Word Promissory Note Template

Word Promissory Note Template - Explore precise promissory note templates & expert guides for secure lending agreements. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. A promissory note outlines the terms of a loan agreement. The note can be issued in january but its due date will be in may. Paperless workflow30 day free trialfree mobile app24/7 tech support It must have an official stamp. It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. The maker must duly draw and sign it. On payment, the payee pays both the principal amount and the interest. This is a note which has a future date of payment. Web the promissory note is legally documented between two parties and contains information about the amount that was lent, as well as the due maturity date of the payments and the interest rates. Formally, it is defined as: How to write a promissory note. Web promissory notes are typically used for less complex loans or when there is a prior. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. There should be an unconditional and clear promise to repay a specific amount to a specific person. Paperless workflow30 day free trialfree mobile app24/7 tech support Choose from our promissory note templates that are drafted by attorneys. It facilitate private financing arrangements,. It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. It must have an official stamp. Formally, it is defined as: Web secured promissory note (word) it is a legally binding agreement, and it is between the lender and the borrower. This is a note on which the issuer and the payee agree on. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. Web interest bearing promissory note: The note can be issued in january but its due date will be in may. How to write an unsecured. This is a note on which the issuer and the payee agree on a specific interest rate. Details included in this note include the amount borrowed, personal information of the borrower, and payment terms. Examples of unsecured promissory notes include personal loans, credit card debt, and student loans without any collateral attached. It provides clear guidelines for both the borrower and lender, ensuring a fair and transparent transaction. Web promissory notes are typically used for less complex. How to write a promissory note. It facilitate private financing arrangements, ensuring parties are protected and informed about loan repayment. It also contains information about the location and time of issuing the promissory note, as well as the signatures involved. A promissory note outlines the terms of a loan agreement. Examples of unsecured promissory notes include personal loans, credit card. By using promissory notes, lenders ensure legal protection for themselves in the event of a borrower’s failure to return the borrowed money. It also contains information about the location and time of issuing the promissory note, as well as the signatures involved. How to write an unsecured. It provides clear guidelines for both the borrower and lender, ensuring a fair. Web interest bearing promissory note: On payment, the payee pays both the principal amount and the interest. The maker must duly draw and sign it. A promissory note outlines the terms of a loan agreement. Web the promissory note is legally documented between two parties and contains information about the amount that was lent, as well as the due maturity. Web among our survey with promissory note users in 2022, 76% of them with a principal amount less than $100,000 chose not to secure their promissory note with collateral. How to write an unsecured. On payment, the payee pays both the principal amount and the interest. How to write a promissory note. Web interest bearing promissory note: Paperless workflow30 day free trialfree mobile app24/7 tech support It is made on the borrower’s ability to pay, secured via something of value like a house. How to write a promissory note. Web promissory notes are typically used for less complex loans or when there is a prior acquaintance between the lender and the borrower. The note can be issued. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. The maker must duly draw and sign it. It also contains information about the location and time of issuing the promissory note, as well as the signatures involved. Web free promissory note templates. How to write a promissory note. It must have an official stamp. Web interest bearing promissory note: How to write an unsecured. Web the promissory note is legally documented between two parties and contains information about the amount that was lent, as well as the due maturity date of the payments and the interest rates. There should be an unconditional and clear promise to repay a specific amount to a specific person. This is a note on which the issuer and the payee agree on a specific interest rate. A promissory note outlines the terms of a loan agreement. Web promissory notes are typically used for less complex loans or when there is a prior acquaintance between the lender and the borrower. It facilitate private financing arrangements, ensuring parties are protected and informed about loan repayment. Formally, it is defined as: The note can be issued in january but its due date will be in may.![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-07.jpg)

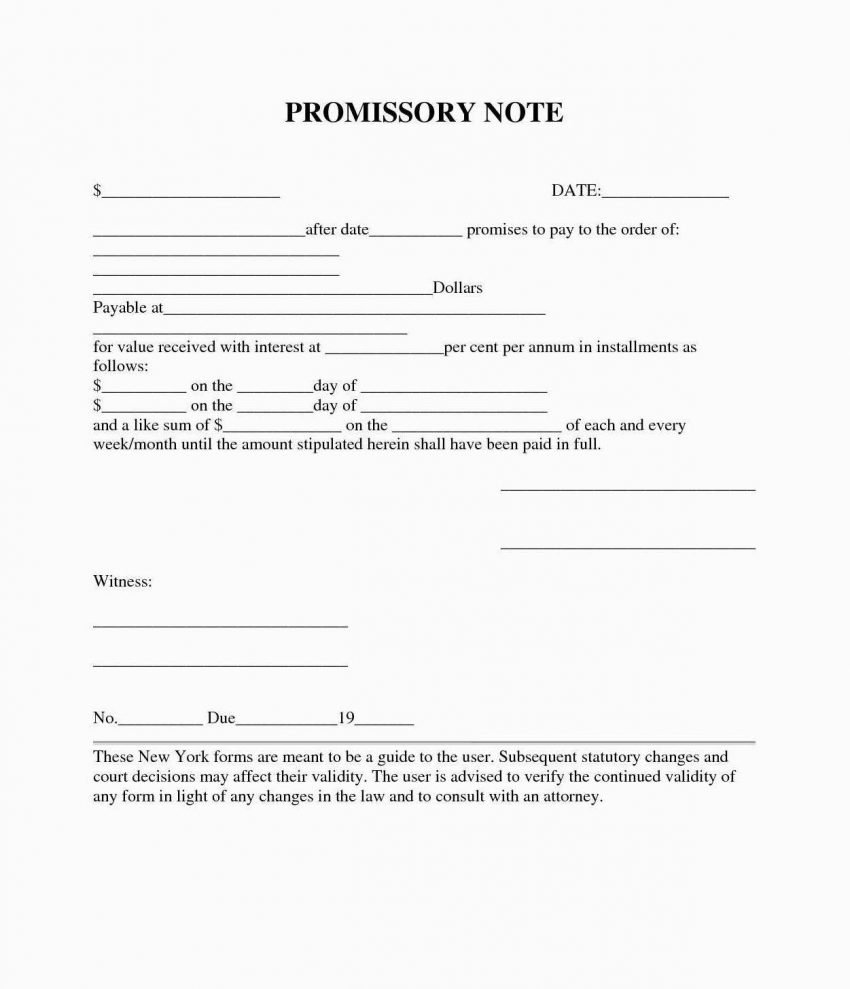

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-08.jpg)

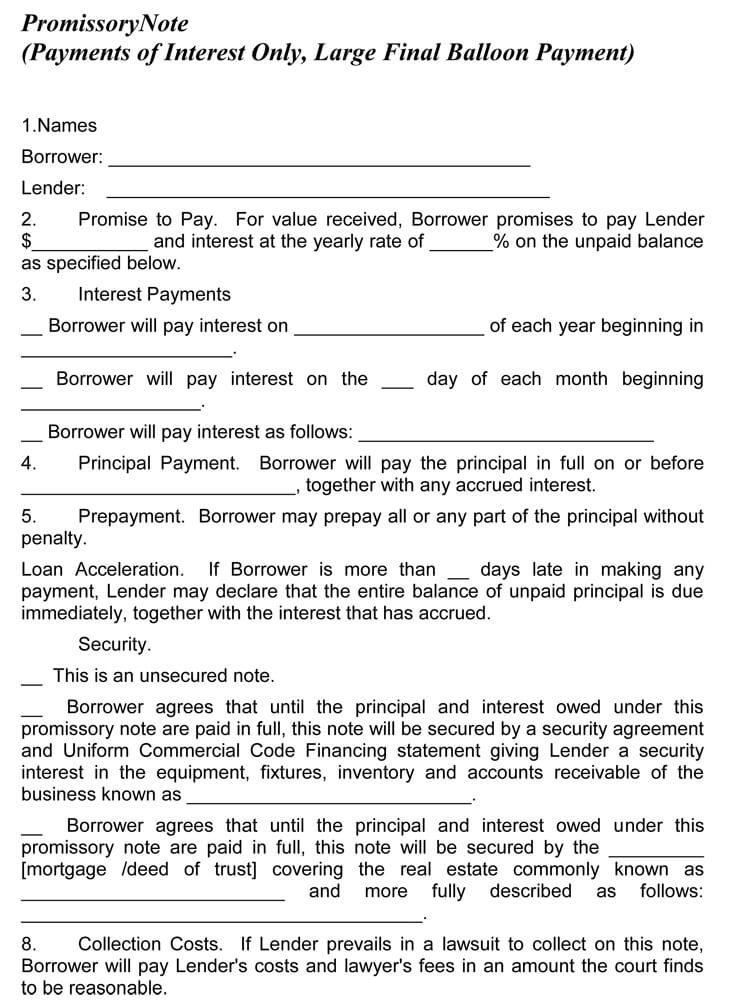

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

Free Promissory Note Template Word PDF

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-40.jpg?w=395)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-31.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

38 Free Promissory Note Templates & Forms (Word PDF)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-33.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-45.jpg?w=790)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-23.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Promissory Note Is A Formal Written Agreement That Outlines A Promise To Repay A Specific Amount Of Money By A Specified Time.

Details Included In This Note Include The Amount Borrowed, Personal Information Of The Borrower, And Payment Terms.

By Using Promissory Notes, Lenders Ensure Legal Protection For Themselves In The Event Of A Borrower’s Failure To Return The Borrowed Money.

It Provides Clear Guidelines For Both The Borrower And Lender, Ensuring A Fair And Transparent Transaction.

Related Post: