Template For Letter To Irs

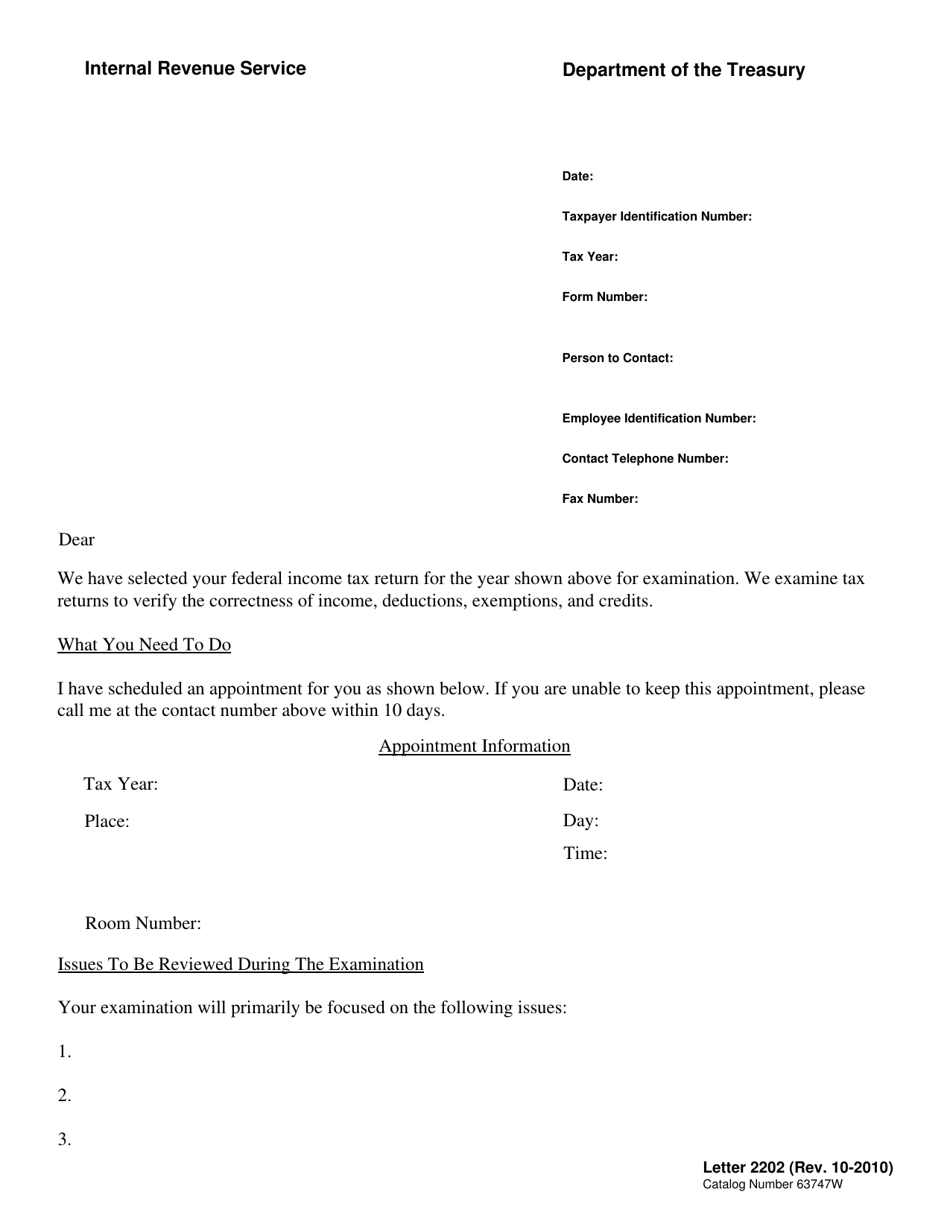

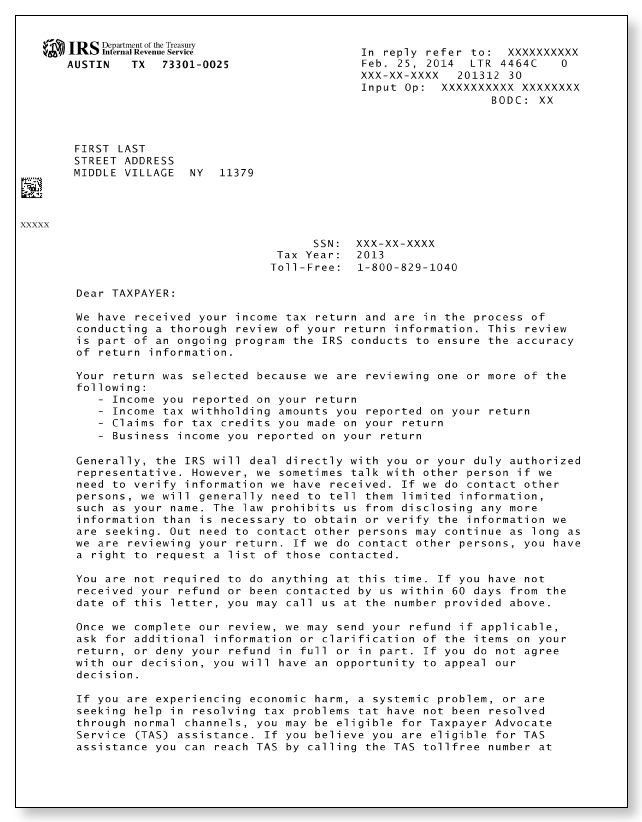

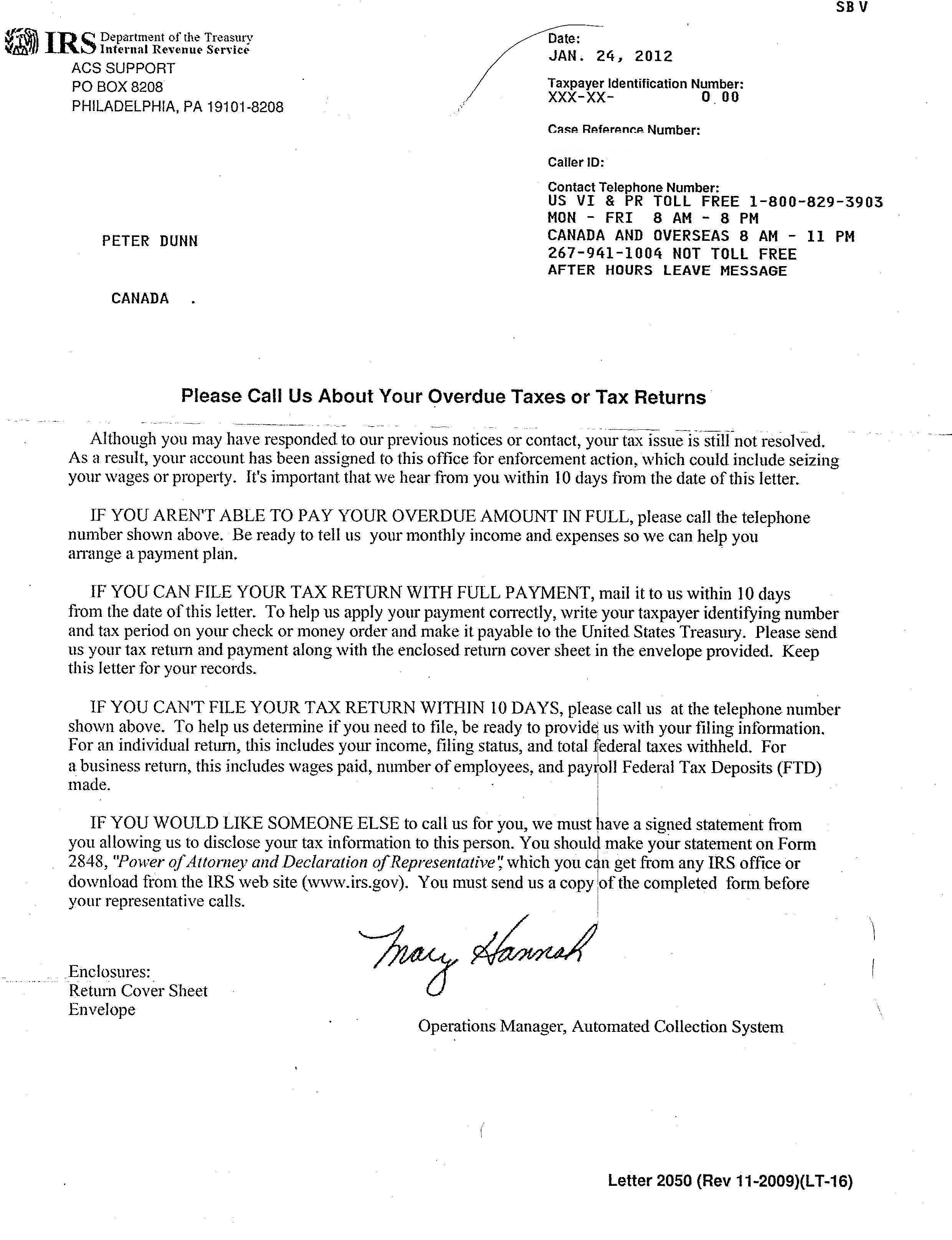

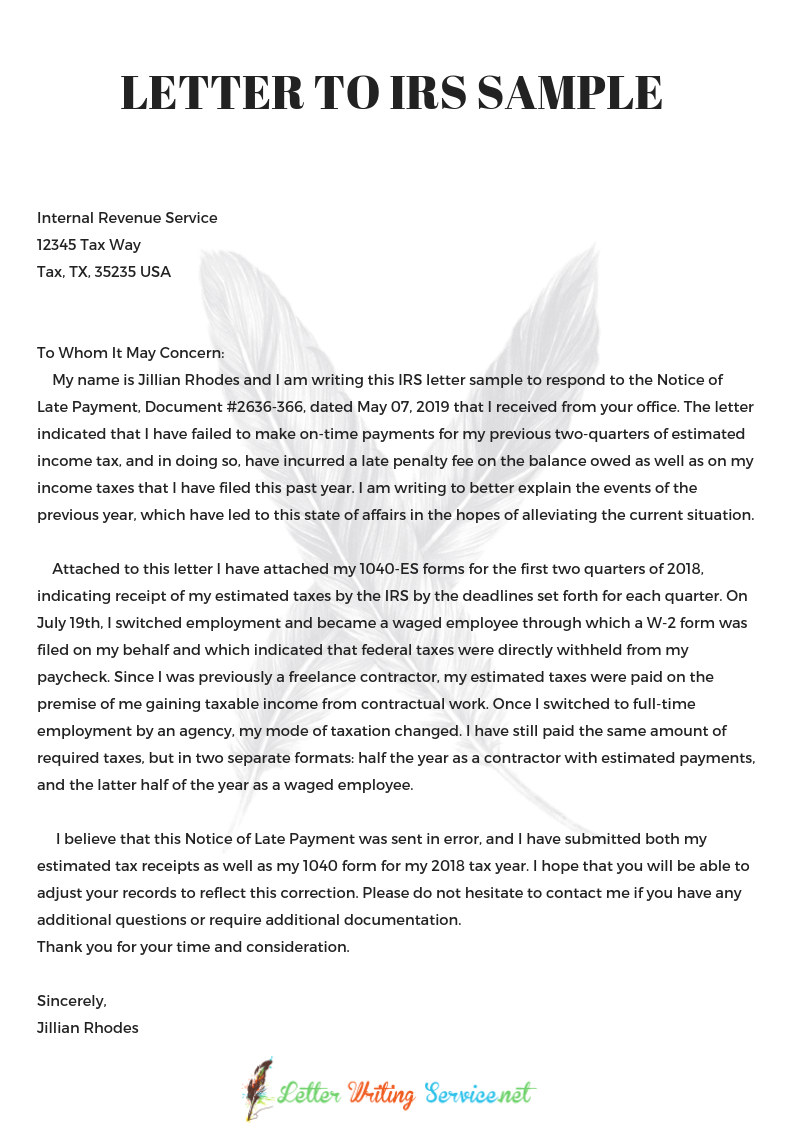

Template For Letter To Irs - Web learn how to write a persuasive letter to the irs to request a waiver of penalties. Ask the school to use this template on the school's letterhead and replace the bracketed information. Request for penalty abatement under reasonable cause. This letter serves as notification and seeks your guidance on the necessary steps to update our records with the irs. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Irs sends notices and letters when it needs to ask a question about a taxpayer’s federal tax return, let them know about a change to their account or request a payment. Irs letter to request installment agreement and appealirs letter to request installment agreement and appeal. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. How to write a letter to irs for payment plan. Ask the healthcare provider’s office to use this template on the provider’s letterhead and replace the bracketed information. Web sample of a cover letter to the irs. Web ** this is a sample of a letter a person could use to notify the irs that he or she has a new social security number. When a taxpayer receives mail from the irs, they should: The irs has installment agreement plans to spread your payments over several years. Web. For example, if you don't agree with their assessment, or want to give notice of steps that you are taking, a letter to irs is a tool that can be used in a variety of different situations. The filing of a tax lien or issuance of a levy can have severe financial repercussions against a taxpayer’s ability to pay the. This notice or letter may include additional topics that have not yet been covered here. Getting mail from the irs is not a cause for panic but, it should not be ignored either. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or. Ask the healthcare provider’s office to use this template on the provider’s letterhead and replace the bracketed information. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process (cdp) or equivalent hearing (eh). Web you disagree with the audit assessment. Save on finance charges and resolve tax disputes. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. If your tax bill is too much for you to pay in a single payment, you have options. Ask the healthcare provider’s office to use this template on the provider’s letterhead and replace the bracketed information. Web learn how to write a persuasive. There will be times when you might encounter some issues, like when the internal revenue service (irs) commits a mistake despite filing your taxes properly. Web dear irs, i am writing to inform you of a crucial change in our business details. Request a response or meeting. Irs letter to request installment agreement and appealirs letter to request installment agreement. Web letter to the irs template. Web you disagree with the audit assessment. Provide a clear and concise explanation. The filing of a tax lien or issuance of a levy can have severe financial repercussions against a taxpayer’s ability to pay the irs. Web sample template for use by schools. Web ** this is a sample of a letter a person could use to notify the irs that he or she has a new social security number. Learn how to properly address the irs in a letter to ensure your financial matters are handled effectively and professionally. [address] [city, state, zip code] dear irs, i am writing to provide additional. Web here is a simplified irs letter template that you can use when writing to the irs: Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. List the disagreed item (s) and the reason (s) you disagree with irs proposed changes from the examination (audit). Ask the school. Web feb 08, 2022 · 45.3 kb download. Web dear irs, i am writing to inform you of a crucial change in our business details. The irs has installment agreement plans to spread your payments over several years. Web ** this is a sample of a letter a person could use to notify the irs that he or she has. Web sample template for use by schools. Web use form 12203, request for appeals review pdf , the form referenced in the letter you received to file your appeal or prepare a brief written statement. Open a blank word processing document and set the font to something readable, such as times new roman 12 point. Begin with a polite and respectful tone. Sign and date your letter. Discover how quickly & painlessly you can write important irs letters! Learn how to properly address the irs in a letter to ensure your financial matters are handled effectively and professionally. List the disagreed item (s) and the reason (s) you disagree with irs proposed changes from the examination (audit). Web ** this is a sample of a letter a person could use to notify the irs that he or she has a new social security number. Web a letter to the internal revenue service (irs) is helpful if you need to make adjustments to your filing or dispute a finding by the irs. This notice or letter may include additional topics that have not yet been covered here. Irs sends notices and letters when it needs to ask a question about a taxpayer’s federal tax return, let them know about a change to their account or request a payment. Web dear irs, i am writing to inform you of a crucial change in our business details. Provide a clear and concise explanation. The irs has installment agreement plans to spread your payments over several years. [your name] [your address] [your social security number] [mmm dd, yyyy] dear sir/madam:IRS Audit Letter 2202B Sample 1

Write A Letter To Irs The best estimate professional

IRS Letter 2202, IRS Audit Letter Fill Out, Sign Online and Download

IRSLetter4464CSample1a Central Tax Services

Letter To Irs Free Printable Documents

IRS Audit Letter CP134B Sample 1

IRS Letter Sample by LetterWriting on DeviantArt

Sample Letter To Irs Free Printable Documents

Example Letters to Irs on Cp504 Form Fill Out and Sign Printable PDF

Sample Letter To Irs

Save On Finance Charges And Resolve Tax Disputes Effectively.

Different Formats And Samples Are Available Based On Specific Circumstances, And Truthfully Stating Personal Reasons Is Crucial.

Request For Penalty Abatement Under Reasonable Cause.

Your Notice Or Letter Will Explain The Reason For The Contact And Give You Instructions On How To Handle The Issue.

Related Post: