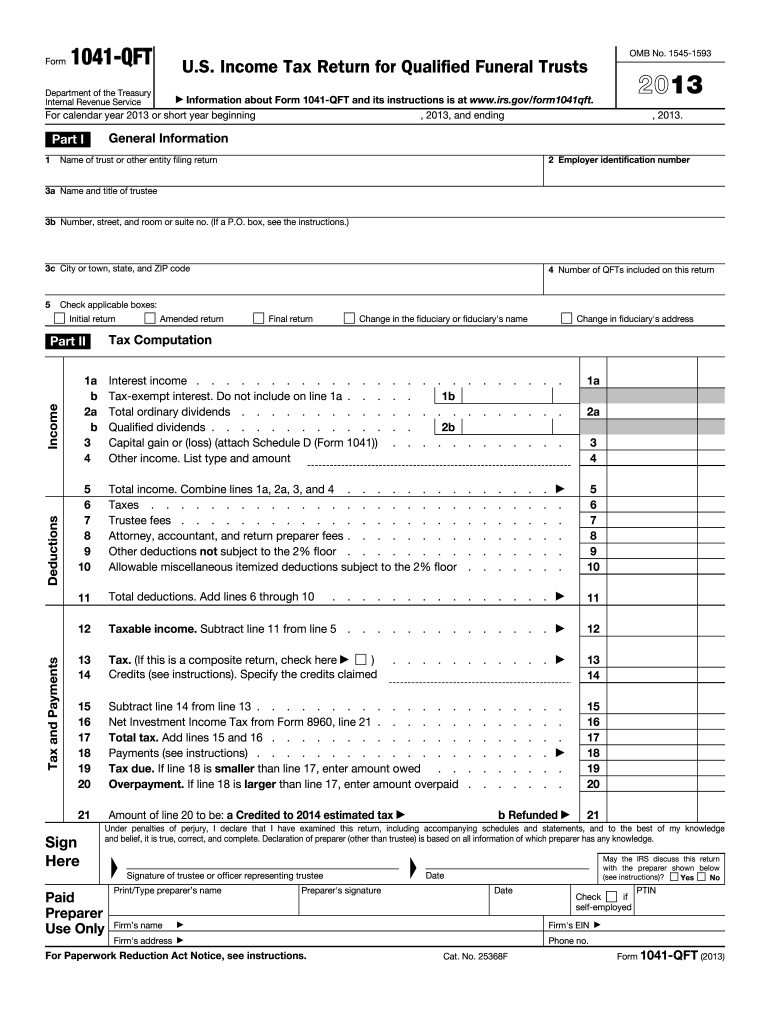

Form 1041 QFT U S Tax Return for Qualified Funeral Trusts Fill

Qualified Miller Trust Fill and Sign Printable Template Online

R185 Trust Form Fill Out and Sign Printable PDF Template

QIT What is a Florida Medicaid Qualified Trust?

Web Qualified Income Trust Information Sheet.

You Can Find It On The Ohio Department Of Medicaid’s Website At.

A Qualified Income Trust (Qit), Also Known As A Miller Trust, Is A Special Legal Arrangement For Holding A.

Web Health Insurance Medicaid & Medicare.

Related Post: