Tax Deductions Template Excel

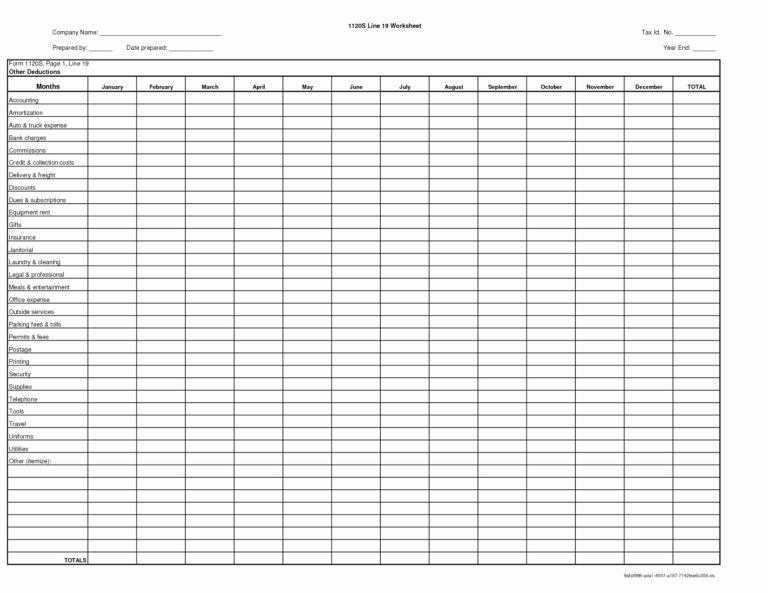

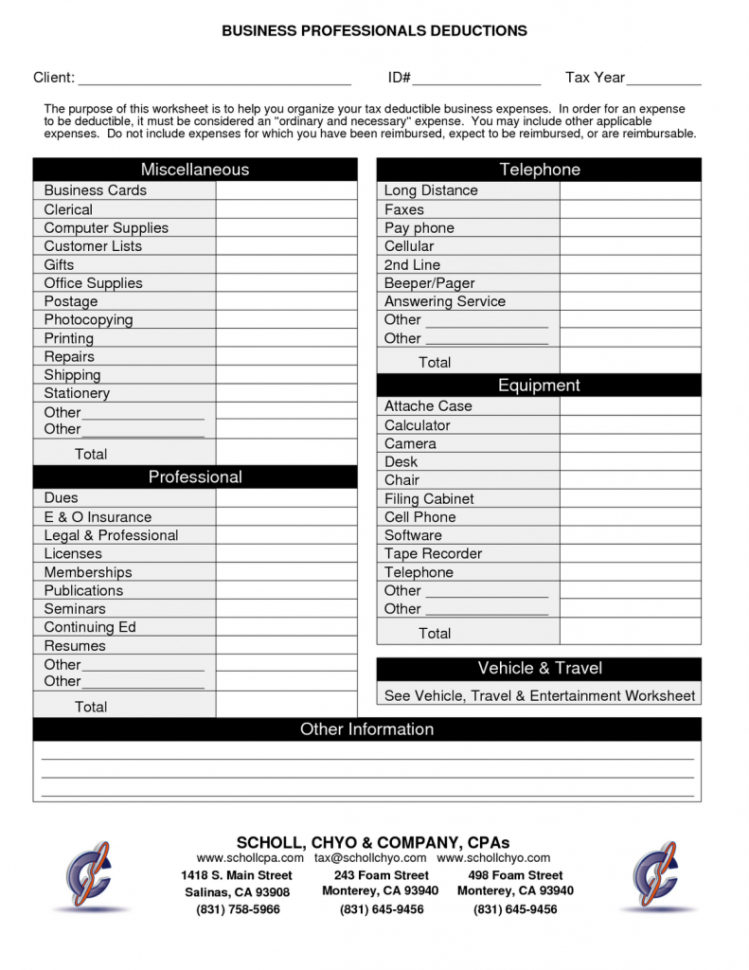

Tax Deductions Template Excel - Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. Web get the template here for free: You just need to enter your basic information and estimate your taxes,. A taxpayer have to choose between. Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Web this free excel template helps the taxpayer to choose between standard and itemized deductions. We use online tax return questionnaires. Web to simplify the filing of the federal income tax return, we have created 10 easy to use excel templates. The worksheet is split up into three parts: This template consists of computations of your adjustments, tax credit,. The following expense spreadsheets range from basic layouts suitable for freelancers and independent contractors to more. 1099 expenses spreadsheet from keeper. Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. Easily manage and streamline your tax filing process. A taxpayer have to choose between. Web tax deductions spreadsheet template. Easily manage and streamline your tax filing process with our comprehensive tax deductions spreadsheet template, designed for. This template consists of computations of your adjustments, tax credit,. Web get the template here for free: Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. The worksheet is split up into three parts: Web itemized deduction calculator is an excel template. Web get the template here for free: We use online tax return questionnaires. A taxpayer needs to choose between. Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Web tax deductions spreadsheet template. Web a tax deduction is an expense you can subtract from your taxable income. 1099 expenses spreadsheet from keeper. Web tax deduction spreadsheet template. It also helps the taxpayer to choose between standard and itemized deductions. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. Exploring our free independent contractor expenses. All you need is an internet connection. We built this worksheet in google docs, so you can use it anywhere you want, for free: Web get the template here for free: Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Web how to calculate federal tax rate in excel?. You just need to enter your basic information and estimate your taxes,. But if you'd like to download your copy and use it in excel, you can do that too. Web what are the best independent contractor expenses spreadsheet templates? It also helps the taxpayer to choose between standard and itemized deductions. Web this free excel template helps the taxpayer. Web what are the best independent contractor expenses spreadsheet templates? At the end of the tax year, most self. Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. A taxpayer have to choose between. We built this worksheet. Easily manage and streamline your tax filing process with our comprehensive tax deductions spreadsheet template, designed for. Web tax deductions spreadsheet template. Web how to calculate federal tax rate in excel? It also helps the taxpayer to choose between standard and itemized deductions. We built this worksheet in google docs, so you can use it anywhere you want, for free: The worksheet is split up into three parts: We use online tax return questionnaires. Web itemized deduction calculator is an excel template. Tax tracker excel template from goskills. It also helps the taxpayer to choose between standard and itemized deductions. It helps the taxpayer to choose between standard and itemized deductions. 1099 expenses spreadsheet from keeper. Web tax deduction spreadsheet template. Microsoft excel offers several standard functions that can be used to calculate your effective tax rate using your income. Web simple tax estimator is an excel template to help you compute/estimate your federal income tax. At the end of the tax year, most self. It also helps the taxpayer to choose between standard and itemized deductions. Simple blue tax estimator from wps. Maximize your tax return with our detailed tax deduction spreadsheet template, designed to streamline income tracking, expense. Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. A taxpayer have to choose between itemized or standard deduction while. You just need to enter your basic information and estimate your taxes,. Easily manage and streamline your tax filing process with our comprehensive tax deductions spreadsheet template, designed for. Web itemized deduction calculator is an excel template. This template consists of computations of your adjustments, tax credit,.

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

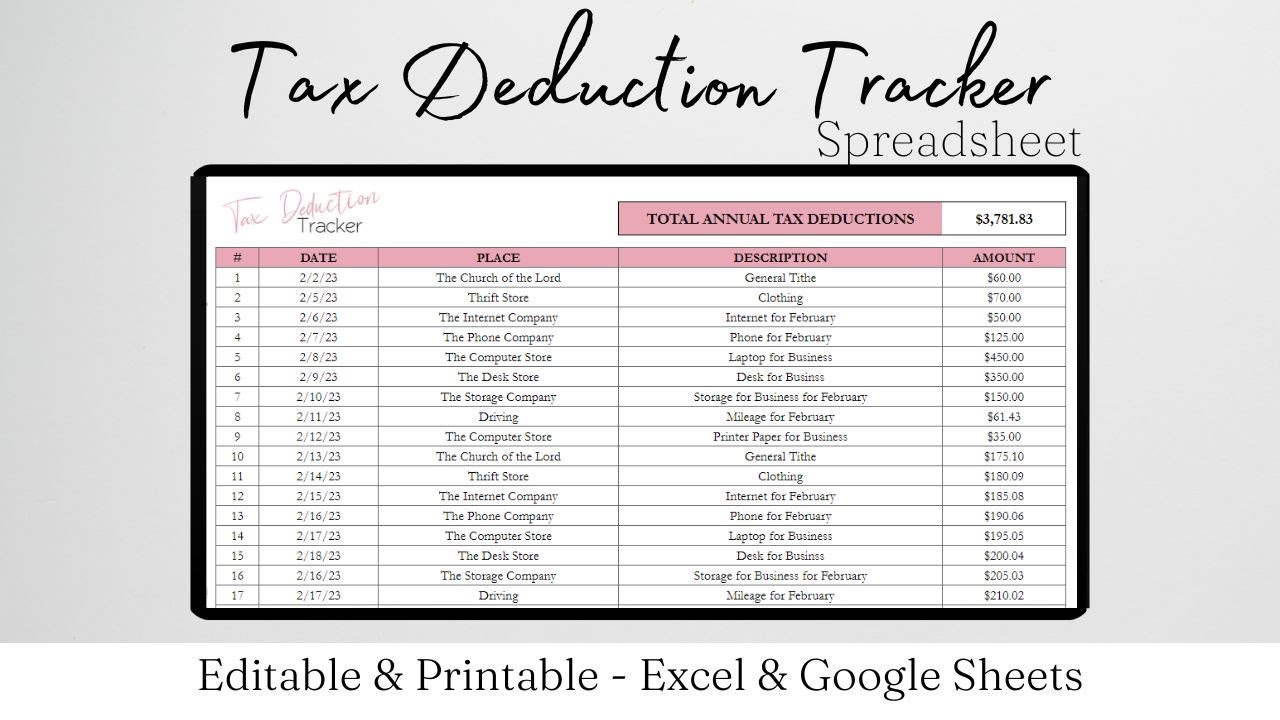

Tax Deduction Template Excel Spreadsheet, Tax Deductions Tracker Google

EXCEL of Tax Deduction Form.xlsx WPS Free Templates

Tax Deduction Spreadsheet Template

Tax Deduction Spreadsheet Excel —

Tax Deduction Spreadsheet Excel —

Tax Deduction Spreadsheet Template Excel —

Free 1099 Template Excel (With StepByStep Instructions!)

Tax Deduction Spreadsheet Template Excel —

Tax Deduction Spreadsheet Template

Web I’m Going To Give You Some Tips And Tricks On How To Do Taxes In Excel, Including A Free Tax Tracker Template You Can Download And Start Using Right Away.

But If You'd Like To Download Your Copy And Use It In Excel, You Can Do That Too.

We Use Online Tax Return Questionnaires.

Web A Tax Deduction Is An Expense You Can Subtract From Your Taxable Income.

Related Post: