Tax Receipt For Donation Template

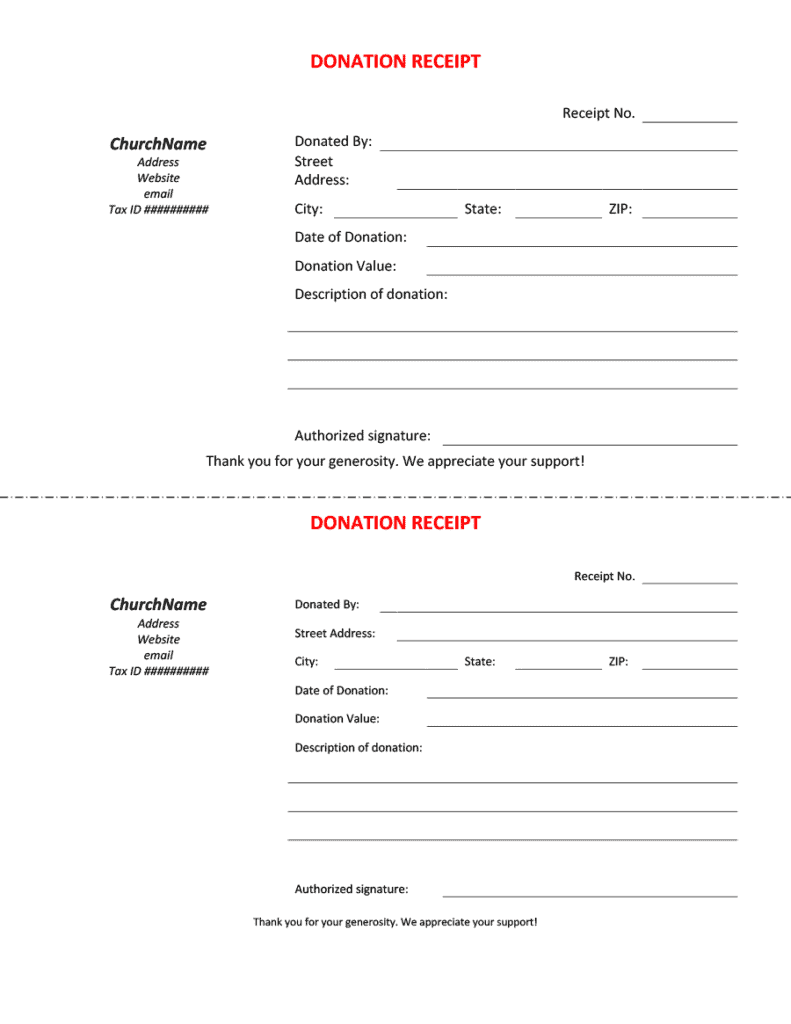

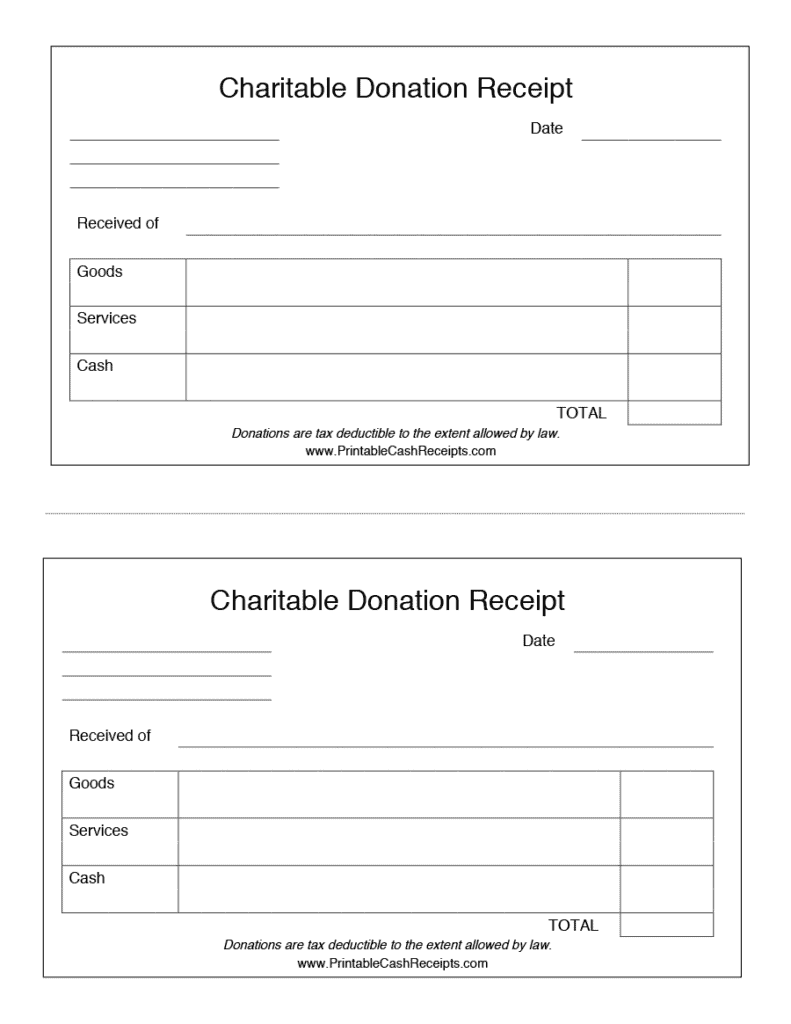

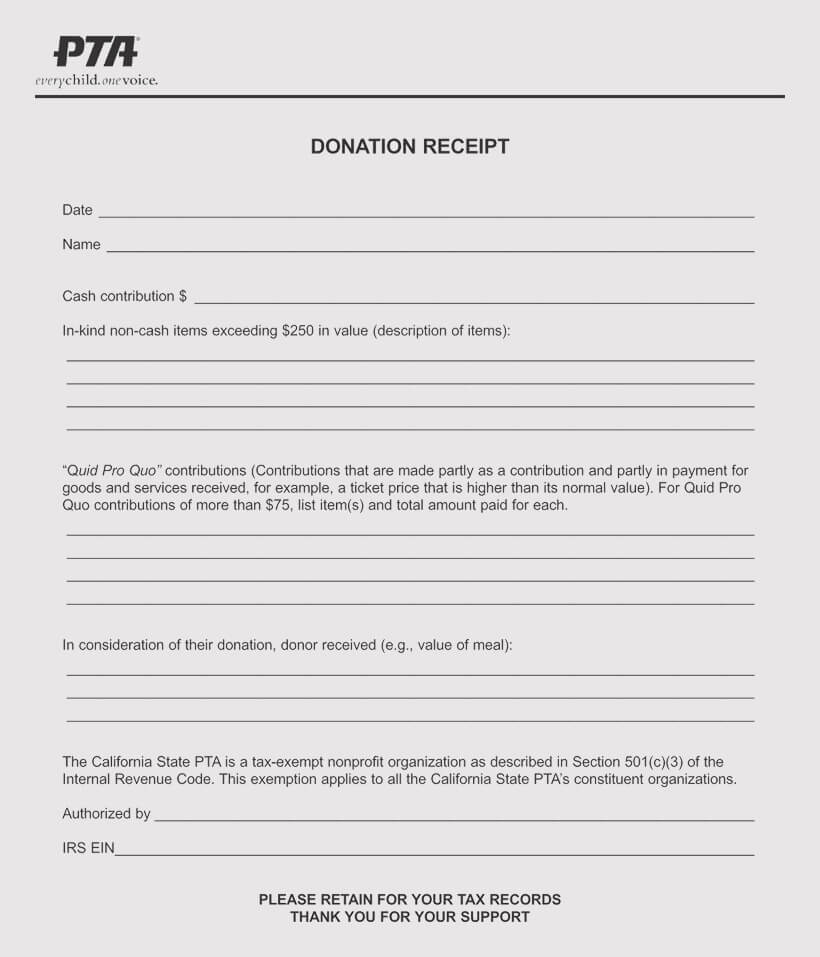

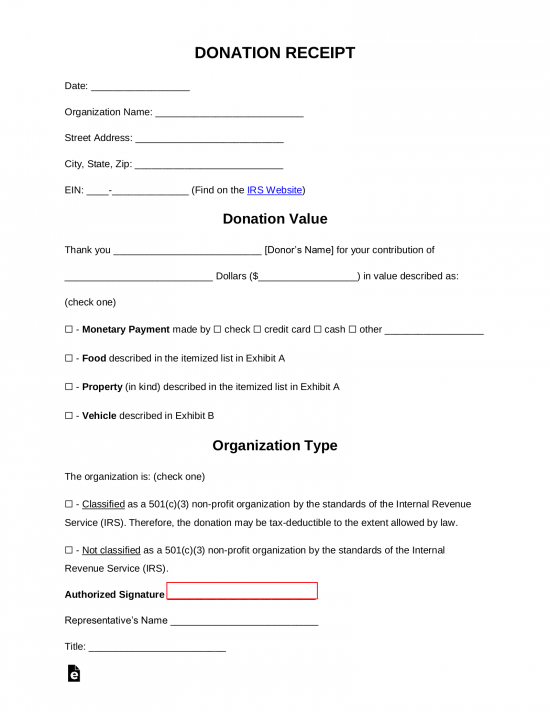

Tax Receipt For Donation Template - Single donations greater than $250. So, the eligible amount of the gift is $80,000. A donation receipt template should include all of the fields needed for the required information. These free printable templates in pdf and word format simplify the. As described above, this means. This can be achieved by automating the process of issuing donation tax receipts (more on this below). These receipts are also used for tax purposes by the organization. A donor gives a charity a house valued at $100,000. In its guideline on charitable contributions the irs states that donation tax receipts should include the following information: Whatever the form, every receipt must include six items. In its guideline on charitable contributions the irs states that donation tax receipts should include the following information: It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving. The irs requires donation receipts in certain situations: Single donations greater than $250. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. Standard guidelines, such as a fixed percentage. Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their state and/or federal taxes. So, the eligible amount of the gift is $80,000. It’s important to. To receive a tax deduction, the. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. First, let’s talk about the practical information you need to include in your receipt. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business,. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good practice to issue a 501c3 donation receipt for all donations. In its guideline on charitable contributions the irs states that donation tax receipts should include the following information: It’s important to remember that without a written acknowledgment, the donor cannot claim the. Web from the donor side of things, receipts are important when it comes to tax time. These receipts are also used for tax purposes by the organization. Web donation receipt template. Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Single donations greater than $250. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. Web updated august 03, 2023. Deliver the written acknowledgment of the contribution. Web donation receipt template. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against. Web donation receipt template. Standard guidelines, such as a fixed percentage. Web a 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. While there is no legal requirement for you to send a donation receipt for gifts below $250, it is good practice and most nonprofits send. While any donations valued under $250 can be claimed on tax returns without a receipt, anything over that amount requires a record. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. Web from. Receipt templates simple donation receipt. These free printable templates in pdf and word format simplify the. Single donations greater than $250. Whatever the form, every receipt must include six items. This can be achieved by automating the process of issuing donation tax receipts (more on this below). Web and, with a letter builder, you can also create a free, printable donation receipt template to use again and again. Web how to give a cash donation (3 steps) accept the donation from a recipient. While there is no legal requirement for you to send a donation receipt for gifts below $250, it is good practice and most nonprofits send acknowledgements for every donation. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. While any donations valued under $250 can be claimed on tax returns without a receipt, anything over that amount requires a record. First, craft the outline of your donation receipt with all the legal requirements included. A donor gives a charity a house valued at $100,000. Web updated may 02, 2024. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. Web donors can choose the 501(c)(3) donation receipt template that fits best their needs. As described above, this means. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. These receipts are also used for tax purposes by the organization. Single donations greater than $250. Charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. Web what should a donation receipt template include?

6+ Free Donation Receipt Templates

6+ Free Donation Receipt Templates Word Excel Formats

FREE 7+ Tax Receipts for Donation in MS Word PDF

14+ Printable Donation Receipt Sample Templates Sample Templates

Donation Receipt Templates 17+ Free Word, Excel & PDF Formats

Free Salvation Army Donation Receipt PDF Word eForms

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Donation Receipt Template 12 Free Samples in Word and Excel

Printable Donation Receipt Letter Template

Free Donation Receipt Templates Samples PDF Word eForms

After The Receipt Has Been Issued, The Donor Will.

Then, You Can Customize This Basic Template Based On Donation Type, Such As Noncash Contributions Or Monetary Support.

A Donation Receipt Is Used To Claim A Tax Deduction For Clothing And Household Property Itemized On An Individual’s Taxes.

For Example, A Business May Choose To Donate Computers To A School And Declare That Donation As A Tax Deduction.

Related Post: