Tax Donation Letter Template

Tax Donation Letter Template - Web remember to pay attention to the items for donors who have given a gift of $250 or more. Web if your organization uses kindful, it’s easy to create templates for your donation receipts. Cash with advantage/merchandise deduction donation receipt. Web 🕑 12 min read. Below, you will find a receipt for your records. Each letter should include the. Donation receipts are important for a few reasons. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web updated december 18, 2023. To make sure you cover your. Benefits of an automated donation receipt process. Donation receipts are important for a few reasons. When you write their donation receipt/letter, be sure to. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: Web for donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: The donor will use this letter as proof of his or her donation to claim a tax deduction. To make sure you cover your. Content marketing manager, neon one. Donation receipts are important for a few reasons. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: Benefits of an automated donation receipt process. We’ve included the following 2 samples. Web your. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. After all, donation letters are one of the most effective ways to connect with your supporters and inspire them to contribute to your nonprofit. The formal name of your nonprofit. Web acknowledgment letters are. Web updated december 18, 2023. Web for donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. After all, donation letters are one of the most effective ways to connect with your supporters and inspire them to contribute to your nonprofit. Web cullinane law group jan 19, 2023. Benefits of a 501c3 donation receipt. Cash with advantage/merchandise deduction donation receipt. The date of the donation. To make sure you cover your. Web 🕑 12 min read. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Donation receipts are important for a few reasons. The donor will use this letter as proof of his or her donation to claim a tax deduction. Each letter should include the. To ensure irs compliance, you need to send your donation acknowledgment letters by january 31 each year. Web updated december 18, 2023. To ensure irs compliance, you need to send your donation acknowledgment letters by january 31 each year. To make sure you cover your. Primarily, the receipt is used by organizations for filing purposes and. Edit on any device24/7 tech supportpaperless solutions Donor acknowledgment letters are more than just a “thank you” letter. To make sure you cover your. Edit on any device24/7 tech supportpaperless solutions Each letter should include the. Web acknowledgment letters are a good way to say thank you to your donors as well as a way to formally acknowledge the appropriate details of each contribution, which will help your donors when they are filing their personal tax returns. To. Donor acknowledgment letters are more than just a “thank you” letter. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: Benefits of a 501c3 donation receipt. From there, it’s just a matter of creating templates that include the information that’s required and are compelling for your donors. We’ve included the. Benefits of a 501c3 donation receipt. Web your amazing donation of $250 has a tax deductible amount of $200. From there, it’s just a matter of creating templates that include the information that’s required and are compelling for your donors. Web 🕑 12 min read. Edit on any device24/7 tech supportpaperless solutions Web for donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. Web if your organization uses kindful, it’s easy to create templates for your donation receipts. To ensure irs compliance, you need to send your donation acknowledgment letters by january 31 each year. Web acknowledgment letters are a good way to say thank you to your donors as well as a way to formally acknowledge the appropriate details of each contribution, which will help your donors when they are filing their personal tax returns. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: Benefits of an automated donation receipt process. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Content marketing manager, neon one. The donor will use this letter as proof of his or her donation to claim a tax deduction. Web cullinane law group jan 19, 2023. Donor acknowledgment letters are more than just a “thank you” letter.

Tax Deductible Donation Letter Sample Edit, Fill, Sign Online Handypdf

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format

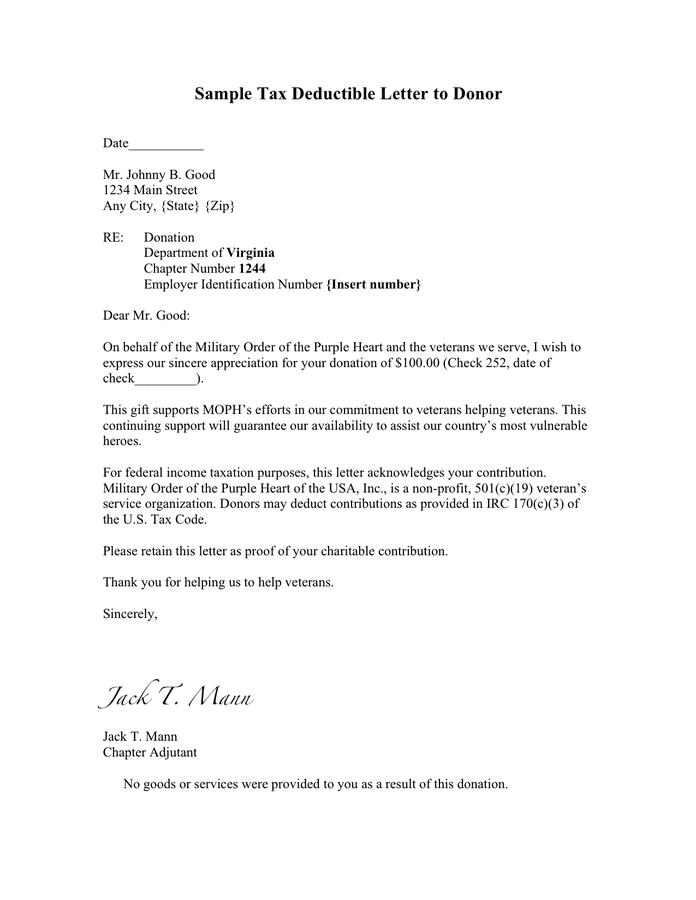

Sample tax deductible letter to donor in Word and Pdf formats

13+ Free Donation Letter Template Format, Sample & Example

FREE 51+ Sample Donation Letter Templates in MS Word Pages Google

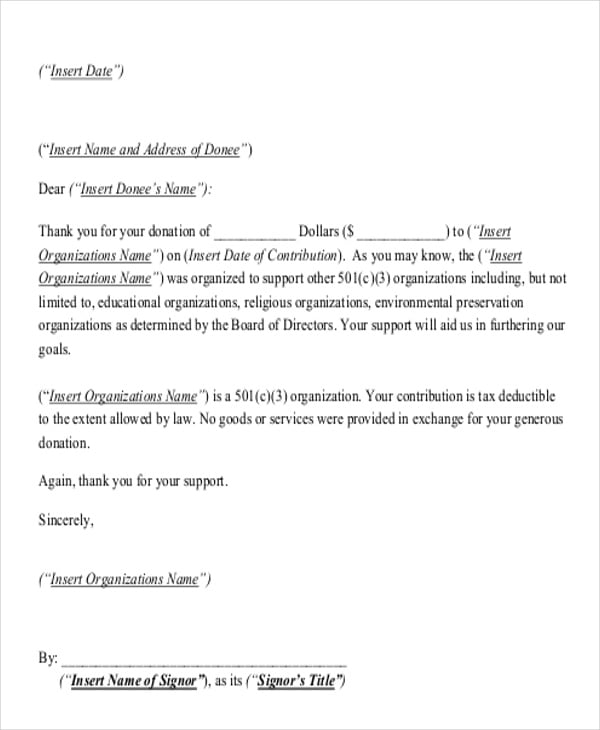

501(c)(3) Donation Receipt

Donation Letter for Taxes Template in PDF & Word

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

FREE 7+ Tax Receipts for Donation in MS Word PDF

FREE 8+ Sample Donation Receipts in PDF

To Make Sure You Cover Your.

The Written Acknowledgment Required To Substantiate A Charitable Contribution Of $250 Or More Must Contain The Following Information:

Below, You Will Find A Receipt For Your Records.

Donation Receipts Are Important For A Few Reasons.

Related Post: