Template Of A Promissory Note

Template Of A Promissory Note - It is made on the borrower’s ability to pay, secured via something of value like a house. There should be an unconditional and clear promise to repay a specific amount to a specific person. Formally, it is defined as: Web a promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details, interest, late fees, any collateral, and more. What is a promissory note? If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. Details included in this note include the amount borrowed, personal information of the borrower, and payment terms. Web a promissory note is a written promise by a borrower to repay a loan to a lender according to predetermined terms and conditions. Interest rate — the cost of borrowing, expressed as a percentage of the principal amount. Web among our survey with promissory note users in 2022, 76% of them with a principal amount less than $100,000 chose not to secure their promissory note with collateral. It is a legal, financial tool which makes the terms for a loan written. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Web formswift’s promissory note template can be used for personal loans, business loans, and student loans. Small loans might only need a. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. The lender may specify what collateral will be acceptable. This agreement also outlines what will happen if the debt is not repaid. Web among our survey with promissory note users in 2022, 76% of. Web a promissory note is a written promise by a borrower to repay a loan to a lender according to predetermined terms and conditions. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. A promissory note includes much more detail than a simple. Before the requested fund is provided, the lender and the borrower document terms mutually agreed upon on a promissory note, such as the repayment schedule, interest rates, and collaterals. Web a promissory note is a document that sets out all the details of a loan that has been made between two parties. The parties.this promissory note (the “note”) is made. Web this promissory note template can help you create the right note in order to keep track of that transaction. A secured promissory note is one that comes with collateral for the lender to hold until their money is paid back. Web all unsecured promissory notes contain the same depth of information. Include the names and addresses of all lenders. Details included in this note include the amount borrowed, personal information of the borrower, and payment terms. An unsecured promissory note is a promissory note that is written without any collateral. Web formswift’s promissory note template can be used for personal loans, business loans, and student loans. A secured promissory note is one that comes with collateral for the lender. Promissory notes have much in common with loan agreements, but the former only binds the borrower and is more informal.they function similarly to iou notes, detailing information about what one person owes another. It lays out all the specifics of the loan, including the amount, the interest rate, and when payments are due. Web a promissory note is a document. Financing the purchase of a vehicle, boat, or physical property. Small loans might only need a simple promissory note to be protected, but you should still create this. Web the promissory note is legally documented between two parties and contains information about the amount that was lent, as well as the due maturity date of the payments and the interest. Web a promissory note is a legal contract between a lender and a borrower that defines the terms of a loan, including payment details, interest, late fees, any collateral, and more. Select the state where the loan is taking place. What is a promissory note? Banks and other financial institutions give loans to people. Web a promissory note is a. Web a promissory note is a note payable form whereby a borrower promises to repay the lender. Unsecured notes may be used. Web a promissory note outlines the terms of a loan agreement. Formally, it is defined as: Easy to build, a promissory note is an effective way for any lender to record the terms and. The parties.this promissory note (the “note”) is made this [mm/dd/yyyy], (the “start date”), by and between [borrower name] of [borrower address] (the “borrower”), who has received and promises to payback [lender name] of [lender address] (the “lender”) the principal sum of $. It lays out all the specifics of the loan, including the amount, the interest rate, and when payments are due. There should be an unconditional and clear promise to repay a specific amount to a specific person. Web all unsecured promissory notes contain the same depth of information. Formally, it is defined as: Small loans might only need a simple promissory note to be protected, but you should still create this. A promissory note is useful for both borrowers and. An unsecured promissory note is a promissory note that is written without any collateral. The lender may specify what collateral will be acceptable. The amount of the loan (including an applicable interest rate). It is a legal, financial tool which makes the terms for a loan written. Web principal amount — this is the original sum of money being borrowed as specified in the promissory note or as seen in a promissory note template. Before the requested fund is provided, the lender and the borrower document terms mutually agreed upon on a promissory note, such as the repayment schedule, interest rates, and collaterals. Web although it’s a legal document, writing a promissory note doesn’t have to be difficult. It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. Unsecured notes may be used.![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-38.jpg?w=790)

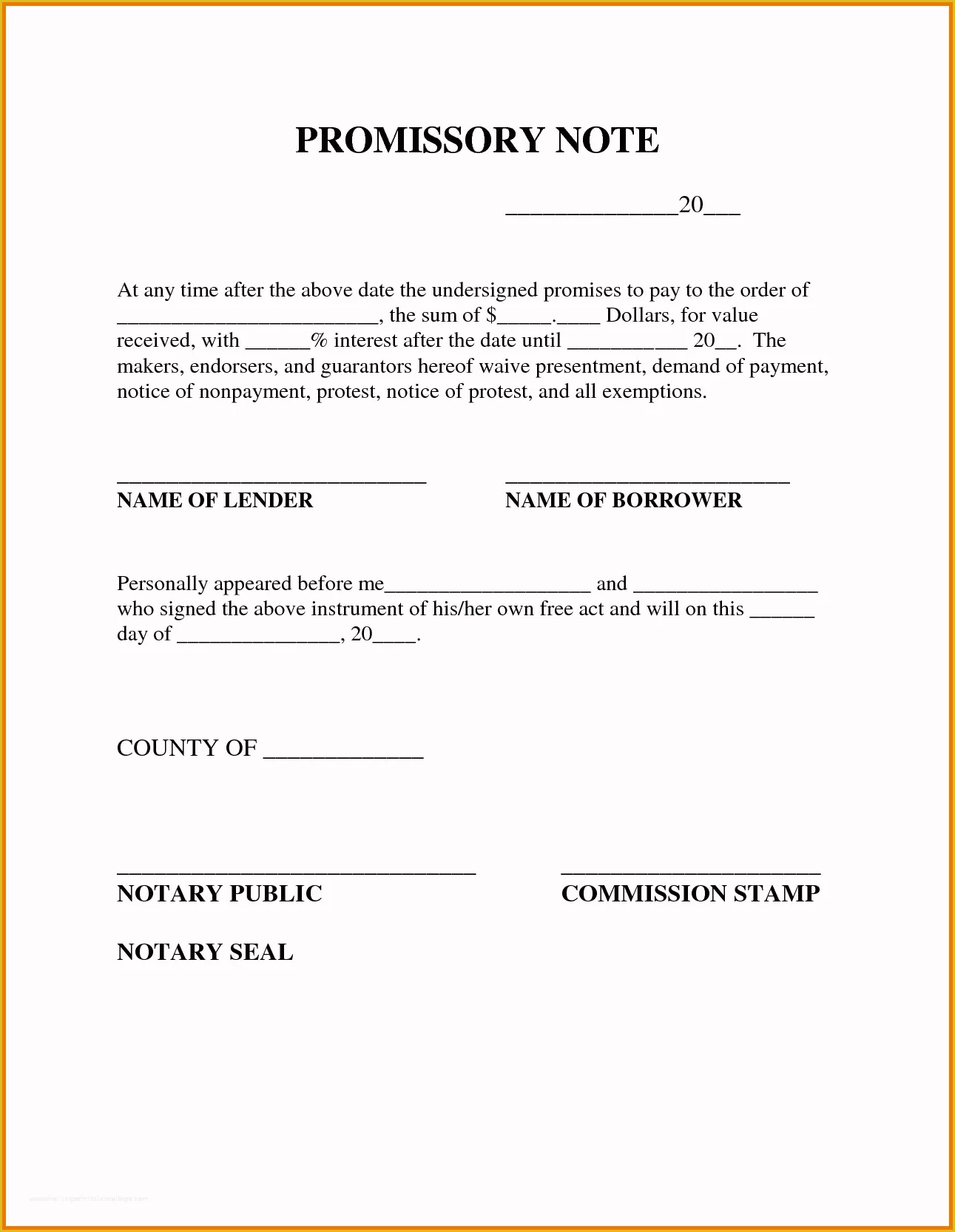

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-01.jpg)

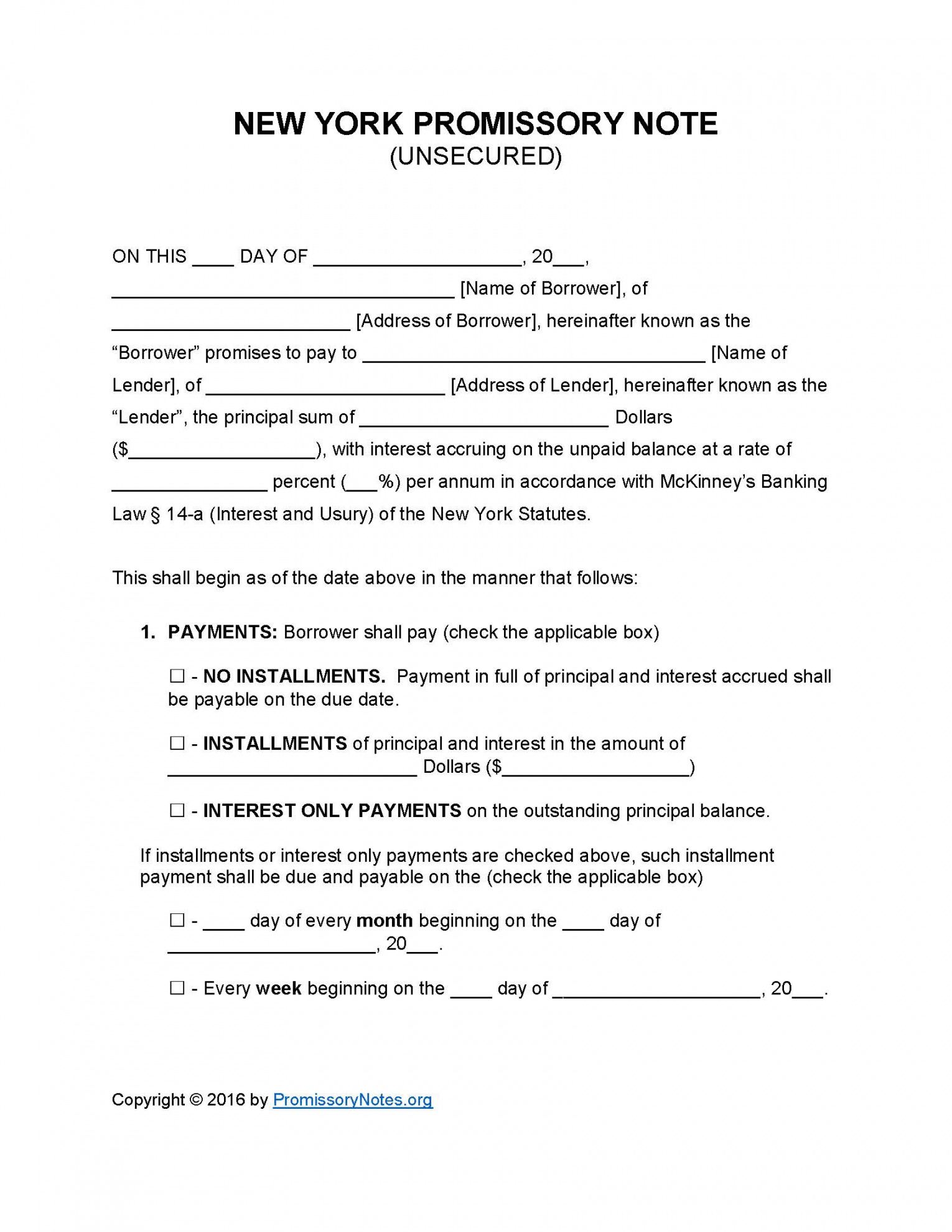

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

Free Promissory Note Template Illinois Printable Templates

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-29-790x1022.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-23.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-34.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-31.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-04.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-33.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Release Of Promissory Note Template

Create And Download Promissory Notes For Free!

Web This Promissory Note Template Can Help You Create The Right Note In Order To Keep Track Of That Transaction.

Web Among Our Survey With Promissory Note Users In 2022, 76% Of Them With A Principal Amount Less Than $100,000 Chose Not To Secure Their Promissory Note With Collateral.

It Does Not Include Any Interest Or Fees.

Related Post: