Safe Valuation Cap And Discount Template

Safe Valuation Cap And Discount Template - Web it’s $7.50 here, which means the series a investors pay $7.50 for each new share they purchase in this round. Upon raising funds above a certain. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your. Investor has purchased a safe for $100,000. You can view their template here. The valuation cap is $8,000,000 and the discount rate is 85%. It can also have a valuation cap. Web safe notes are simple and fast, without the pressure of interest payments, maturity dates, or valuation caps. Purchase and download templates drafted by lawyers in our network that match your needs. So, instead of capping the valuation at say $6 million, it says there's a 20% discount on the series a price. See section 2 for certain additional defined terms. Mfn, no valuation cap, no discount. Web it’s $7.50 here, which means the series a investors pay $7.50 for each new share they purchase in this round. Web so, there may be the concept of a discount instead of a cap. Investor has purchased a safe for $20,000. Web the “valuation cap” is $[_____]. Investor has purchased a safe for $20,000. See section 2 for certain additional defined terms. Purchase and download templates drafted by lawyers in our network that match your needs. Web learnings in the safe calculator. Web it’s $7.50 here, which means the series a investors pay $7.50 for each new share they purchase in this round. 80% (20% discount) valuation cap: Web so, there may be the concept of a discount instead of a cap. Mfn, no valuation cap, no discount. Web the safe discount is derived by dividing the valuation cap by the typical. Upon raising funds above a certain. Web so, there may be the concept of a discount instead of a cap. Investor has purchased a safe for $100,000. Purchase and download templates drafted by lawyers in our network that match your needs. It can also have a valuation cap. Web discount and valuation caps: It is a type of convertible security, similar to an option or warrant,. Web the safe discount is derived by dividing the valuation cap by the typical equity financing valuation and then removing that value from one (representing no discount). The valuation cap is $8,000,000 and the discount rate is 85%. Safe notes can include. 80% (20% discount) valuation cap: The valuation cap is $8,000,000 and the discount rate is 85%. There is a little switch which says “a cap is used”. Web it’s $7.50 here, which means the series a investors pay $7.50 for each new share they purchase in this round. The “discount rate” is [100 minus the discount]%. There is a little switch which says “a cap is used”. Safe notes can include a discount that is applied to a future valuation when it is time to convert. Web the safe discount is derived by dividing the valuation cap by the typical equity financing valuation and then removing that value from one (representing no discount). You can view. You can have a safe note with/without a cap and a discount. Investor has purchased a safe for $20,000. The valuation cap is $8,000,000 and the discount rate is 85%. Web discount rates typically range between 10% and 25%, and the discount factor is calculated as follows: It can also have a valuation cap. Web it’s $7.50 here, which means the series a investors pay $7.50 for each new share they purchase in this round. You can have a safe note with/without a cap and a discount. Web learnings in the safe calculator. Web this flexibility can include valuation caps and discount rates, allowing startups to negotiate terms that align with their growth strategy. Determine the “price per share” for the safe note. If the founder raises $500k on each cap, then she will have sold ~15%. Investor has purchased a safe for $100,000. 80% (20% discount) valuation cap: Web discount rates typically range between 10% and 25%, and the discount factor is calculated as follows: Web safe note templates. The “discount rate” is [100 minus the discount]%. If the founder raises $500k on each cap, then she will have sold ~15%. Web discount and valuation caps: Upon raising funds above a certain. Determine the “price per share” for the safe note. So, instead of capping the valuation at say $6 million, it says there's a 20% discount on the series a price. It can also have a valuation cap. Safe notes can include a discount that is applied to a future valuation when it is time to convert. An uncapped, discounted safe with a special (not conventional) “super mfn” provision that allows your f&f investors to get a discounted (from your. Web safe notes are simple and fast, without the pressure of interest payments, maturity dates, or valuation caps. Mfn, no valuation cap, no discount. Note that in the fall of 2021, y combinator removed number three, the safe:. Web link to the cap discount: See section 2 for certain additional defined terms. You can view their template here.

Post Money Safe Agreement Valuation Cap and Discount Doc Template

What is a SAFE Note? How Does a SAFE Note Work Pandadoc

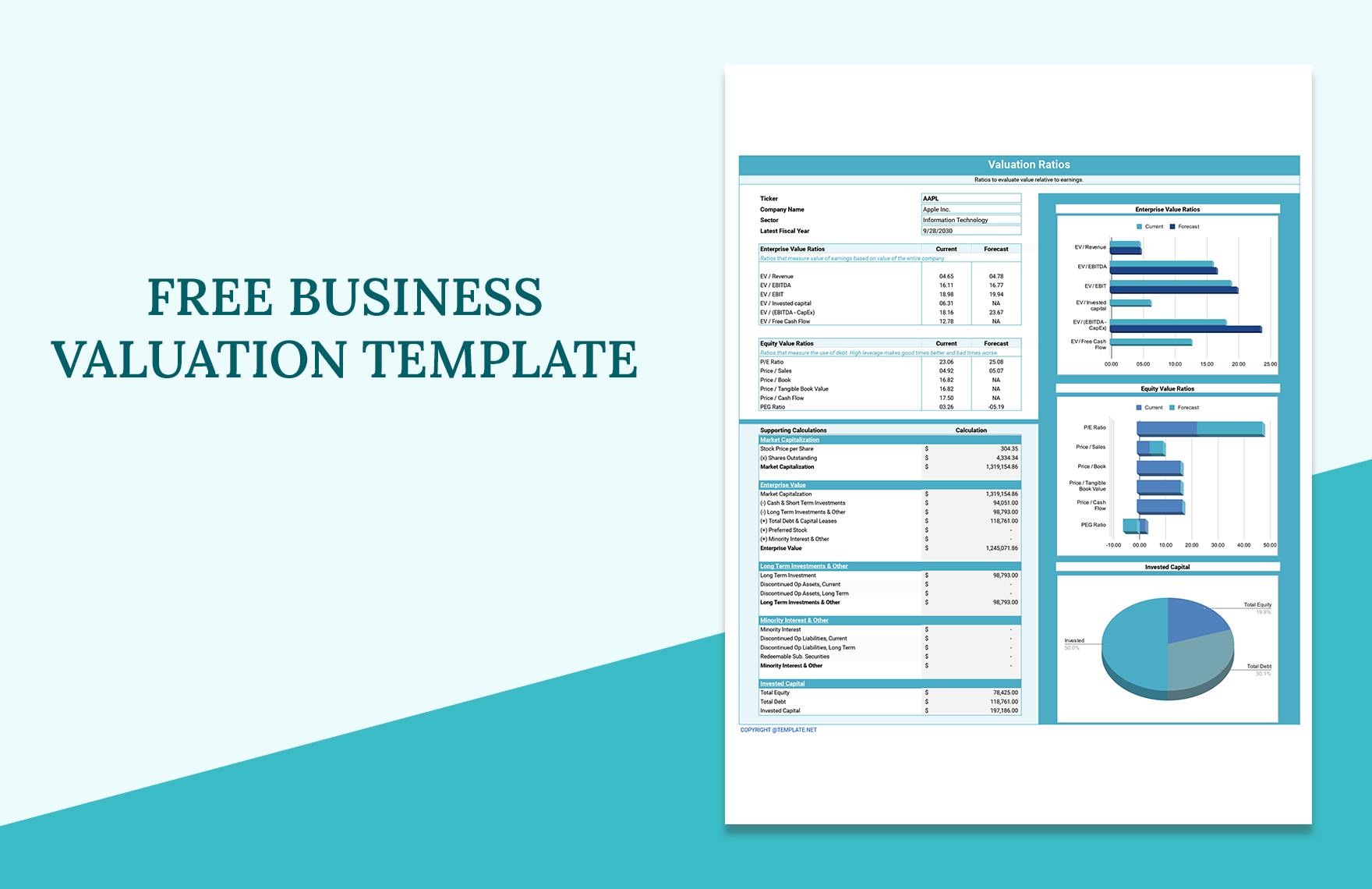

Excel Valuation Template

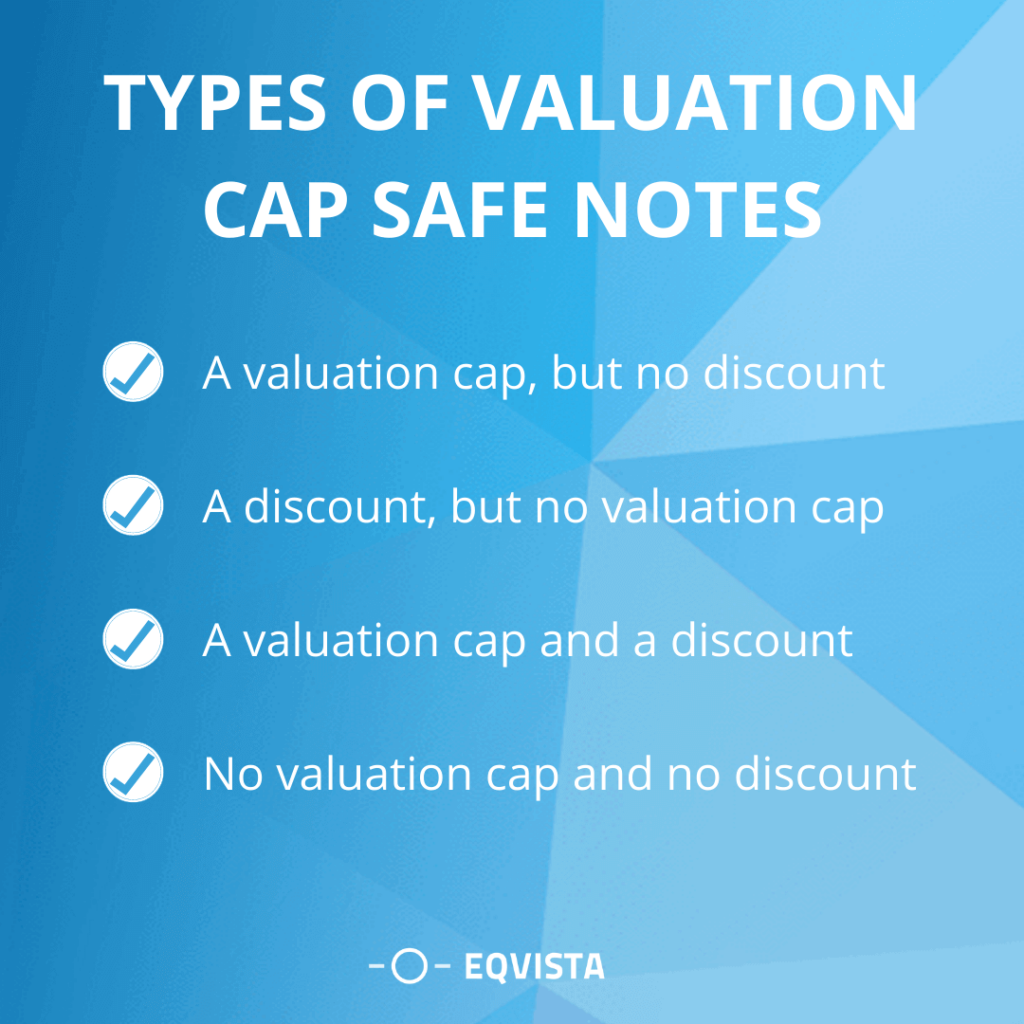

Valuation cap for SAFE Notes Eqvista

What Happened to Safe Valuation Cap and Discount? Doc Template pdfFiller

Discounted Cash Flow Template Business Tools Excel Templates DCF

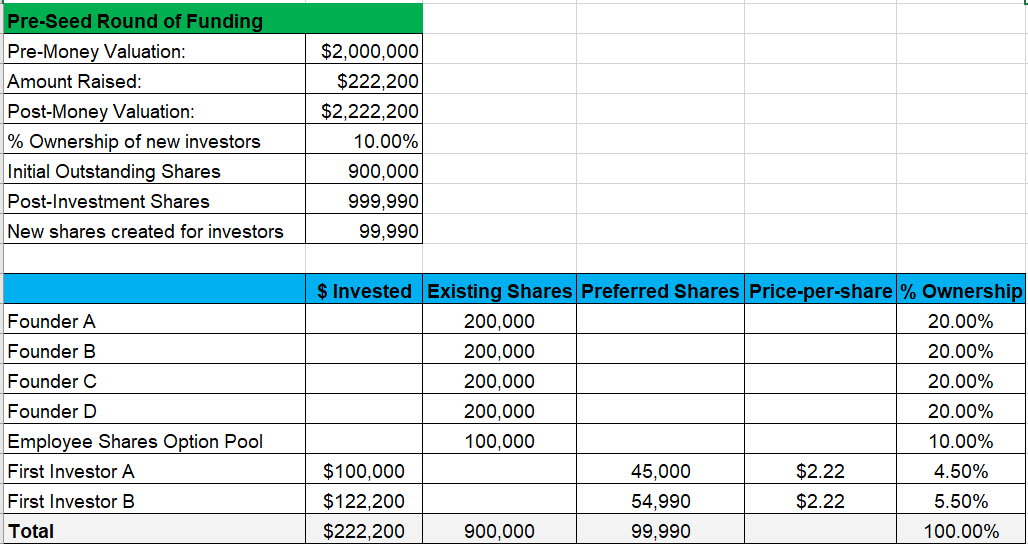

Cap Table Excel Template Simple Sheets

Cap Table Template

Free Business Valuation Template Google Sheets, Excel

Cap Table Template and Examples Eqvista

You Can Have A Safe Note With/Without A Cap And A Discount.

Investor Has Purchased A Safe For $100,000.

80% (20% Discount) Valuation Cap:

Web So, There May Be The Concept Of A Discount Instead Of A Cap.

Related Post: