Biweekly Paycheck Budget Template

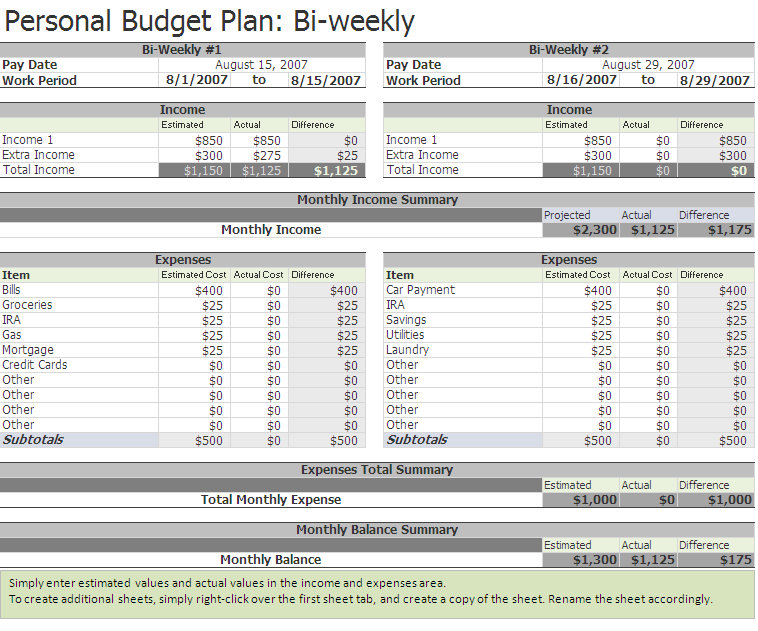

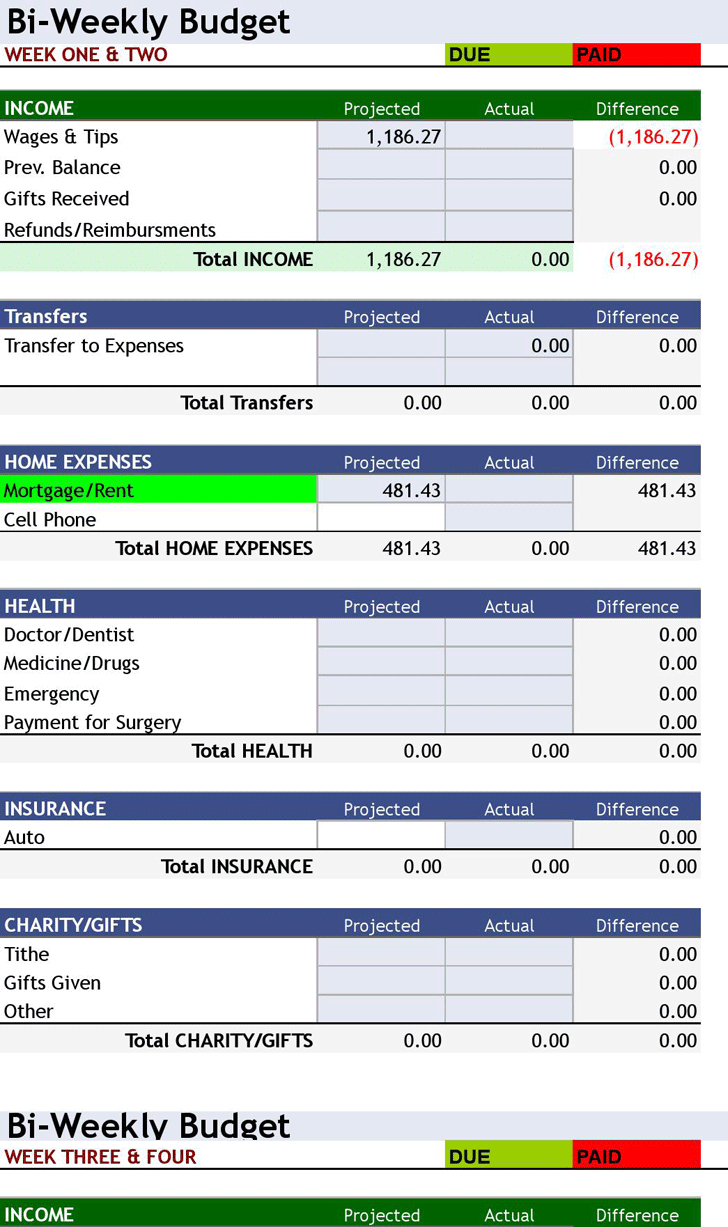

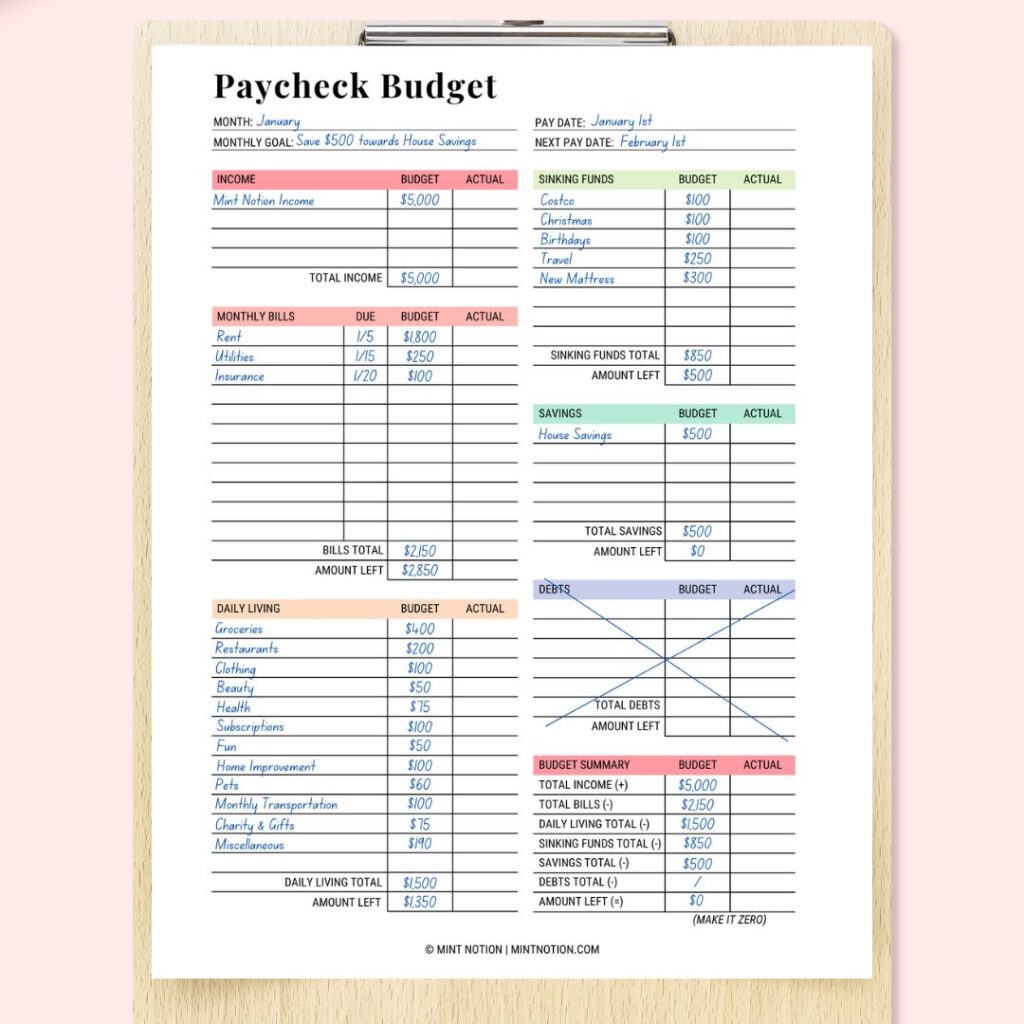

Biweekly Paycheck Budget Template - 3.3 fund much needed rewards. This means that you receive 26 paychecks throughout the year. 3.1 make an emergency fund. 2.2 get ahead on bills. With short notice, it can help you save up for special events such as birthdays, holidays. Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. Web to adopt this new strategy, you’ll have to take some basic steps. Set aside money for savings. Bill payments and due dates are easier to track using a budget. Here’s a colorful paycheck budget template from money bliss. 2.2 get ahead on bills. It’s important that you set up a plan for each paycheck to make sure your bills get paid. With short notice, it can help you save up for special events such as birthdays, holidays. 3.1 make an emergency fund. 3.2 save for a big goal. And in a twelve month period,. Bill payments and due dates are easier to track using a budget. So, here’s how to budget biweekly paycheck and improve your financial health in the process. Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. 3.2 save for a big goal. Before you can decide how to break up your biweekly paychecks, you need to figure out exactly where your money is going. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailedand intentional approach. Web by decoding the biweekly pay cycle and implementing accurate income calculation strategies, individuals can lay the foundation for. Web here is how to budget biweekly: In the subsequent sections, we will explore the essential components of a biweekly budget template and practical tips for successful implementation. Money bliss’s paycheck budget template. Make a list of your monthly expenses. 2.2 get ahead on bills. This way you can tell the money from each individual paycheck exactly where want it to go before it even arrives! It’s important that you set up a plan for each paycheck to make sure your bills get paid. Set aside money for savings. Web to adopt this new strategy, you’ll have to take some basic steps. So, here’s how. Before you can decide how to break up your biweekly paychecks, you need to figure out exactly where your money is going. Web here is how to budget biweekly: 2.2 get ahead on bills. Web by decoding the biweekly pay cycle and implementing accurate income calculation strategies, individuals can lay the foundation for a precise and effective biweekly budget. Fill. Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. Make a list of your monthly expenses. Bill payments and due dates are easier to track using a budget. In a 12 month period would get paid 26 times. Here’s a colorful paycheck budget template from money bliss. You need to subscribe to her entire free resource library to get access to it. Web to adopt this new strategy, you’ll have to take some basic steps. 3.2 save for a big goal. 2.2 get ahead on bills. It’s important that you set up a plan for each paycheck to make sure your bills get paid. Before you can decide how to break up your biweekly paychecks, you need to figure out exactly where your money is going. 3.2 save for a big goal. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailedand intentional approach. Web here is how to budget biweekly: Web by decoding the biweekly pay. Before you can decide how to break up your biweekly paychecks, you need to figure out exactly where your money is going. Money bliss’s paycheck budget template. Set aside money for savings. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailedand intentional approach. 3.3 fund much needed rewards. Web to adopt this new strategy, you’ll have to take some basic steps. Set aside money for savings. Bill payments and due dates are easier to track using a budget. This means that you receive 26 paychecks throughout the year. In a 12 month period would get paid 26 times. Web here is how to budget biweekly: Web by decoding the biweekly pay cycle and implementing accurate income calculation strategies, individuals can lay the foundation for a precise and effective biweekly budget. So, here’s how to budget biweekly paycheck and improve your financial health in the process. 3.1 make an emergency fund. Write your first biweekly budget. In the subsequent sections, we will explore the essential components of a biweekly budget template and practical tips for successful implementation. Instead of doing one traditional monthly budget, create a separate budget for each check that you get every 2 weeks. With short notice, it can help you save up for special events such as birthdays, holidays. Money bliss’s paycheck budget template. This way you can tell the money from each individual paycheck exactly where want it to go before it even arrives! Writing a biweekly budget is the first step to creating financial stability.

Biweekly Budget Template 2 PRINTABLE Finance Budget Sheets Etsy

Bi Weekly Budget Planner Template Paycheck Budget Printable Etsy Canada

11 Free BiWeekly Budget Templates

Weekly/bi Weekly Paycheck Budget Template Printabledigital Etsy

Biweekly Paycheck Budget Template

BIWEEKLY Budget Overview Template Printable Paycheck Budget Etsy

Free Printable Bi Weekly Budget Sheets PORTABLE

Simple weekly budget worksheet pdf gaseaspen

How to Budget Monthly Bills with Biweekly Paychecks Weekly budget

How to Budget Biweekly Paychecks StepbyStep Guide Mint Notion

Here’s A Colorful Paycheck Budget Template From Money Bliss.

How To Budget Biweekly Paychecks In 7 Easy Steps:

It’s Important That You Set Up A Plan For Each Paycheck To Make Sure Your Bills Get Paid.

You Need To Subscribe To Her Entire Free Resource Library To Get Access To It.

Related Post: