Tax Write Off Donation Letter Template

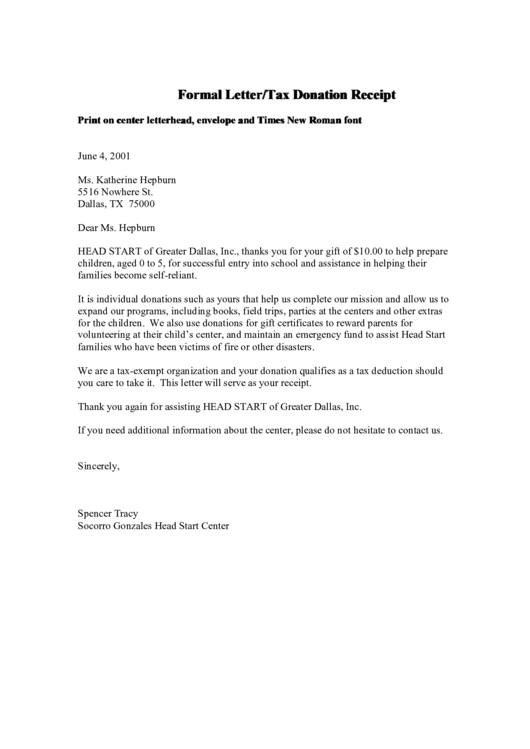

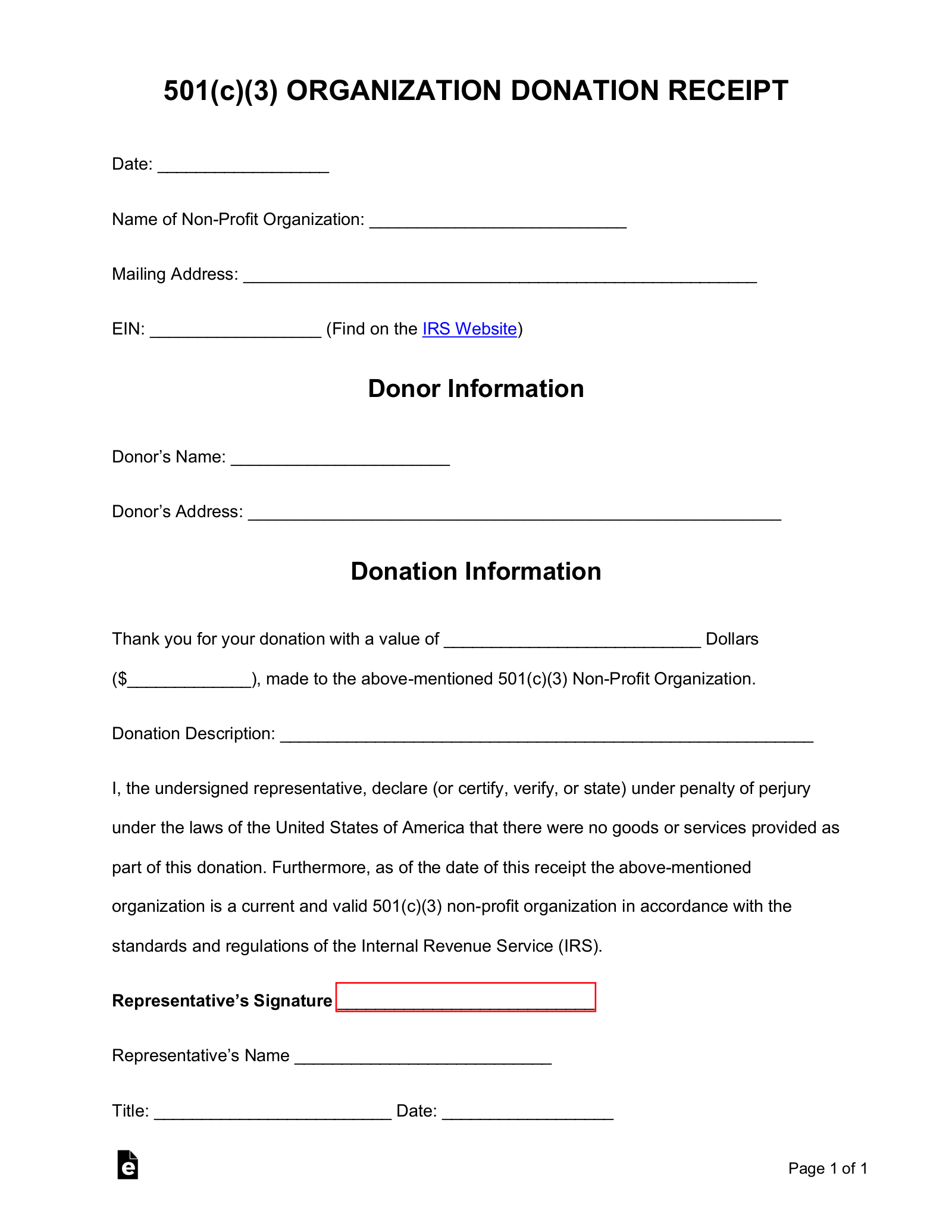

Tax Write Off Donation Letter Template - Web learn how to write the perfect donation letter by understanding the ins and outs of appeals, following simple best practices, and referencing these two stellar examples. When you write their donation receipt/letter, be sure to. Benefits of a 501c3 donation receipt. Shared by davidmjuarez in letter. A tax deduction letter is used by charities and foundations to. Please note that according to irs regulations, the amount paid for. __________________ (find on the irs website) Web updated december 18, 2023. Web here’s a free donation tracking template. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following. Shared by davidmjuarez in letter. Web this letter is to confirm that you made a payment of $ [amount] for [item/experience] during the auction on [date]. You can incur penalties from the irs if you don’t provide a donation receipt for certain donations.. Web the letter should be about what the donor—not your nonprofit—accomplished with their gift. People donate because they want to further your cause, but they may want the tax break too. Web here’s a free donation tracking template. These letters are already formatted to be used with a standard #10 envelope (or the option to use a #9 envelope). Benefits. Web cullinane law group jan 19, 2023. Rocket lawyer guaranteedownload our mobile appsmobile & desktop Web here’s a free donation tracking template. Benefits of a 501c3 donation receipt. Web the letter should be about what the donor—not your nonprofit—accomplished with their gift. Benefits of an automated donation receipt process. The donor will use this letter as proof of. You can incur penalties from the irs if you don’t provide a donation receipt for certain donations. __________________ (find on the irs website) Please note that according to irs regulations, the amount paid for. Web 501(c)(3) organization donation receipt. Edit on any device24/7 tech supportpaperless solutionsfast, easy & secure Web for donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. Web also called a gift acknowledgment letter or a donation receipt letter, a donation receipt is (you guessed it) an acknowledgment of receipt for a contribution made to. Web learn how to write the perfect donation letter by understanding the ins and outs of appeals, following simple best practices, and referencing these two stellar examples. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: It’s utilized by an individual that has donated cash or payment, personal. These letters are already formatted to be used with a standard #10 envelope (or the option to use a #9 envelope). Web 501(c)(3) organization donation receipt. __________________ (find on the irs website) Web the letter should be about what the donor—not your nonprofit—accomplished with their gift. Craft a sincere message by using emotive language to. Web this letter is to confirm that you made a payment of $ [amount] for [item/experience] during the auction on [date]. The irs requires nonprofits to send. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Web here’s a free donation tracking template. Web updated december 18, 2023. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or. Edit on any device24/7 tech supportpaperless solutionsfast, easy & secure These letters are already formatted to be used with a standard #10 envelope (or the option to use a #9 envelope). Web learn how to. The irs requires nonprofits to send. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: __________________ (find on the irs website) Benefits of an automated donation receipt process. A tax deduction letter is used by charities and foundations to. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an. Web also called a gift acknowledgment letter or a donation receipt letter, a donation receipt is (you guessed it) an acknowledgment of receipt for a contribution made to a nonprofit. Benefits of an automated donation receipt process. Web easily editable, printable, downloadable. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Rocket lawyer guaranteedownload our mobile appsmobile & desktop Please note that according to irs regulations, the amount paid for. A tax deduction letter is used by charities and foundations to. Shared by davidmjuarez in letter. These letters are already formatted to be used with a standard #10 envelope (or the option to use a #9 envelope). Benefits of a 501c3 donation receipt. When you write their donation receipt/letter, be sure to. Web cullinane law group jan 19, 2023. Donation receipts are important for a few reasons. Web learn how to write the perfect donation letter by understanding the ins and outs of appeals, following simple best practices, and referencing these two stellar examples. Donor acknowledgment letters are more than just a “thank you” letter.

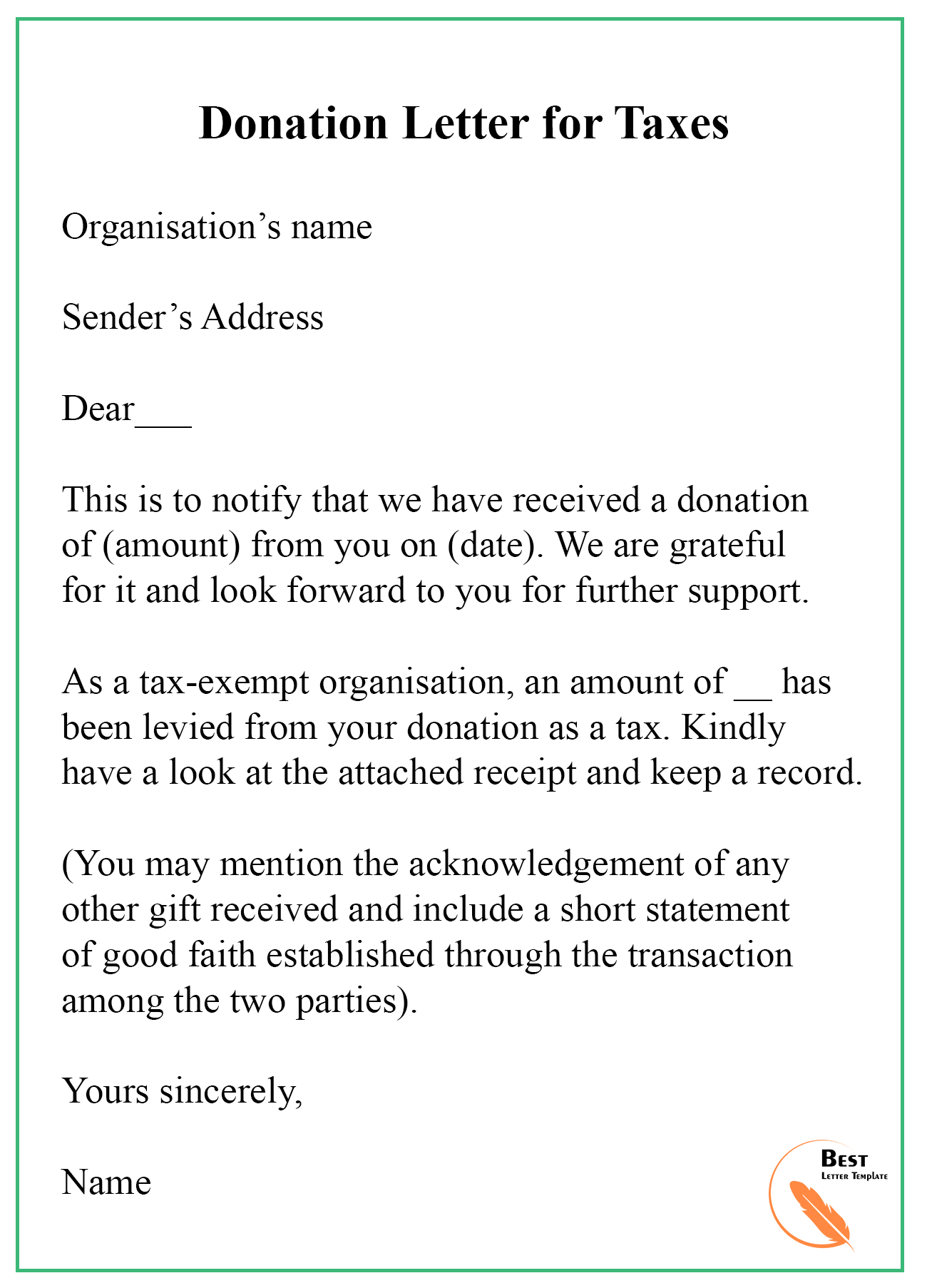

Donation Letter for Taxes Template in PDF & Word

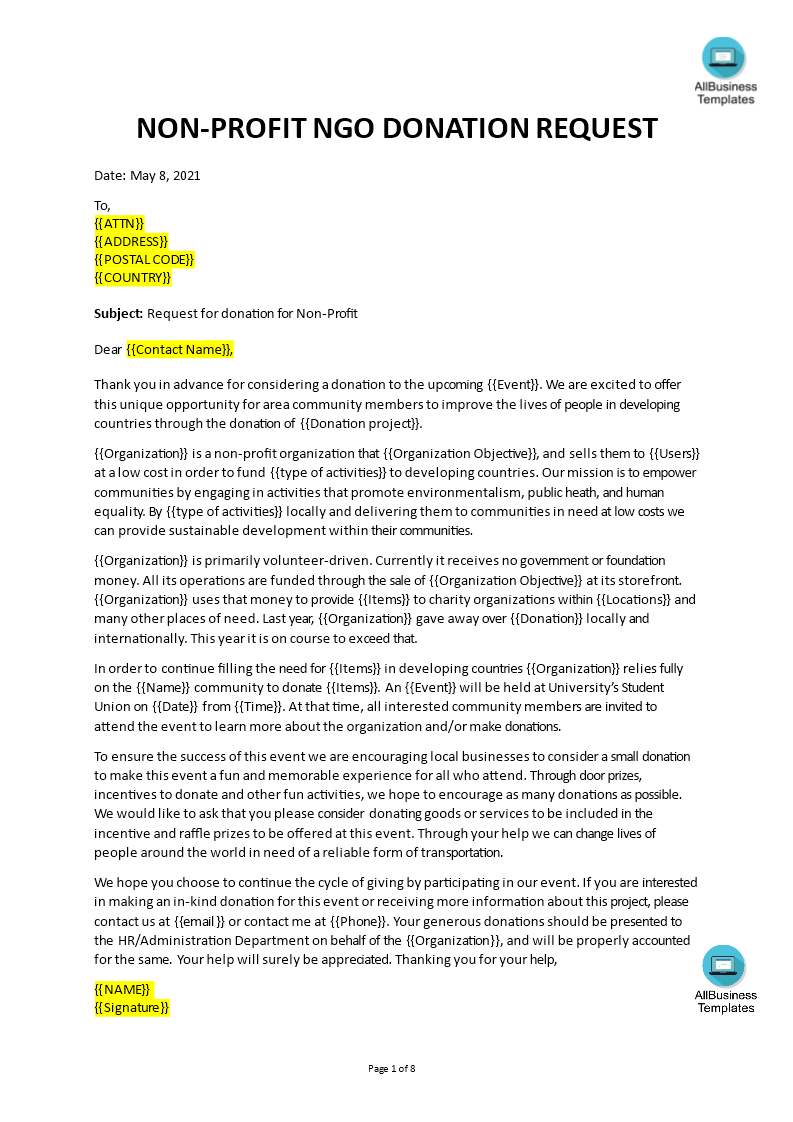

Sample Donation Request Letter For Non Profit Templates at

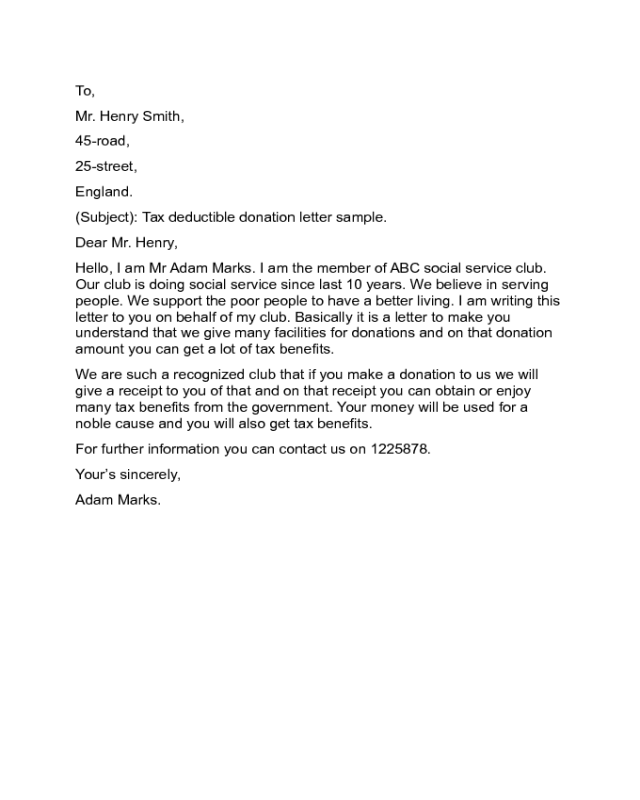

Tax Deductible Donation Letter Sample Edit, Fill, Sign Online Handypdf

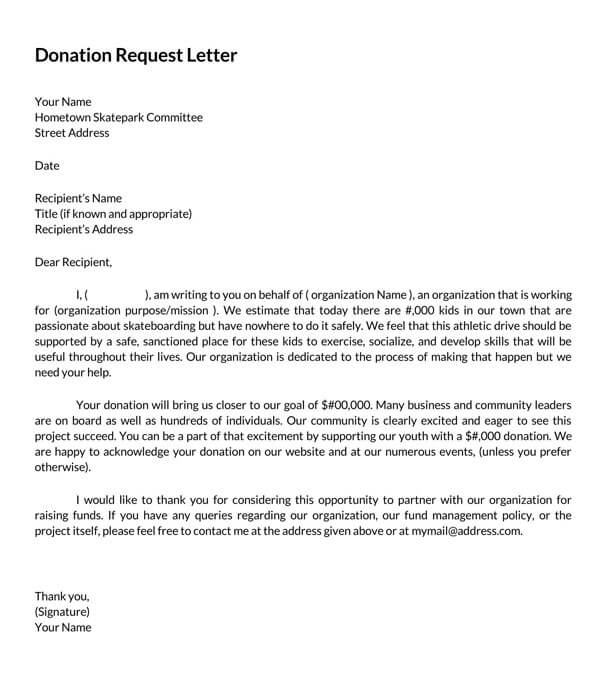

Writing the Perfect Donation Letter (Sample Letters & Templates)

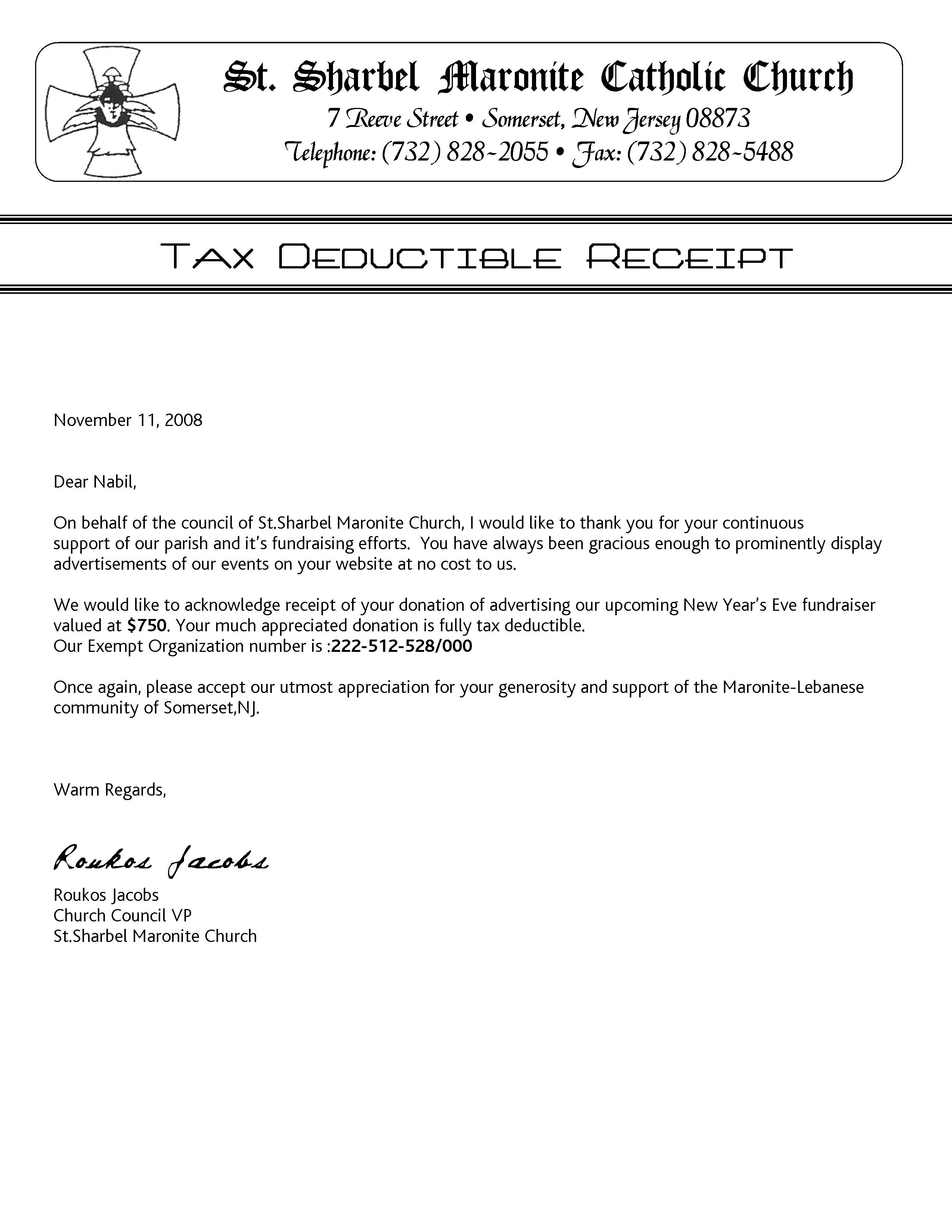

Fillable Formal Letter/tax Donation Receipt printable pdf download

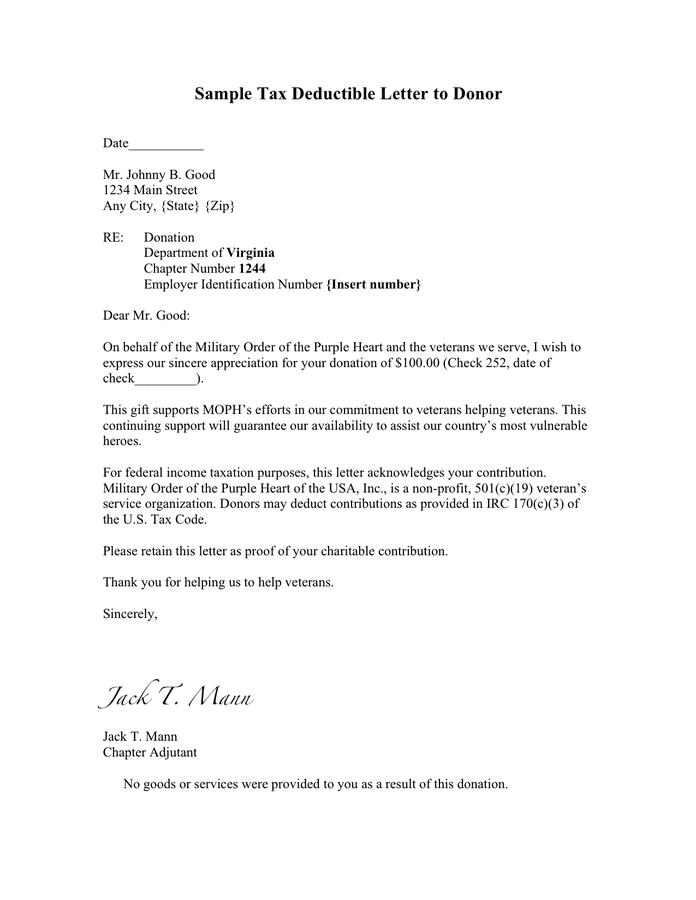

Sample tax deductible letter to donor in Word and Pdf formats

501c3 Tax Deductible Donation Letter Template Business

Donation Letter Template For Tax Purposes Examples Letter Template

13+ Free Donation Letter Template Format, Sample & Example

Free Donation Receipt Template 501(c)(3) PDF Word eForms

People Donate Because They Want To Further Your Cause, But They May Want The Tax Break Too.

Web This Letter Is To Confirm That You Made A Payment Of $ [Amount] For [Item/Experience] During The Auction On [Date].

Why Does Donor Acknowledgment Matter?

The Donor Will Use This Letter As Proof Of.

Related Post: