Irs B Notice Word Template

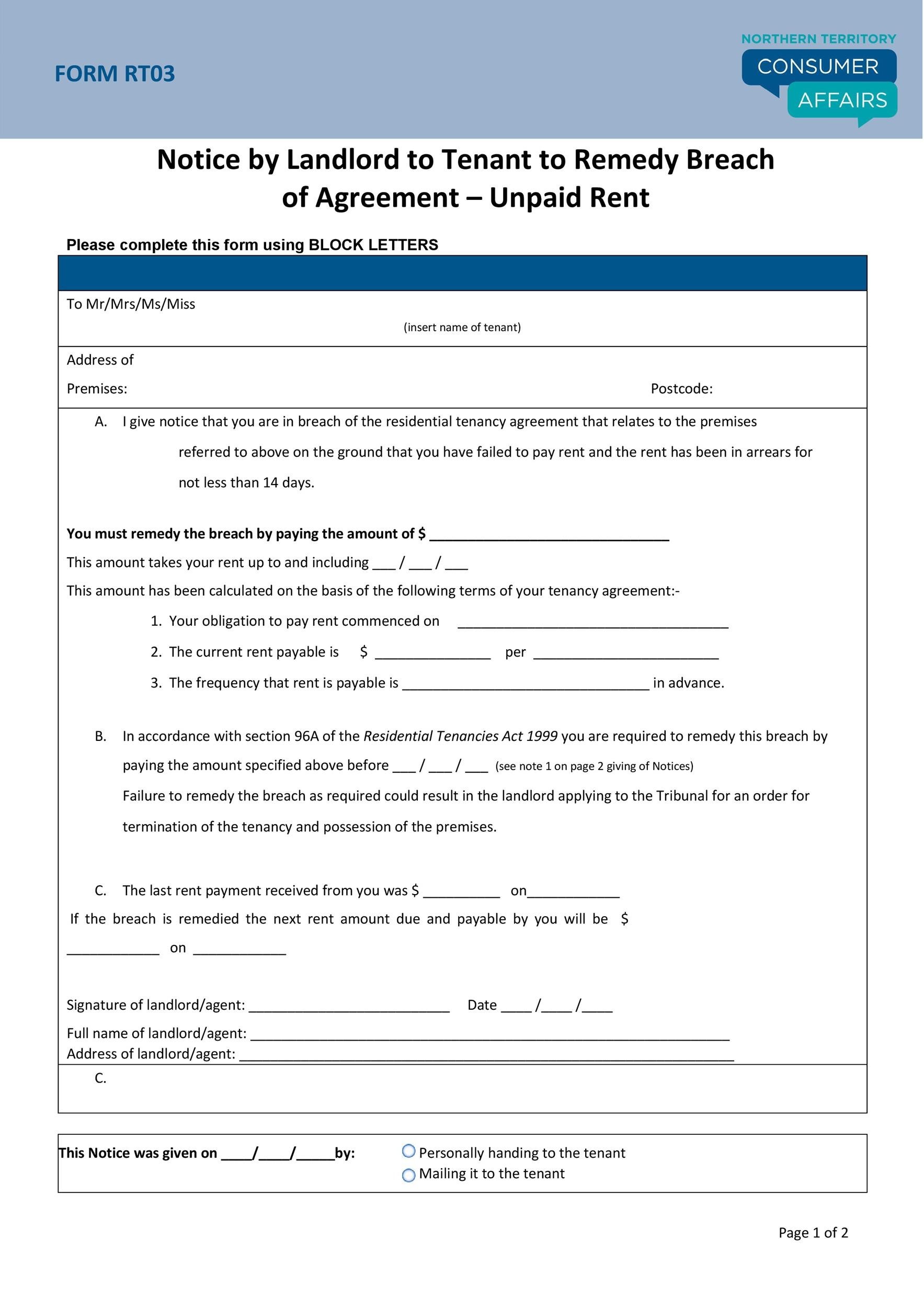

Irs B Notice Word Template - To reduce b notices, organizations. Web a first b notice is defined as a name and tin combination that hasn’t been identified in a b notice received within the last three calendar years. Web this includes a template letter to send to your payees to get the corrected information. Identify which irs notice you received. Easily sign the form with your finger. Enclose a copy of this notice in your letter to the. Web this page contains irs tax forms and instructions in text (.txt) and braille ready file (.brf) formats. Search for your notice or letter to learn what it means and what you should do. Check those out in irs publication 1281. Text files can be opened. Identify which irs notice you received. Web published october 13, 2012 · updated may 11, 2021. Both formats are bundled together in a zip (.zip) file. Easily sign the form with your finger. Text files can be opened. If this is the first time an incorrect name and tin for an individual has been. Enclose a copy of this notice in your letter to the. Easily sign the form with your finger. You must have the irs or ssa validate your. Web adjustment, notices of final partnership administrative adjustment, notices of final partnership adjustment, and appraisals and similar. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. Money back guaranteecancel anytimefast, easy & secure30 day free trial Identify which irs notice you received. Open form follow the instructions. If this is the first time an incorrect name and tin for an individual has. Search for your notice or letter to learn what it means and what you should do. Easily sign the form with your finger. What is a b notice (i.e., what is required if a b notice is received? To reduce b notices, organizations. Web this includes a template letter to send to your payees to get the corrected information. Both formats are bundled together in a zip (.zip) file. Compare your records with the list of incorrect tins or name/tin combinations. Payees identified in a first b notice. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. Search for your notice or letter to. Web published october 13, 2012 · updated may 11, 2021. Send filled & signed form or save. The irs provides a template letter in publication. If this is the first time an incorrect name and tin for an individual has been. Money back guaranteecancel anytimefast, easy & secure30 day free trial Enclose a copy of this notice in your letter to the. Web published october 13, 2012 · updated may 11, 2021. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. Additional complexities of b notice resolution. Open form follow the instructions. Money back guaranteecancel anytimefast, easy & secure30 day free trial Web any missing or incorrect information can trigger a “b” notice. Enclose a copy of this notice in your letter to the. Write the internal revenue service center where you file your income tax return, and ask the irs to send you a letter 147c; Web templates should be created. If this is the first time an incorrect name and tin for an individual has been. Web this page contains irs tax forms and instructions in text (.txt) and braille ready file (.brf) formats. Check those out in irs publication 1281. To reduce b notices, organizations. Write the internal revenue service center where you file your income tax return, and. Identify which irs notice you received. Web this includes a template letter to send to your payees to get the corrected information. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. Payees identified in a first b notice. Web the initial b notice informs the payer that the combination. Easily sign the form with your finger. Web irs provides rules on backup withholding notices. If your business receives a cp2100 or cp2100a notice, you must take the following steps: What is a b notice (i.e., what is required if a b notice is received? Money back guaranteecancel anytimefast, easy & secure30 day free trial Additional complexities of b notice resolution. Web this includes a template letter to send to your payees to get the corrected information. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the “b” notice. To reduce b notices, organizations. Compare your records with the list of incorrect tins or name/tin combinations. Web ðï ࡱ á> þÿ q s. The irs provides a template letter in publication. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. Web did you receive an irs notice or letter? Web published october 13, 2012 · updated may 11, 2021. Web a first b notice is defined as a name and tin combination that hasn’t been identified in a b notice received within the last three calendar years.

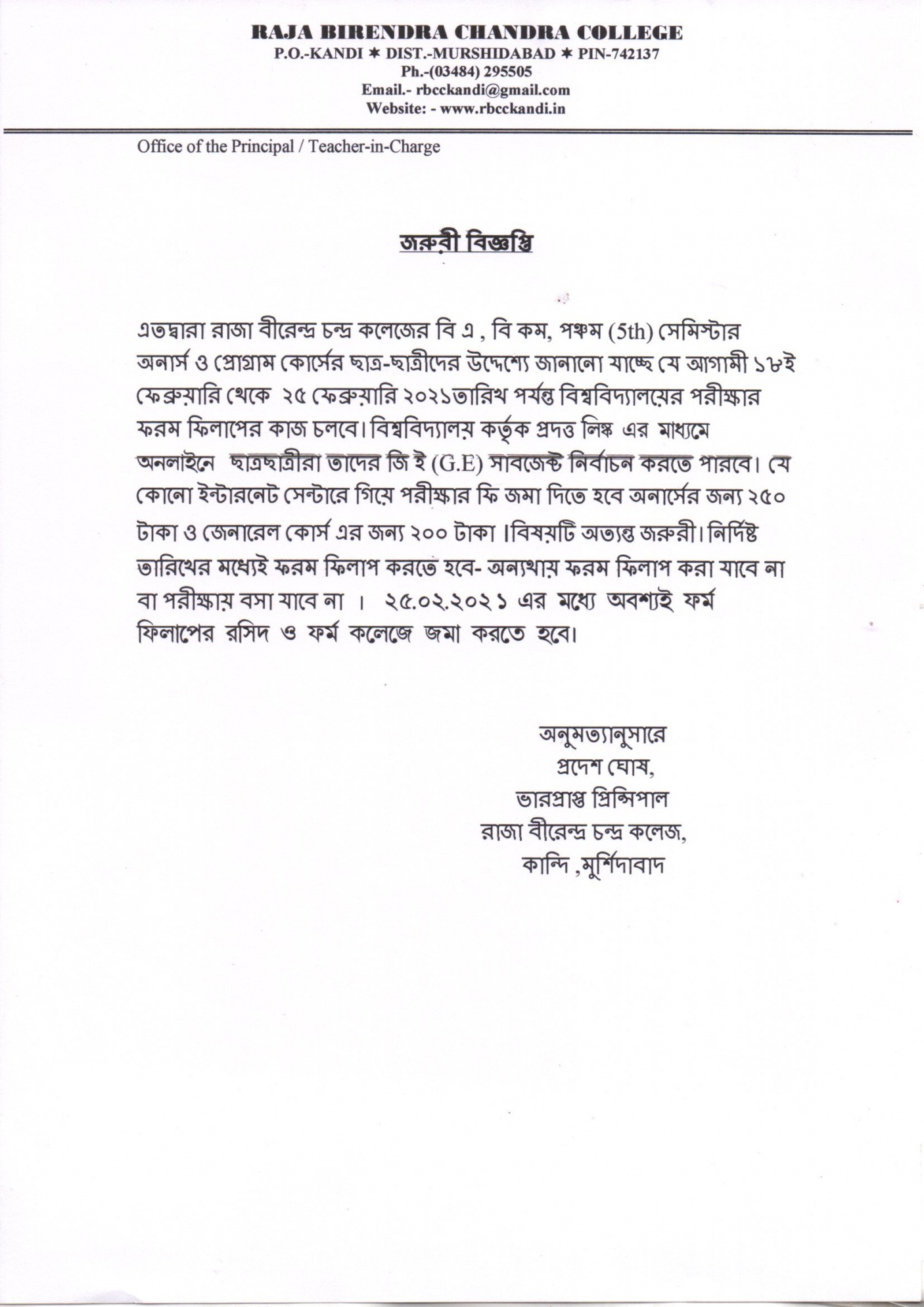

Irs B Notice Template

Printable First B Notice Template Printable Templates

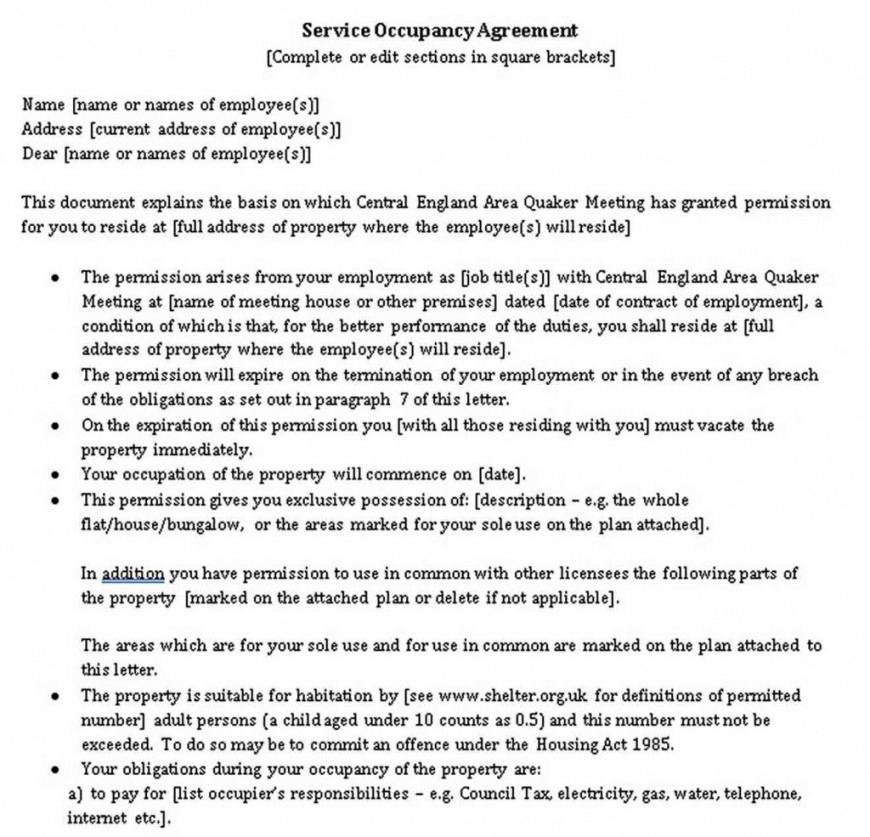

How To Format Letter To Irs Biusnsse

Irs First B Notice Template Tacitproject

Irs B Notice Word Template

First B Notice Template

First B Notice Template

First B Notice Form Template Word

IRS Audit Letter CP134B Sample 1

B Notice Irs Fill Online, Printable, Fillable, Blank pdfFiller

Text Files Can Be Opened.

Open Form Follow The Instructions.

Web Any Missing Or Incorrect Information Can Trigger A “B” Notice.

Web Adjustment, Notices Of Final Partnership Administrative Adjustment, Notices Of Final Partnership Adjustment, And Appraisals And Similar Materials Relating To Any Real Or.

Related Post: