Simple Loan Agreement Template Word

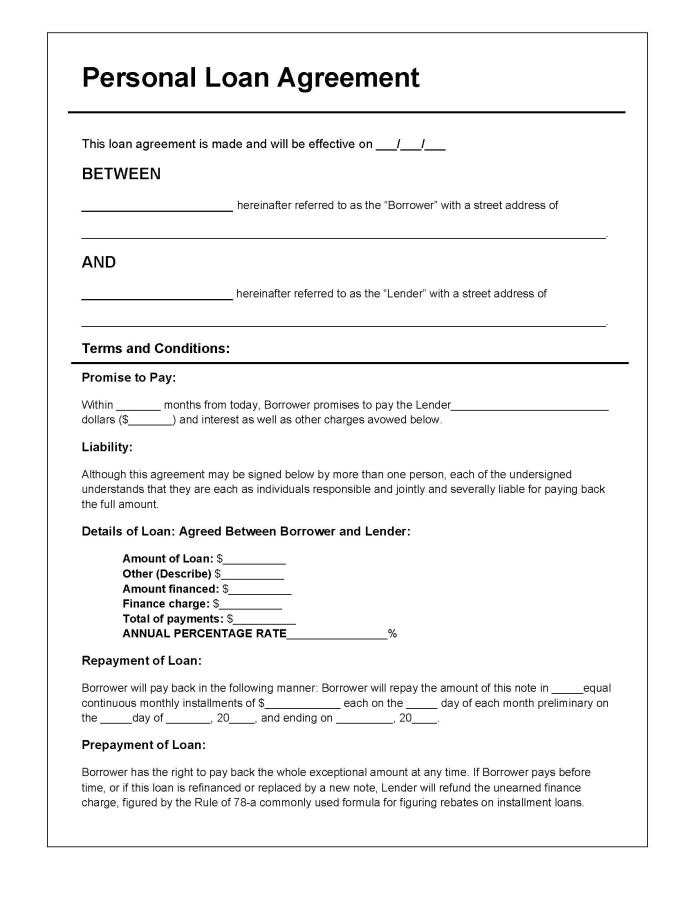

Simple Loan Agreement Template Word - Web updated april 14, 2023. It serves as a written agreement that establishes the rights and responsibilities of both parties in relation to the loan transaction. The agreement typically includes the following key elements: Web a simple loan agreement is a straightforward and legally binding document that outlines the terms under which a lender agrees to loan a specific sum of money to a borrower. The borrower is the person receiving the loan. Web a loan agreement is a contract between a borrower and a lender that spells out the terms of the payment of a loan and the rights and obligations of the lender and the borrower. Web a loan agreement is a document between a borrower and lender that details a loan repayment schedule. The purpose of the document is to set the legally binding terms that will remain in place until the loan is paid off, such as the payment schedule the borrower will be required to follow. Web a family loan agreement is also known as a simple loan agreement between families is a legally binding agreement between two family members that clearly spells out the terms of lending money to a family member with the aim of being paid back after a given duration of time with an accrued interest. Web a simple loan agreement is a contract between two parties — the borrower and lender — that details and formalizes the terms of a loan. You can use our loan agreement template for a variety of purposes, including: Loan agreements are binding contracts between a borrower and a lender to formalize a loan process and regulated the mutual promises made by each other. You may now share or print the finished document on all digital platforms and a selection of print and paper options. Nothing. It is a simple agreement that includes the borrowed amount, interest rate, and when the money must be repaid. Business transactions, such as securing capital for a startup. Web let’s look at some examples below.t. A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. All of the. Web in the event that the borrower doesn’t pay their loan by the end of the term or fails to make regular payments, acceleration will occur. A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. Web a loan agreement is a written promise from a lender to loan money to. Web a simple loan agreement is a contract between two parties — the borrower and lender — that details and formalizes the terms of a loan. Upon acceleration under this agreement, the lender shall have the right to declare the loan balance immediately due and payable. Web 38 free loan agreement templates & forms (word | pdf) facilitate legal and. Its primary function is to serve as written evidence of the amount of a debt and the terms under which it will be repaid, including the rate of interest (if any). The borrower will be required to pay back the loan in accordance with a payment schedule (unless there is a balloon payment). Web loan agreement template in word. The. Basically, a promissory note only requires the signature of the borrower, whereas a loan agreement requires a signature from both parties. It serves as a written agreement that establishes the rights and responsibilities of both parties in relation to the loan transaction. This includes details such as name and contacts, and in the case of borrowers, relevant references, and collateral. Web in the event that the borrower doesn’t pay their loan by the end of the term or fails to make regular payments, acceleration will occur. If you receive loan offers after applying, review them carefully. Upon acceleration under this agreement, the lender shall have the right to declare the loan balance immediately due and payable. If the borrower misses. Loans can be secured or unsecured; Web a loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan. The borrower agrees and acknowledges that they owe the lender an amount of money equal to the loan as defined above. Loan agreements are binding contracts between a borrower and. The borrower is the person receiving the loan. The loan agreement explains the agreement between the parties, the amount of the loan, the amount of the payments, and when the payments should be made. It can be formed between a person and a lender (such as a bank or credit union), a friend, or a family member. The agreement typically. Loans can be secured or unsecured; Should the borrower refuse, the lender may seek legal action. You will use this kind of loan agreement template most often, even when dealing with businesses that you are entering into a loan agreement with. Financing large purchases, such as. Nothing in this agreement is a waiver of any other amounts owed and in. Financing large purchases, such as. Pay attention to the loan amount, interest rate, repayment term, and associated fees, and read and understand the fine print. Should the borrower refuse, the lender may seek legal action. Download our free loan agreement microsoft word templates from template.net and secure your financial agreements with ease! Web a loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan. If the borrower misses a payment or doesn’t pay back the loan, they will be in default of their agreement with. A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. Upon acceleration under this agreement, the lender shall have the right to declare the loan balance immediately due and payable. Web with this in hand, all you need to do is download your chosen template in microsoft word format and replace some wordings with the appropriate information, such as the name, the date, and the time. All of the document’s contents fit on a. Web updated april 14, 2023. Business transactions, such as securing capital for a startup. Web 38 free loan agreement templates & forms (word | pdf) facilitate legal and organized lending or borrowing of money with loan agreement templates. It can be formed between a person and a lender (such as a bank or credit union), a friend, or a family member. Nothing in this agreement is a waiver of any other amounts owed and in the event of any breach of this agreement by the borrower, the lender's rights to the loan shall not be limited. That is, it may or may not attract collateral.![40+ Free Loan Agreement Templates [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-08.jpg)

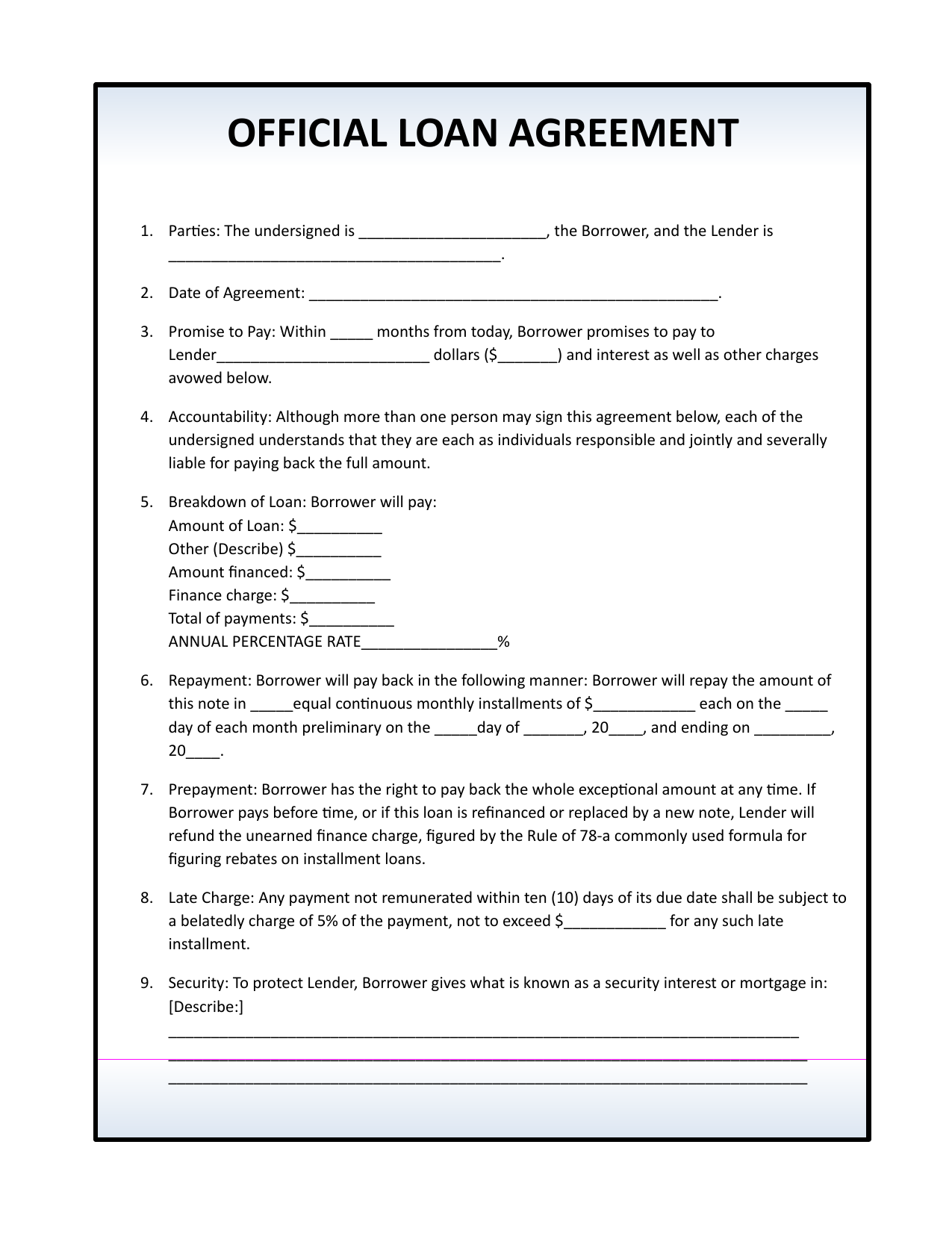

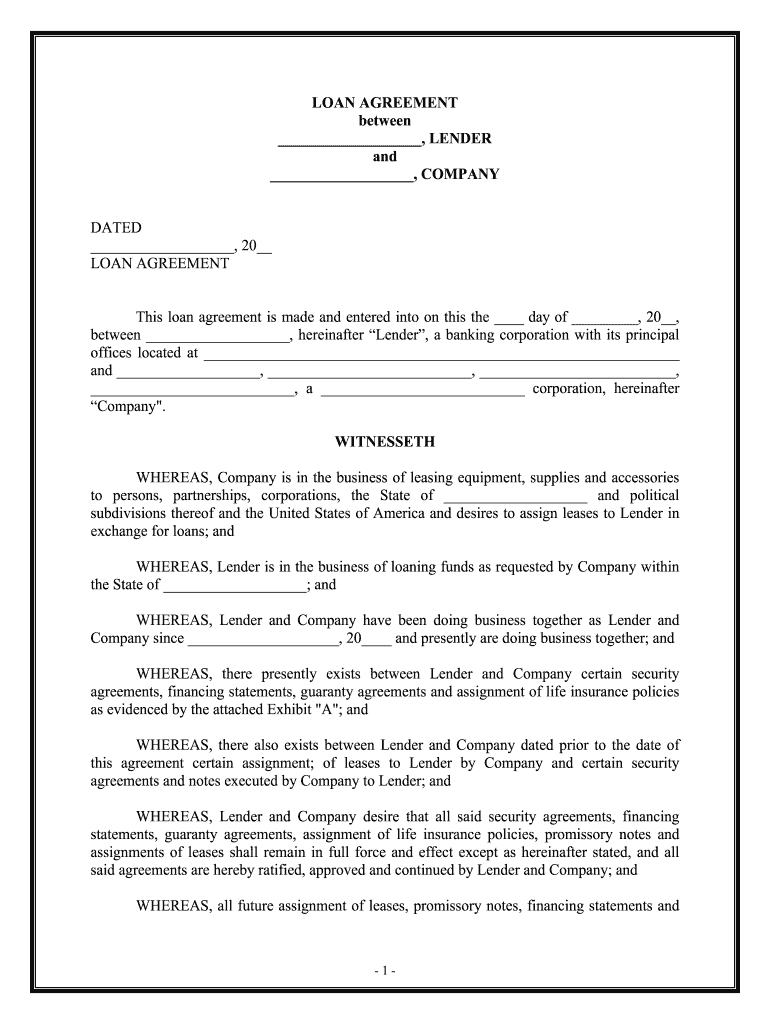

40+ Free Loan Agreement Templates [Word & PDF] Template Lab

Term Loan Agreement Template

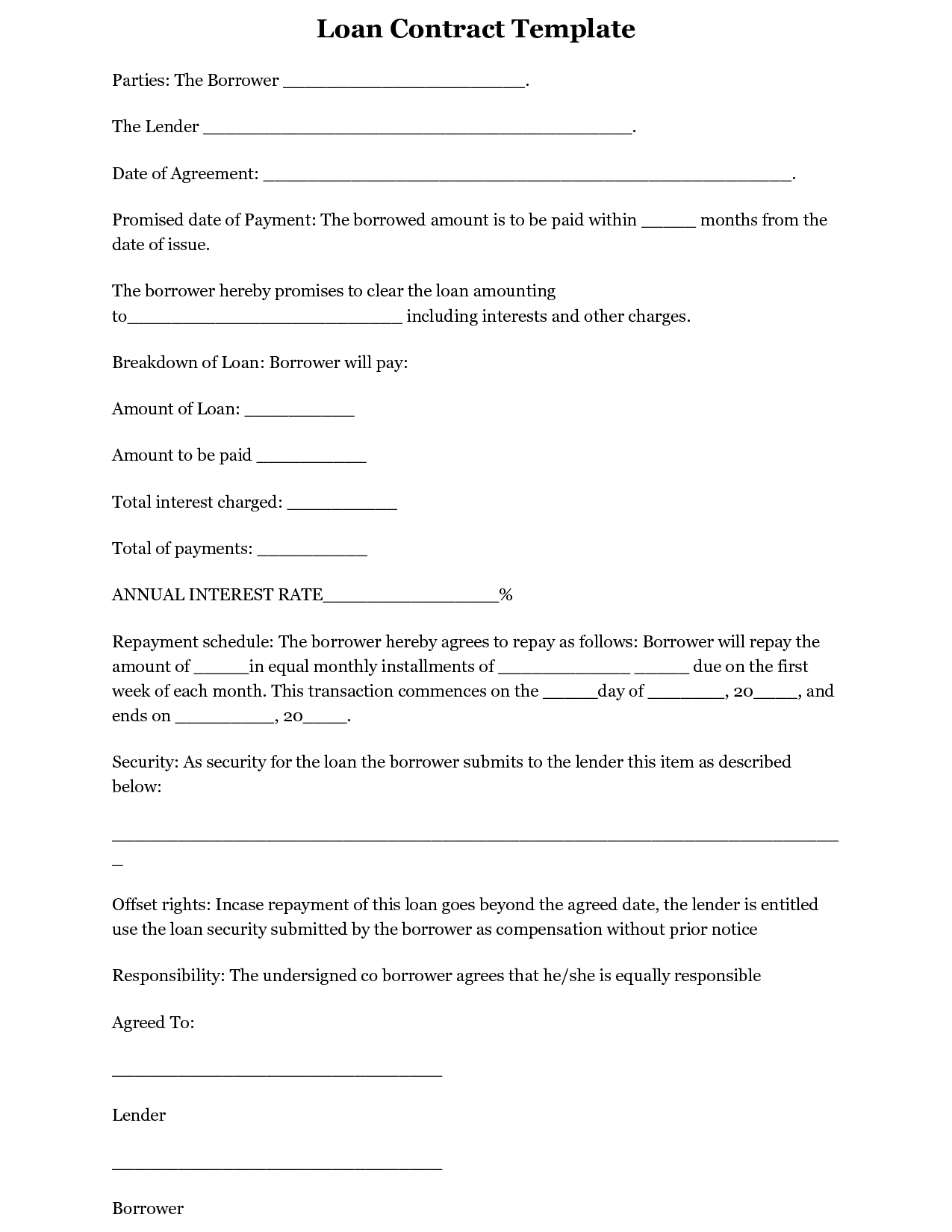

Simple Loan Contract

Blank Loan Agreement Template

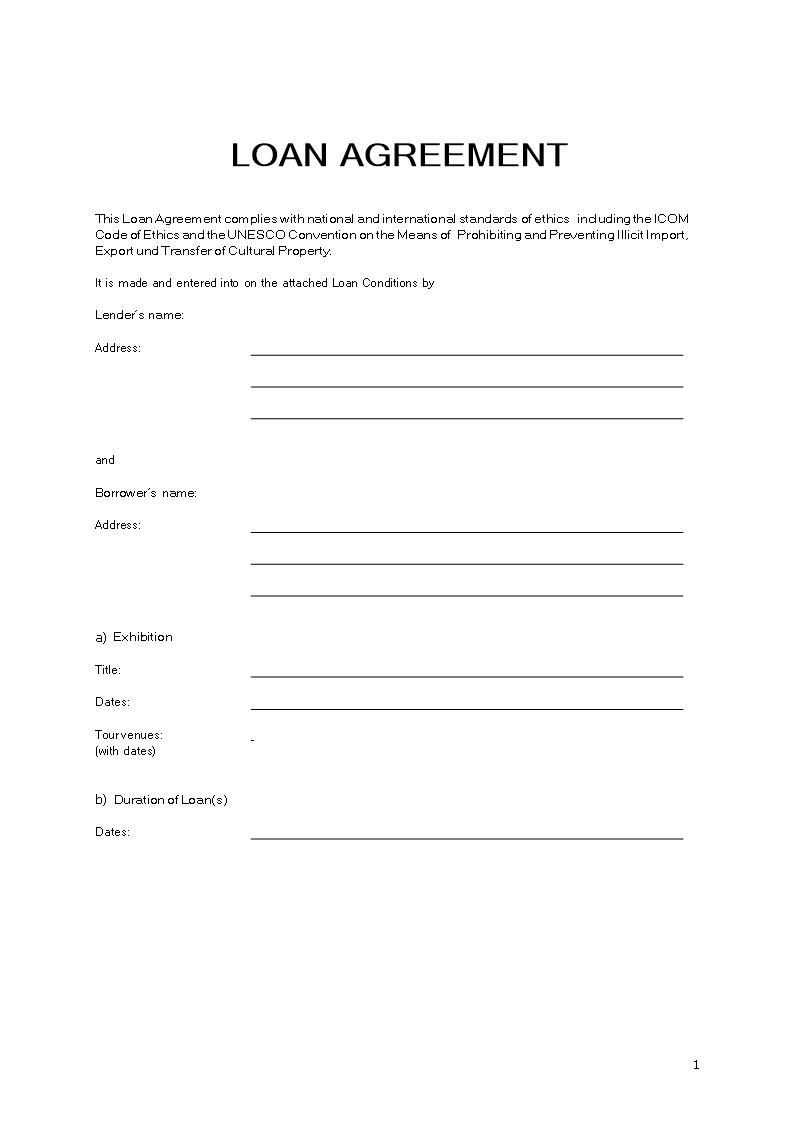

Printable Simple Loan Agreement Sample

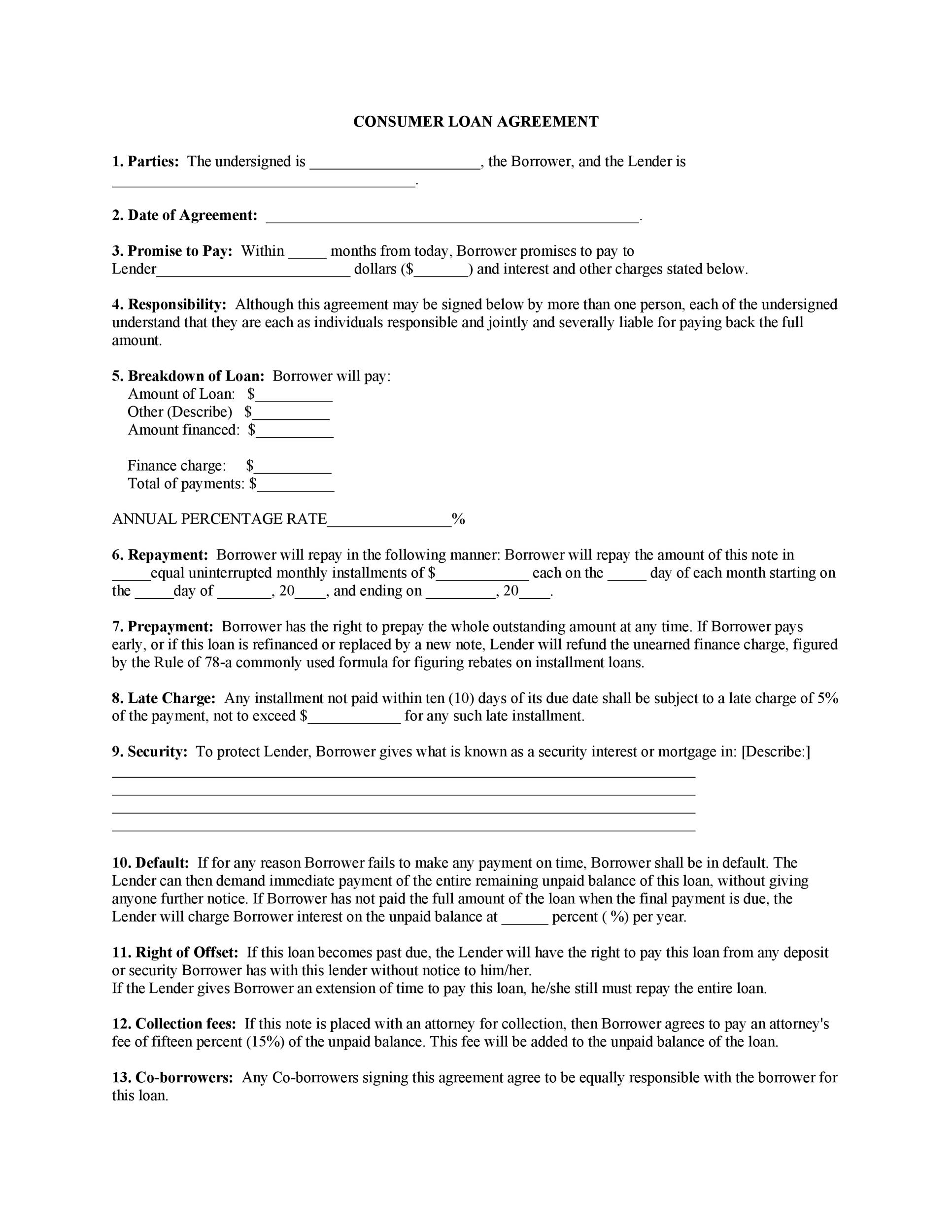

Loan Agreement Template Prebuilt template airSlate SignNow

5+ Free Loan Agreement Templates Word Excel Formats

![40+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-03.jpg)

40+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-27.jpg?w=320)

40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-32.jpg)

40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab

Loan Agreements Are Binding Contracts Between A Borrower And A Lender To Formalize A Loan Process And Regulated The Mutual Promises Made By Each Other.

Web In The Event That The Borrower Doesn’t Pay Their Loan By The End Of The Term Or Fails To Make Regular Payments, Acceleration Will Occur.

Lower Value Personal Loans Are Often Unsecured (Meaning The Borrower Isn’t Required To Put Up An Asset As.

You Can Accept The Offer And Sign The Loan Agreement If All The Details Meet Your Needs.

Related Post: