Trust Accounting Template California

Trust Accounting Template California - These templates are provided as a resource for attorneys to help with their client. Providing accounting services to professional fiduciaries, probate attorneys & individuals since 2002. Organize financial transactions by date. Web california statutory law requires a trustee to account annually to current trust beneficiaries, i.e., those who are currently entitled to receive distributions of income and principal. Matrix/chart of states, upia, power to. The 2023 edition includes rules that became operative on january 1, 2023 and ctapp information. Web the following templates and guides for client trust accounting were created by the state bar. Web fortunately, with marcia campbell cpa, you receive unmatched trust accounting services to protect trust assets and be wary of a breach of duties. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. Web the goal in client trust accounting is to make sure that every dollar you receive on behalf of a client is ultimately paid out. Checklist for trust instrument provisions (content) 230 b. What comes in for each client must equal what goes out. The following forms, taken from the ardc publication, the client trust account handbook, can be used as a. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting. These templates are provided as a resource for attorneys to help with their client. Enter each trust transaction into the accounting software. In the state of california, trustees have a duty to keep the beneficiaries of the trust reasonably informed about the trust and how it is being administered. Web in late 2022, california enacted the client trust account protection. Web the goal in client trust accounting is to make sure that every dollar you receive on behalf of a client is ultimately paid out. Web the following templates and guides for client trust accounting were created by the state bar. Web in late 2022, california enacted the client trust account protection program (ctapp) to help ensure attorneys fulfill their. What comes in for each client must equal what goes out. Organize financial transactions by date. Matrix/chart of states, upia, power to. Web a trust accounting should meet the california probate code requirements, but preparing a trust accounting can be tedious and very complicated. Posted on september 5, 2012. Web navigating a trust or probate accounting: The handbook is currently only available online. Organize financial transactions by date. Download a sample fiduciary accounting prepared. At this year’s annual meeting, one of our members asked if asb would. Download a sample fiduciary accounting prepared. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. The handbook is currently only available online. The following forms, taken from the ardc publication, the client trust account handbook, can be used as a. Web the following two sample. Web the following templates and guides for client trust accounting were created by the state bar. These templates are provided as a resource for attorneys to help with their client. Download a sample fiduciary accounting prepared. The 2023 edition includes rules that became operative on january 1, 2023 and ctapp information. Published on august 29, 2022. Web a trust accounting should meet the california probate code requirements, but preparing a trust accounting can be tedious and very complicated. Enter each trust transaction into the accounting software. These templates are provided as a resource for attorneys to help with their client. Web in late 2022, california enacted the client trust account protection program (ctapp) to help ensure. These templates are provided as a resource for attorneys to help with their client. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. Web navigating a trust or probate accounting: Web sample recordkeeping account forms for client trust accounts. At this. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. Beginning list of accounts and assets (see attached list naming each property and bank account and stating value of each) although not legally required, it is preferable to also attach all of. Web a trust accounting should meet the california probate code requirements, but preparing a trust accounting can be tedious and very complicated. The following forms, taken from the ardc publication, the client trust account handbook, can be used as a. Checklist for trust instrument provisions (content) 230 b. The power of a calculator | california trust, estate & probate litigation. Posted on september 5, 2012. Matrix/chart of states, upia, power to. Web the following templates and guides for client trust accounting were created by the state bar. Providing accounting services to professional fiduciaries, probate attorneys & individuals since 2002. Web california statutory law requires a trustee to account annually to current trust beneficiaries, i.e., those who are currently entitled to receive distributions of income and principal. At this year’s annual meeting, one of our members asked if asb would. Organize financial transactions by date. Web the following two sample trust account review (tar) reports are being provided solely as a guideline to assist threshold brokers and their accountants in complying with business. The handbook is currently only available online. Web sample recordkeeping account forms for client trust accounts. Gain a complete understanding of the state bar of california trust rules. Web navigating a trust or probate accounting:

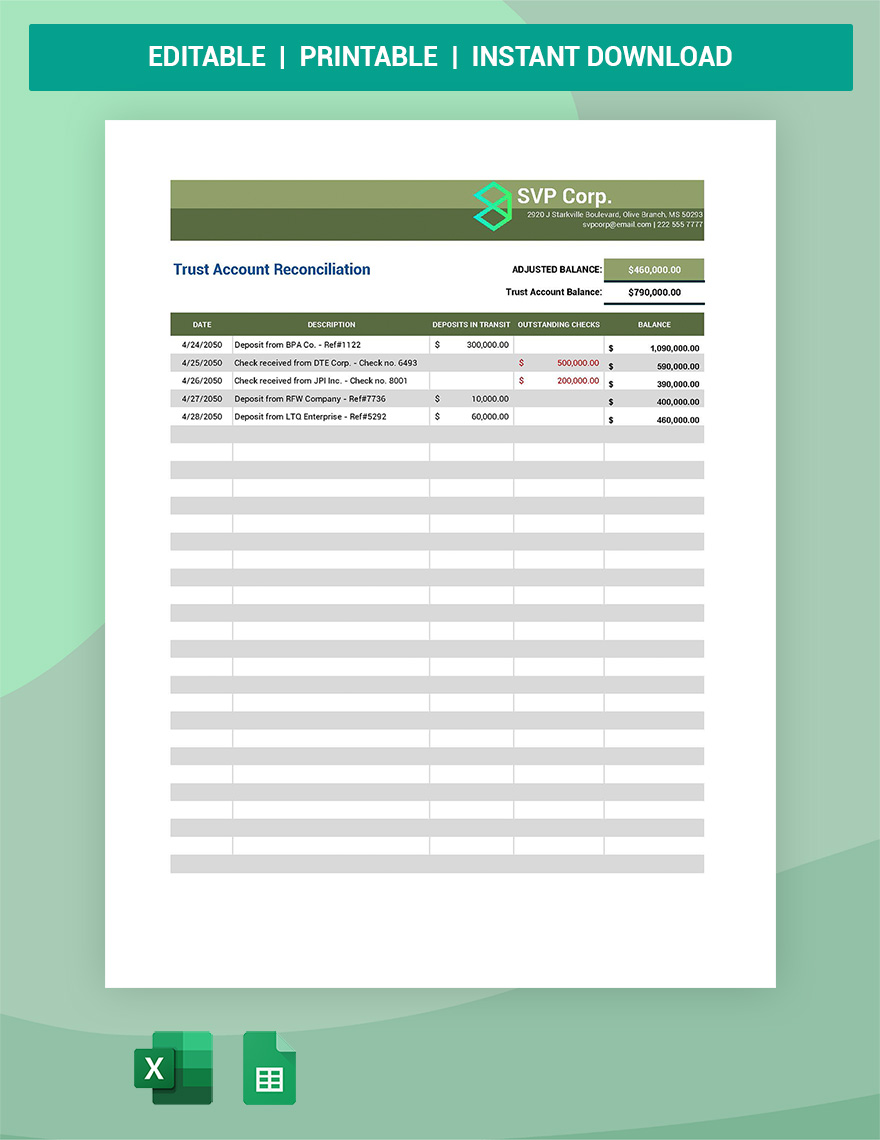

Trust Account Reconciliation Template Google Sheets, Excel

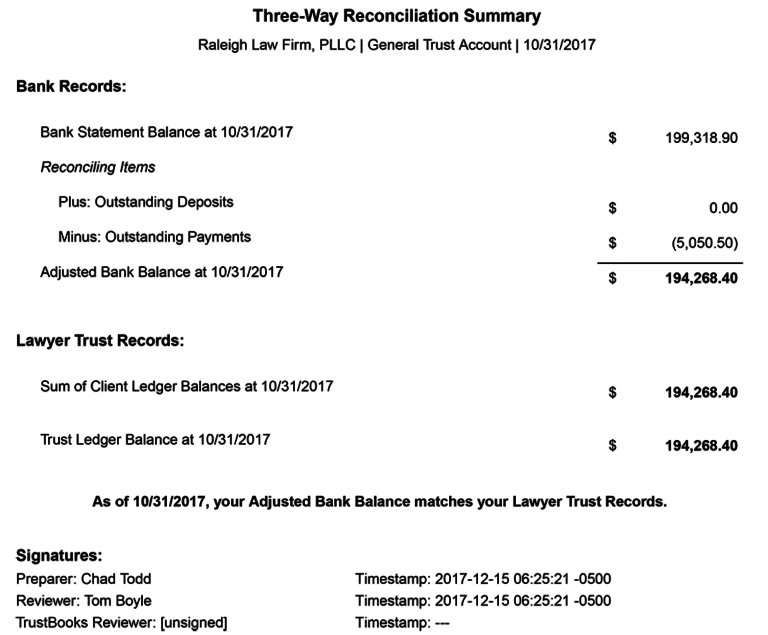

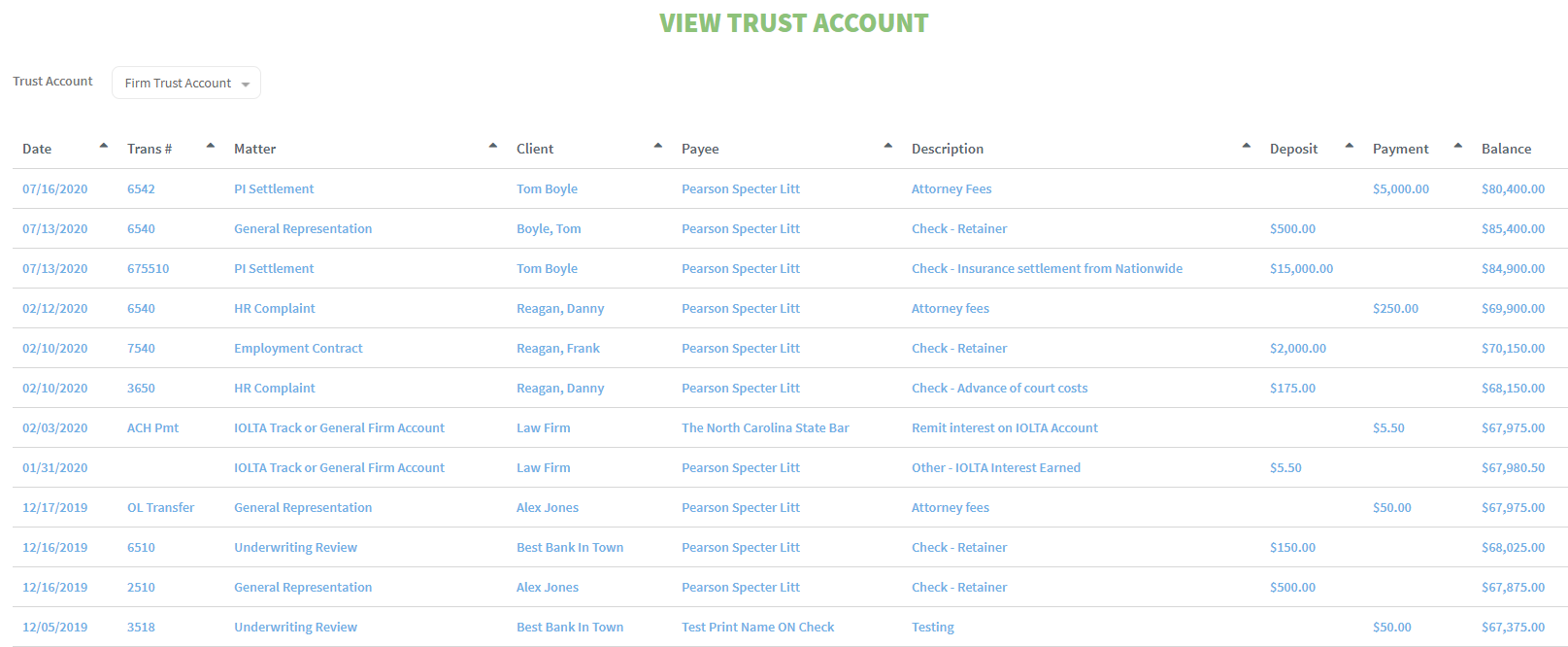

California Trust Accounting Software TrustBooks

Troika Trust Accounting Software thewealthworks

Trust Accounting Software (IOLTA) for Law Firms CosmoLex

Trust Accounting Excel Template California

California Certification Trust Fill Online, Printable, Fillable

Trust Accounting Template

2015 Form CA Affidavit of Successor Trustee Fill Online, Printable

Trust Accounting Template California

Trust Accounting Template California

Published On August 29, 2022.

In The State Of California, Trustees Have A Duty To Keep The Beneficiaries Of The Trust Reasonably Informed About The Trust And How It Is Being Administered.

Web Probate Accounting, Also Known As Trust Accounting, Is Simply An Accounting Of The Transactions Undertaken By An Estate During A Specific Reporting Period.

Web In Late 2022, California Enacted The Client Trust Account Protection Program (Ctapp) To Help Ensure Attorneys Fulfill Their Client Trust Accounting Duties.

Related Post: