Retirement Plan Template

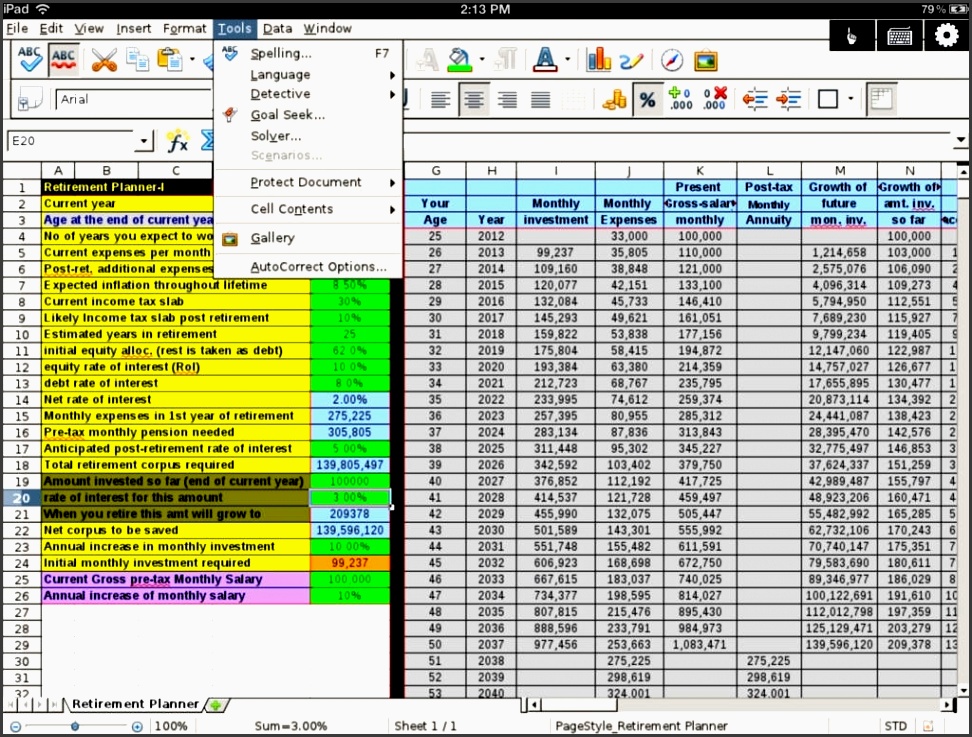

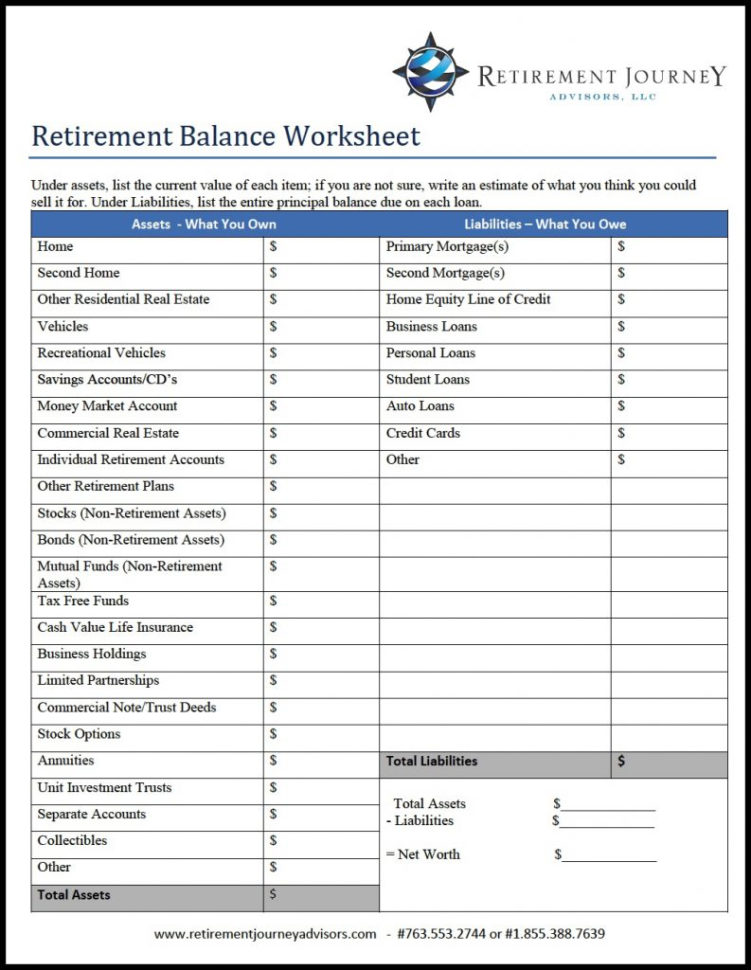

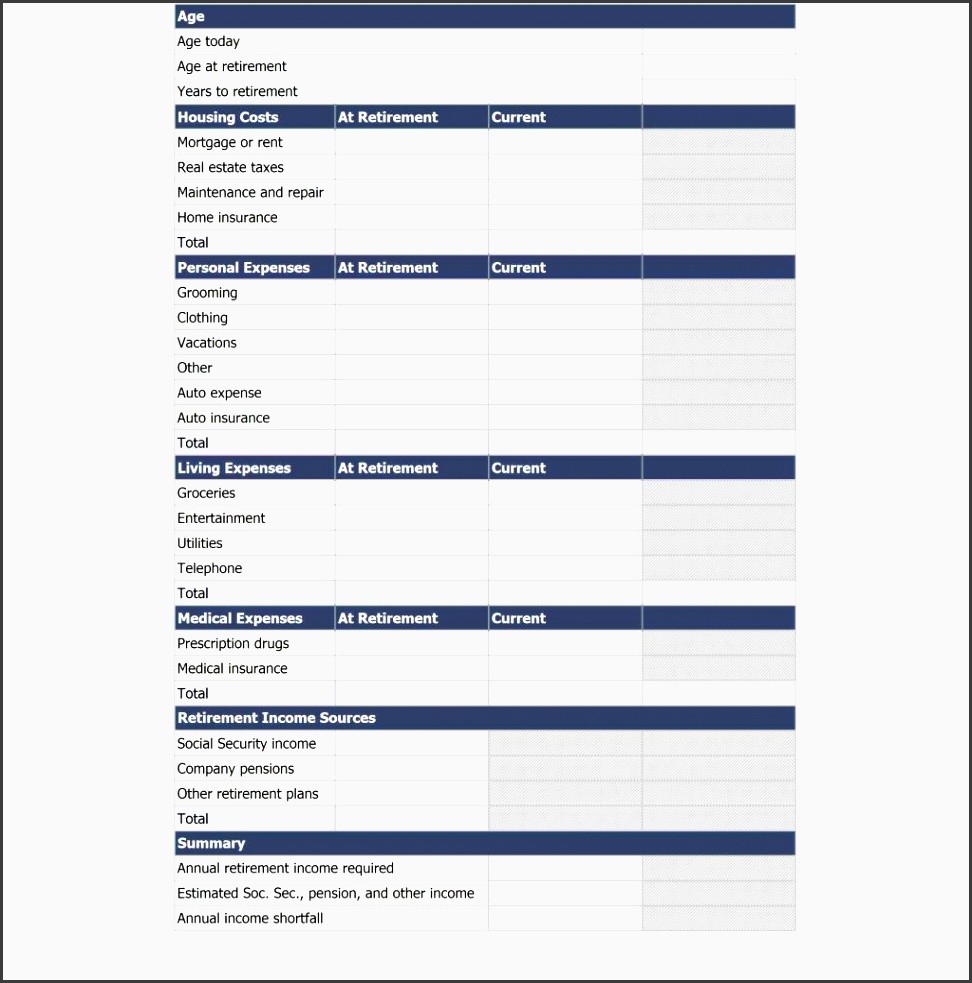

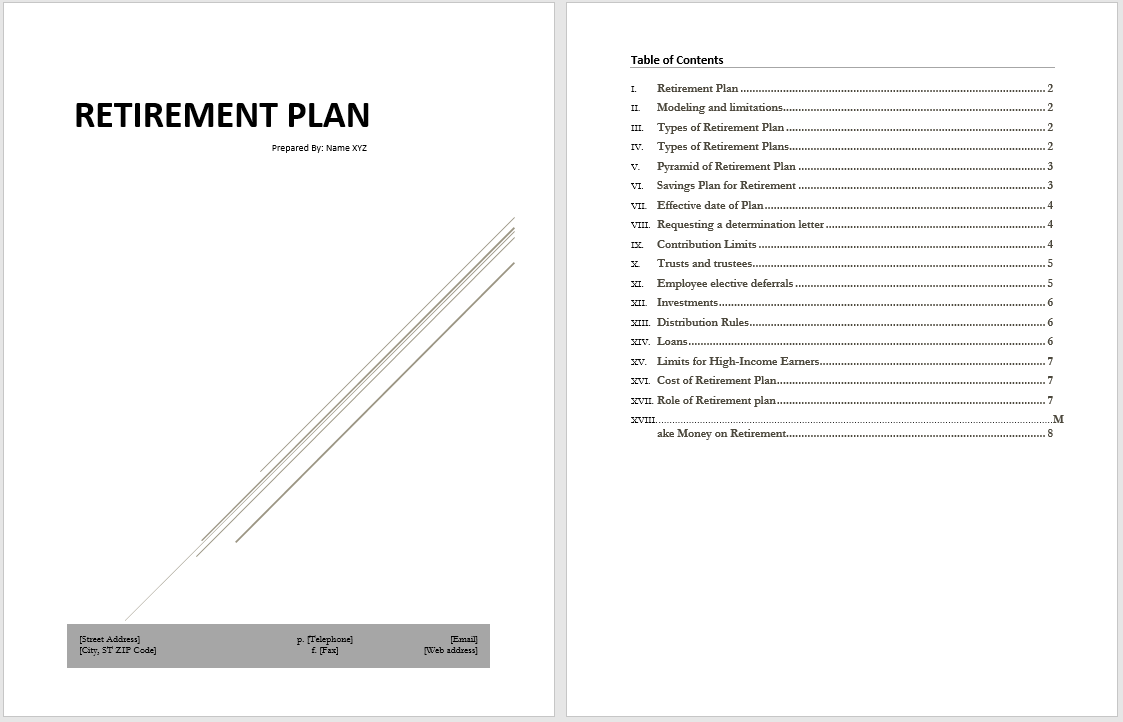

Retirement Plan Template - Web suppose your fra is 66, and your monthly benefit at fra is $2,000. Web creating a college savings plan? Year 2 (age 67 to 68): Year 1 (age 66 to 67): Web 7 best free retirement planning spreadsheets (updated for 2024) these 7 free retirement planning spreadsheets will help you plan your financial future and experiment with savings, investment, and withdrawal rate scenarios. Frequently asked questions (faqs) photo: Give time to others, to see. We plan which accounts to draw from, when to draw from them, and how much to draw. You might not want to work forever, or be able to fully rely on social security. Web don't assume that being a landlord is a great plan for your senior years. A bad combination of stress, risk. Web this happens surprisingly often, with roughly 29.2 million forgotten 401(k)s holding an average balance of $56,616, according to capitalize, a technology platform for workplace retirement plans. One of the purposes many families turn to microsoft excel for is working out their retirement plan in an easy and quick manner. We find the best. Tagged collected spreadsheet templates google sheets templates microsoft excel templates. Customize this template according to your needs and start your journey toward a. With your account open, create your free plan, 1 including a saving and investing roadmap to help you meet your retirement goals. Web our personal retirement planner template comes with retirement tools, a fully customizable retirement calculator,. I’ll cover a few of the most important reasons to use a retirement planning spreadsheet below. Web the flexible retirement planner. Martin barraud / getty images. Web choose the way you want to enter your expense. Enter your estimated expenses for each category, then click calculate at the bottom to see your total. Generally, you'll face a 10% early withdrawal penalty for taking money out of a traditional ira or 401(k) plan prior to age 59 1/2.but. Our retirement planning worksheet can help you calculate your retirement expenses and income. These are 7.65% of your pay, which you calculate to be $367 monthly. Year 2 (age 67 to 68): Open a fidelity retirement. Web ron’s mission statement. Web choose the way you want to enter your expense. Web planning for retirement is a way to help you maintain the same quality of life in the future. With your account open, create your free plan, 1 including a saving and investing roadmap to help you meet your retirement goals. Note that these retirement spreadsheet. Your retirement can come from a wide range of sources and will differ by person, so it's important to account for the full picture. You'll often hear that it's really important to save well for retirement and line up income outside of social security. Live in a comfortable home with minimal maintenance and maximum protection from climate change. Our retirement. Web 7 best free retirement planning spreadsheets (updated for 2024) these 7 free retirement planning spreadsheets will help you plan your financial future and experiment with savings, investment, and withdrawal rate scenarios. Our free retirement and savings spreadsheets are designed for microsoft excel, so you can work with them. Web choose the way you want to enter your expense. Here. Pick a date to retire. This type of number crunching and planning is exactly the kind of math that gives me a headache. Our free retirement and savings spreadsheets are designed for microsoft excel, so you can work with them. Web choose the way you want to enter your expense. Give time to others, to see. Web a millennial couple invested in a $143,000 vacation home in bali. With your account open, create your free plan, 1 including a saving and investing roadmap to help you meet your retirement goals. In retirement, you'll also stop paying fica taxes. Web a retirement income plan can be created much like a budget, but to predict your spending needs. Here’s how the calculation works: Fidelity's planning and guidance center allows you to create and monitor multiple independent financial goals. Note that these retirement spreadsheet templates are free. Web choose the way you want to enter your expense. Here are the steps, select the cell “ e18 “. Excel 2007 or later & excel for ipad/iphone. Customize this template according to your needs and start your journey toward a. Web creating a college savings plan? Web 7 best free retirement planning spreadsheets (updated for 2024) these 7 free retirement planning spreadsheets will help you plan your financial future and experiment with savings, investment, and withdrawal rate scenarios. Live in a comfortable home with minimal maintenance and maximum protection from climate change. Web suppose your fra is 66, and your monthly benefit at fra is $2,000. Martin barraud / getty images. While there is no fee to generate a plan, expenses charged by your investments and other fees associated with trading or transacting in your account would still apply. May 12, 2024, 4:14 pm pdt. While some workers think they'll need $1.5 million or more, many don't have nearly that much. Web planning for retirement is a way to help you maintain the same quality of life in the future. We plan which accounts to draw from, when to draw from them, and how much to draw. See if a 401 (k) rollover is right for you. Enter your estimated expenses for each category, then click calculate at the bottom to see your total. Frequently asked questions (faqs) photo: Pick a date to retire.

Sample Hr Policy Template

Free Editable Retirement Budget Worksheet by Template Designer Issuu

Retirement planning worksheet excel Early Retirement

Qualified Retirement Plan How It Works, Investing, & Taxes

Sample Retirement Plan Advantage Wealth Planning

Retirement Planning Spreadsheet —

One Page Retirement Plan Chart Presentation Report Infographic PPT PDF

Retirement Planner Planner Retirement Financial Planner Etsy

9+ Retirement Planning Template DocTemplates

Retirement Plan Template Word Templates for Free Download

$2,000 X 1.08 = $2,160.

Open A Fidelity Retirement Account.

These Are 7.65% Of Your Pay, Which You Calculate To Be $367 Monthly.

Web It States That An Investor Can Withdraw 4% Annually (Adjusted For Inflation) From A Portfolio Of 60% Stocks And 40% Bonds, And Expect Their Savings To Last At Least 30 Years.

Related Post: