Tax Write Off Spreadsheet Template

Tax Write Off Spreadsheet Template - Collect all physical or electronic receipts. Identify the tax deductions applicable to you or your business. Customize the template to suit your home, business, or brand and keep track. Web view our free and editable tax write offs templates for excel or google sheets. Scan all the documents if they are in paper. Keeper tax’s independent contractor expenses spreadsheet. Scan or take photos of physical receipts if needed. Web download a free excel template to calculate your standard or itemized tax deductions for the year. This free 1099 template does two things that are very important for busy freelancers and small business owners. The next step is to gather all necessary records that prove these small business tax write. Scan or take photos of physical receipts if needed. The home office deduction is one of the most significant tax benefits of running a small business. Input each receipt data into a. Web download a free pdf worksheet to track and claim 55 deductible business expenses in 2022. Collect all physical or electronic receipts. Compare five free templates from different sources and. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. If you use part of your home as a photography studio or home office,. Web in this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. Web organize your finances for your small business with this. Compare five free templates from different sources and. Web in this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. Scan or take photos of physical receipts if needed. Customize the template to suit your home, business, or brand and keep track. At the end of the tax year,. These tax write offs spreadsheet templates are easy to modify and you can customize the. Web download a free pdf worksheet to track and claim 55 deductible business expenses in 2022. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. Start tracking your business expenses today so you. Keeper tax’s independent contractor expenses spreadsheet. Web this free template helps you track business expenses using t2125 tax categories. If you use part of your home as a photography studio or home office,. The next step is to gather all necessary records that prove these small business tax write. Collect all physical or electronic receipts. Gather all the required documents for the identified deductions. Web the first step in itemizing is to list all the deductions you want to claim. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Input each receipt data into a. It calculates how much you can deduct from your taxable income, and 2. Scan all the documents if they are in. Compare five free templates from different sources and. Start tracking your business expenses today so you. Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. Learn what a tax deduction is, how it works, and who to consult. Web the first step in itemizing is to list all the deductions you want to claim. Keeper tax’s independent contractor expenses spreadsheet. Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions. This free 1099 template does two things that are very important for busy freelancers and small business. Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. At the end of the tax year, most self. Learn what a tax deduction is, how it works, and who to consult for. Learn how to do your taxes. The home office deduction is one of the most significant tax benefits of running a small business. Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. Gather all tax documents for the year. Collect all physical or electronic. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. The home office deduction is one of the most significant tax benefits of running a small business. Learn what a tax deduction is, how it works, and who to consult for. Keeper tax’s independent contractor expenses spreadsheet. Identify all deductible expenses for the tax year. It calculates how much you can deduct from your taxable income, and 2. Web this free template helps you track business expenses using t2125 tax categories. Don't wait until tax time to get organized. Collect all physical or electronic receipts. Identify the tax deductions applicable to you or your business. At the end of the tax year, most self. Web i’m going to give you some tips and tricks on how to do taxes in excel, including a free tax tracker template you can download and start using right away. Start tracking your business expenses today so you. These tax write offs spreadsheet templates are easy to modify and you can customize the. Input each receipt data into a. Web download a free pdf worksheet to track and claim 55 deductible business expenses in 2022.

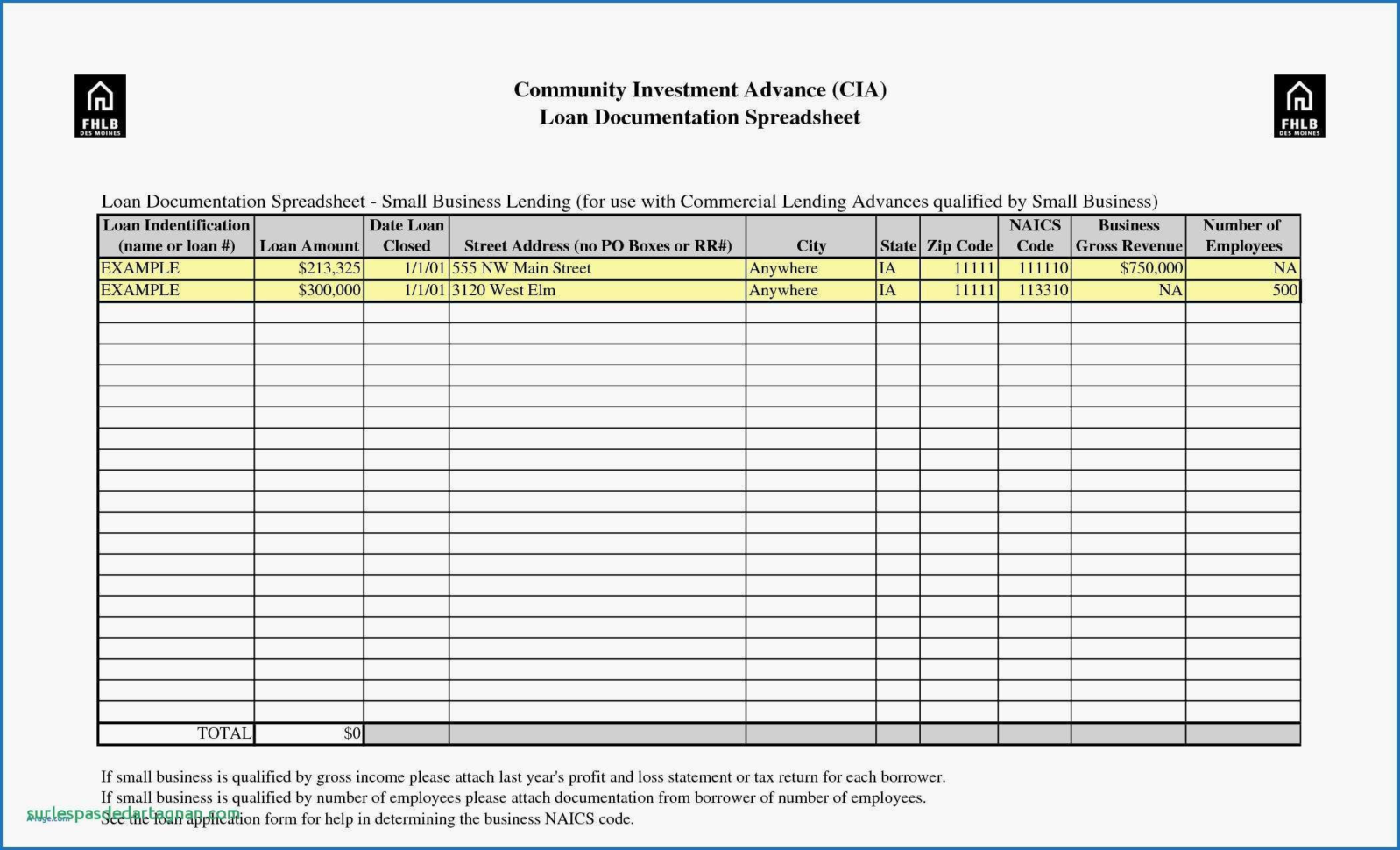

Business Tax Spreadsheet Templates —

EXCEL of Tax Deduction Form.xlsx WPS Free Templates

Tax Write Off Spreadsheet Template For Your Needs

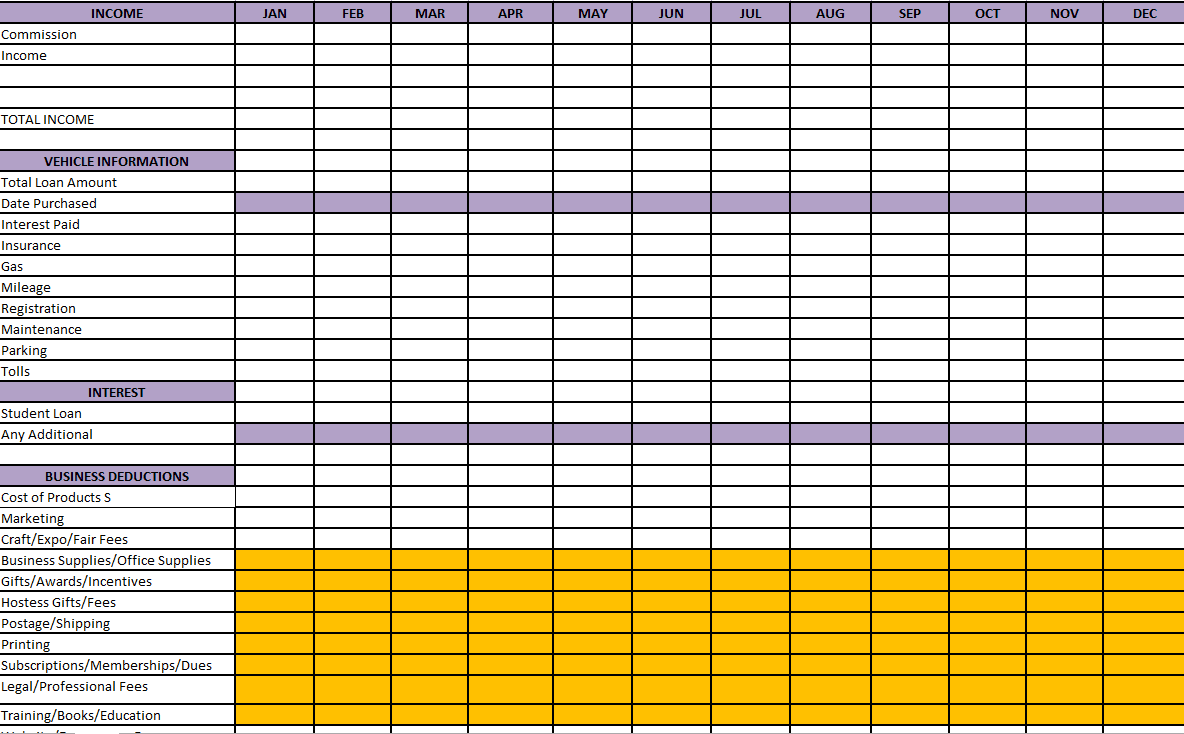

Perfect Tax And Expenses Spreadsheet Attendance Tracking

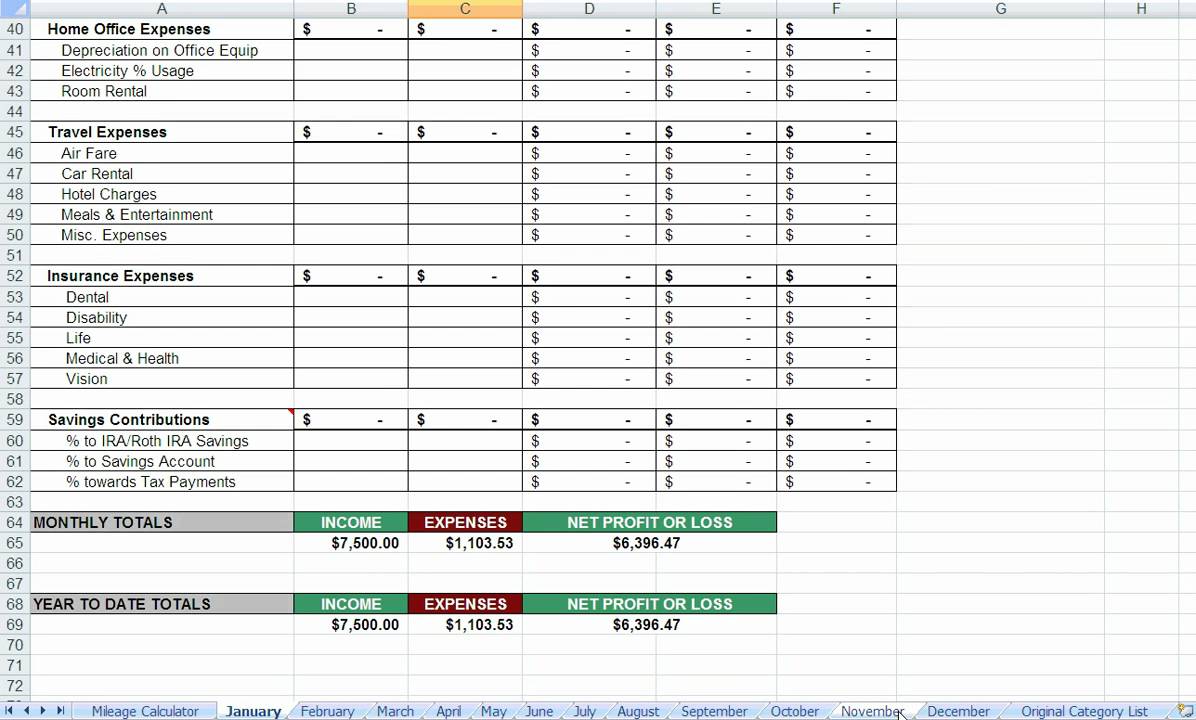

Free 1099 Template Excel (With StepByStep Instructions!) (2023)

Tax Expenses Spreadsheet Template Printable Templates

Free 1099 Template Excel (With StepByStep Instructions!)

spreadsheet for tax expenses —

2019 Photography Tax Spreadsheets, 400 Tax Write Offs, Audit Guide

Free 1099 Template Excel (With StepByStep Instructions!)

If You Use Part Of Your Home As A Photography Studio Or Home Office,.

Scan Or Take Photos Of Physical Receipts If Needed.

Scan All The Documents If They Are In Paper.

Web The First Step In Itemizing Is To List All The Deductions You Want To Claim.

Related Post: