Tax Expense Spreadsheet Template

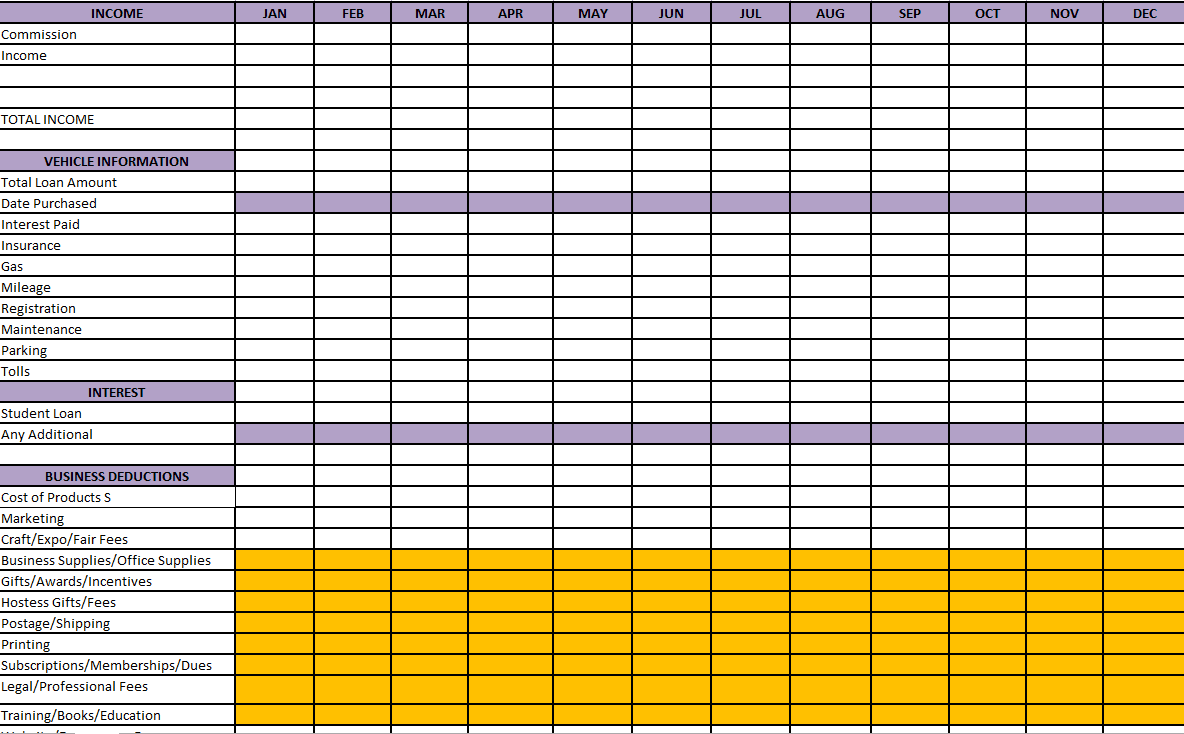

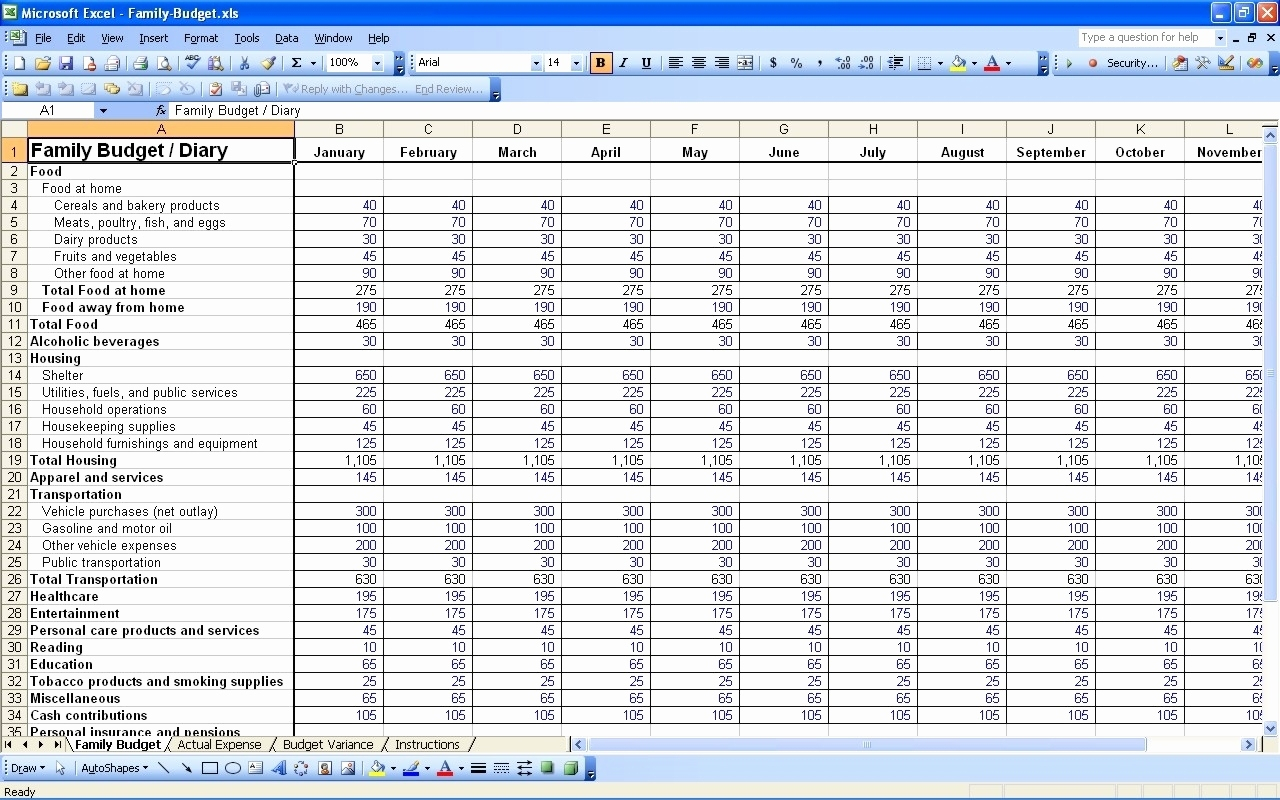

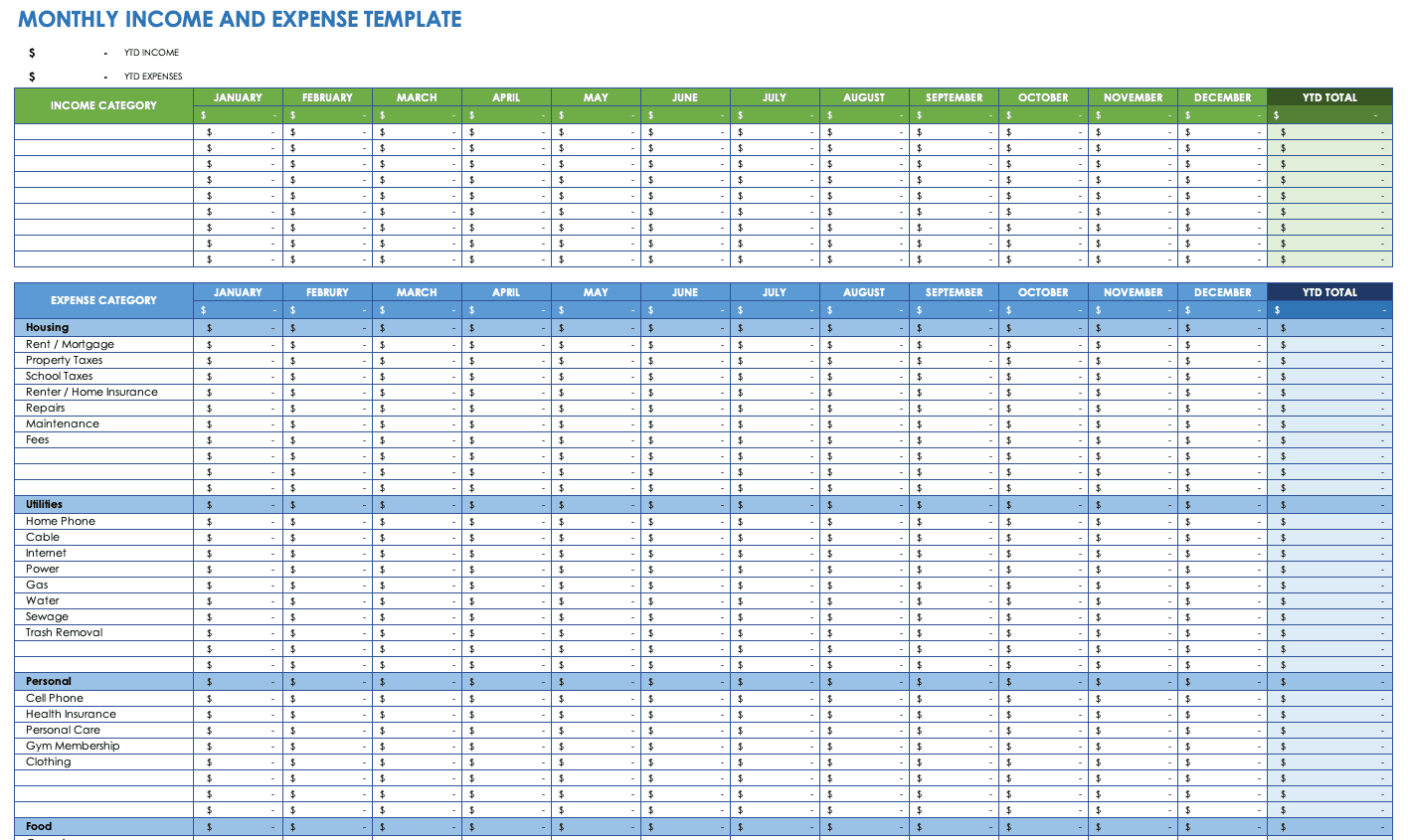

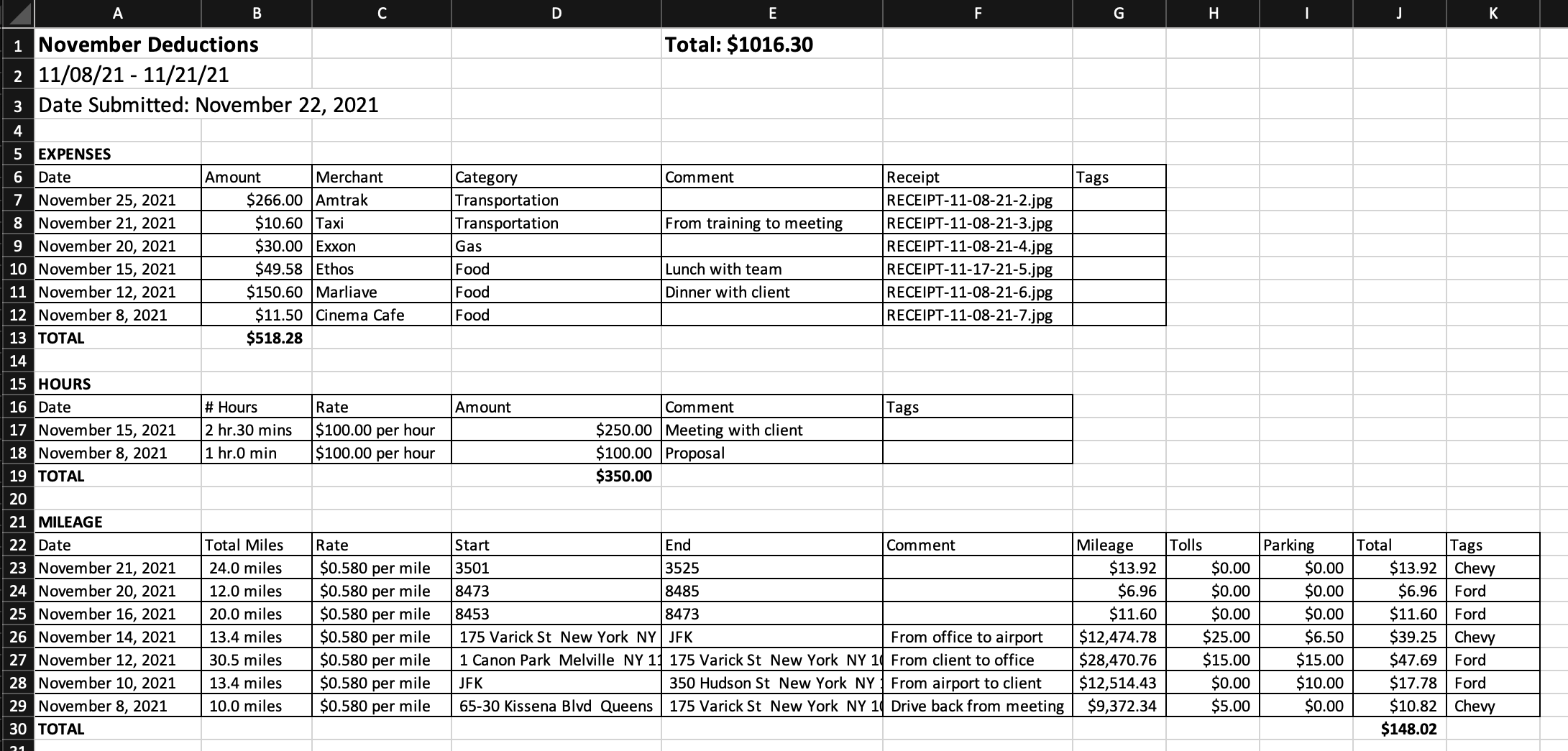

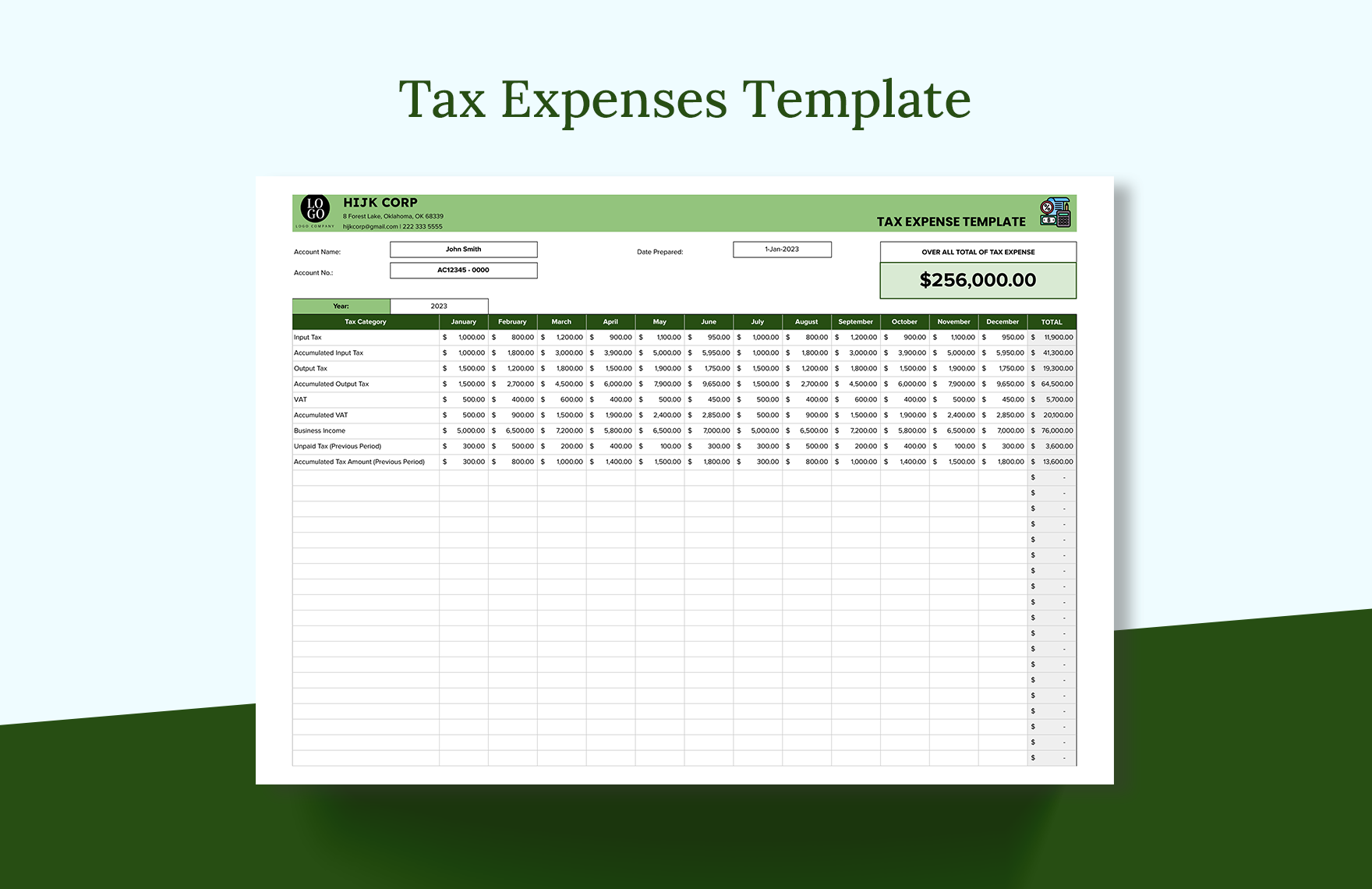

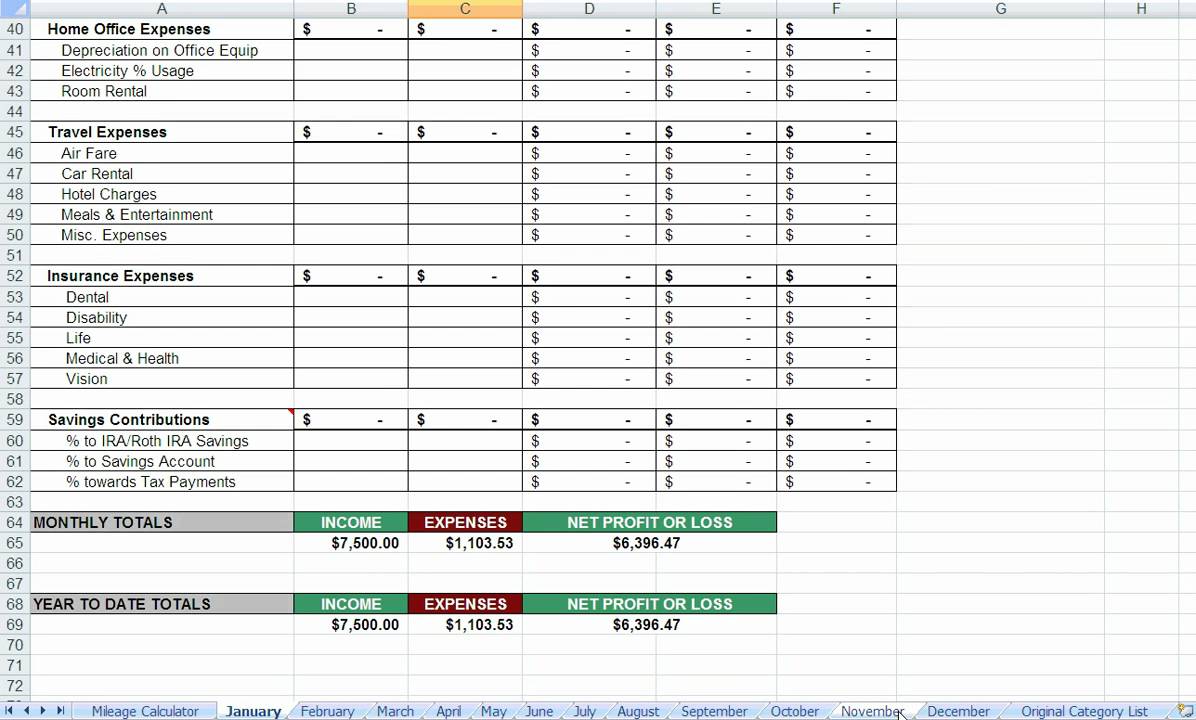

Tax Expense Spreadsheet Template - Small businesses often benefit from integrating their expense spreadsheets with tax software. Use the existing category names or enter your own column headings to best track business expenses. This is super helpful at tax time. Web the worksheet will automatically calculate your deductible amount for each purchase in column f. You can deduct expenses when traveling for work. Web this printable small business expense report template offers an easy way to track company expenses. Compile expense receipts and records. 1099 expenses spreadsheet from keeper. If you purchase alcohol, tobacco, or fuel for your business, you may be required to pay excise taxes.the good news is that you can deduct excise taxes on your tax return. Under use function select sum, and under add subtotal to, select transaction amount. Just click on the link above and make a copy in google sheets. For each expense, provide the date, a description, and category details. Once you enter the amounts, the template automatically. Open a blank spreadsheet in google sheets. Web download the simple expense report template in google sheets on this page. Column labels with an asterisk (*) denote required columns. Once you enter the amounts, the template automatically. Web benefits of using a tax sheet template 1. In the pop up window, select category under at each change in. It's been updated with all the latest info for you: You can add or remove rows and columns, adjust formatting, and. Web according to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. Use this spreadsheet to track payments, itemize expenses, and more. Organize all information into categories. Whether you drive,. Keeper tax provides a home office deduction worksheet for excel or google sheets. Web the worksheet will automatically calculate your deductible amount for each purchase in column f. Customers, contacts, reference accounts, customer bank accounts. Web tracking monthly expenses in a budget spreadsheet or template can make managing your money a little easier. Use the existing category names or enter. Web how to make a google sheets business expense template. Input all income data into google sheets template. Web according to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. Shoeboxed—the best alternative to a printable expense tracker. This basic expense. It's been updated with all the latest info for you: Keeper tax office deduction template. Shoeboxed—the best alternative to a printable expense tracker. You can deduct expenses when traveling for work. Web benefits of using a tax sheet template 1. Record your monthly income in the appropriate section of the worksheet. Web this printable small business expense report template offers an easy way to track company expenses. Web how to make a google sheets business expense template. Web tax spreadsheet template for google sheets. Open a blank spreadsheet in google sheets. Whether you want to use an excel spreadsheet or a google sheet to define and track a. Web creating a business expense sheet in google sheets is a straightforward process. Keeper tax office deduction template. Web weekly expense tracker by debt free charts. Sort receipts based on categories. Organize all information into categories. Enter the receipts' data into the spreadsheet. Web how to make a google sheets business expense template. Come tax time, a spreadsheet of your expenses is also helpful when claiming tax deductions. Also make sure the check box summary below data is checked. Enter data in the designated columns in each of the four worksheets: Web luckily, keeper's free template will make doing your taxes a little less painful — for your soul and for your wallet. How to create an expense tracker in google sheets. If you purchase alcohol, tobacco, or fuel for your business, you may be required to pay excise. Be sure to include all of your monthly expenses, such as rent or mortgage payments, utility bills, and transportation costs. Web benefits of using a tax sheet template 1. You can deduct expenses when traveling for work. They’re only to help you estimate taxes. Your expenses sheet template is a record book of all your business costs, allowing for reliable tax filing. Whether you want to use an excel spreadsheet or a google sheet to define and track a. If you purchase alcohol, tobacco, or fuel for your business, you may be required to pay excise taxes.the good news is that you can deduct excise taxes on your tax return. Under use function select sum, and under add subtotal to, select transaction amount. Tax tracker excel template from goskills. Printable budgeting worksheets by cambridge credit counseling corporation. If you travel for work, expenses such as airfare, lodging, and rental car expenses should be recorded in your spreadsheet. Organize all information into categories. Enter the receipts' data into the spreadsheet. First, fill in the template with the information you need. Keeper tax office deduction template. You can add or remove rows and columns, adjust formatting, and.

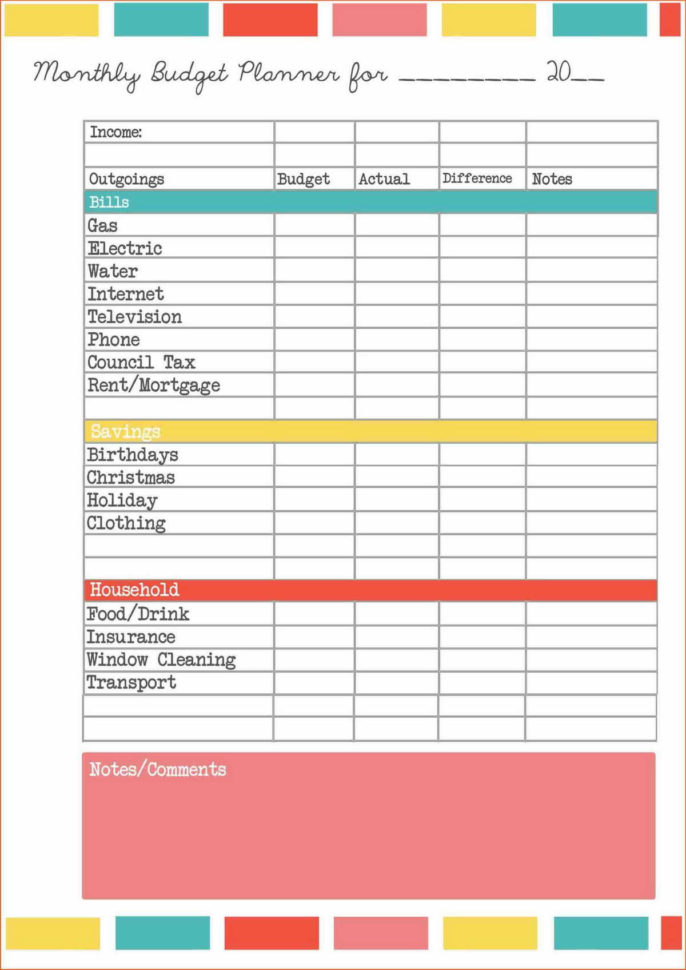

Tax Expenses Spreadsheet Template Printable Templates

Tax Expense Spreadsheet Template

EXCEL of and Expense.xlsx WPS Free Templates

Free Expense Report Templates Smartsheet

![]()

FREE 7+ Sample Expense Tracking Templates in PDF MS Word Excel

Free 1099 Template Excel (With StepByStep Instructions!)

The Best Expense Report Template in Excel

Tax Expense Spreadsheet Template

Tax Expenses Template Excel, Google Sheets

spreadsheet for tax expenses —

Another Aspect Of Creating Or Using A Spreadsheet For Cost Tracking Is Finding The Points Where You Might Be Overspending.

This Basic Expense Report Template Simplifies The Business Expense Process For Employees.

Rename And Save The Template To Your Google Drive.

Small Businesses Often Benefit From Integrating Their Expense Spreadsheets With Tax Software.

Related Post: